Market Outlook - BNP PARIBAS - Investment Services India

Market Outlook - BNP PARIBAS - Investment Services India

Market Outlook - BNP PARIBAS - Investment Services India

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

EUR: Eonias Bet on July Jump<br />

• After having eased from levels seen at the<br />

start of the year, ECB meetings are gradually<br />

gaining ground.<br />

• The biggest step remains between June and<br />

July, as the prospect of the EUR 442bn expiry<br />

weighs significantly.<br />

• STRATEGY: Receive May-July gap, pay Aug-<br />

Oct gap.<br />

ECB’s focus is on EUR liquidity<br />

The ECB is stopping temporary swap lines with the<br />

Fed, as well as stopping USD liquidity operations<br />

with EMU banks. At the prospect of the end of these<br />

operations, demand for dollars at the ECB’s weekly<br />

tenders has plunged in recent weeks, reaching zero<br />

this week. What we have seen over the past few<br />

weeks is less demand at the ECB’s USD tenders and<br />

more at the MRO. The ECB allotted EUR 63.4bn at<br />

this week’s MRO, with EUR 58.0bn maturing.<br />

Demand for 1-week liquidity remained close to levels<br />

seen in previous weeks. The number of bidders (83)<br />

was significantly down from last week (101). The<br />

decrease in the number of bidders is a sign of<br />

normalisation for most banks but also indicates that<br />

there is no significant improvement at struggling<br />

banks. After this week’s tender, liquidity provided to<br />

the eurosystem with open market operations was<br />

almost unchanged and remained very high – close to<br />

EUR 760.0bn (EUR 725bn through OMOs and EUR<br />

33bn from the covered bond purchase programme).<br />

This is around EUR 190bn above current needs. In<br />

other words, excess liquidity increased slightly and<br />

this prevented any tension on fixing from developing.<br />

Liquidity expected to remain excessive until June<br />

Current excess liquidity conditions will persist for a<br />

while. Even if demand at the MRO collapses in<br />

coming months, liquidity provided by the three 1y<br />

tender accounts for EUR 614.4bn, still above<br />

expected daily requirements (in the EUR 580-610bn<br />

area). This will continue until the end of June. At this<br />

stage, there are two major uncertainties. What will<br />

the ECB decide with regard to short-term open<br />

market operations while it is gradually removing the<br />

1y and 6mth tenders? And how to deal with the<br />

collapse in liquidity at the end of June?<br />

It is worth bearing in mind that the ECB wants to<br />

drive the “exit strategy” in order to 1/ drain the excess<br />

liquidity and 2/ change the structure of funding –<br />

currently, open market operations at 9% with MROs<br />

and 91% with LTROs – to the structure prevailing<br />

before the crisis, i.e. 60-65% with MROs and 35-40%<br />

billions<br />

350<br />

300<br />

250<br />

200<br />

150<br />

100<br />

50<br />

0<br />

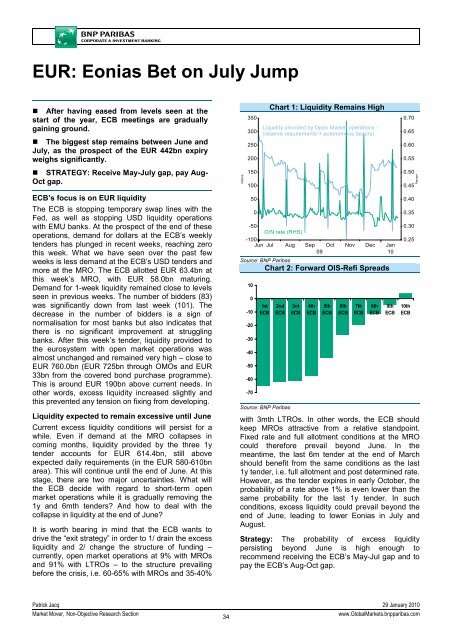

Chart 1: Liquidity Remains High<br />

Liquidity provided by Open <strong>Market</strong> operations -<br />

(reserve requirements + autonomous factors)<br />

-50<br />

O/N rate (RHS)<br />

-100<br />

Jun Jul Aug Sep Oct Nov Dec Jan<br />

09<br />

10<br />

Source: <strong>BNP</strong> Paribas<br />

Chart 2: Forward OIS-Refi Spreads<br />

10<br />

0<br />

-10<br />

-20<br />

-30<br />

-40<br />

-50<br />

-60<br />

-70<br />

1st<br />

ECB<br />

2nd<br />

ECB<br />

Source: <strong>BNP</strong> Paribas<br />

3rd<br />

ECB<br />

4th<br />

ECB<br />

5th<br />

ECB<br />

6th<br />

ECB<br />

7th<br />

ECB<br />

8th<br />

ECB<br />

9th<br />

ECB<br />

0.70<br />

0.65<br />

0.60<br />

0.55<br />

0.50<br />

0.45<br />

0.40<br />

0.35<br />

0.30<br />

0.25<br />

10th<br />

ECB<br />

with 3mth LTROs. In other words, the ECB should<br />

keep MROs attractive from a relative standpoint.<br />

Fixed rate and full allotment conditions at the MRO<br />

could therefore prevail beyond June. In the<br />

meantime, the last 6m tender at the end of March<br />

should benefit from the same conditions as the last<br />

1y tender, i.e. full allotment and post determined rate.<br />

However, as the tender expires in early October, the<br />

probability of a rate above 1% is even lower than the<br />

same probability for the last 1y tender. In such<br />

conditions, excess liquidity could prevail beyond the<br />

end of June, leading to lower Eonias in July and<br />

August.<br />

Strategy: The probability of excess liquidity<br />

persisting beyond June is high enough to<br />

recommend receiving the ECB’s May-Jul gap and to<br />

pay the ECB’s Aug-Oct gap.<br />

Percent<br />

Patrick Jacq 29 January 2010<br />

<strong>Market</strong> Mover, Non-Objective Research Section<br />

34<br />

www.Global<strong>Market</strong>s.bnpparibas.com