Market Outlook - BNP PARIBAS - Investment Services India

Market Outlook - BNP PARIBAS - Investment Services India

Market Outlook - BNP PARIBAS - Investment Services India

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

500,000, the months-supply level of inventories<br />

remains 14, double the industry standard of seven<br />

months considered necessary for prices to stabilise.<br />

Therefore, while high-end prices are likely to correct<br />

further, prices are likely to increase at the lower end<br />

of the market, consistent with NAR reports of multiple<br />

bids for lower priced homes in certain areas of the<br />

country. The overall effect of these cross-currents is<br />

likely to be an increase in median house prices over<br />

the short term, as the sample of available inventories<br />

has shifted slightly to the higher end of the market.<br />

This is because, unlike the S&P Case-Shriller house<br />

price index, the median price for existing home sales<br />

is not adjusted for changes in the housing sample.<br />

Indeed, median existing home sale prices have so far<br />

rebounded at a faster pace than the S&P/Case-<br />

Shiller house price indexes or the LoanPerformance<br />

HPI 3 , rising by 1.5% y/y in December. In contrast,<br />

both the S&P/Case-Shiller 20-cities index and the<br />

LoanPerformance HPI indicate that house prices<br />

were still below last year’s levels, falling by 5.3% y/y<br />

and 5.7% y/y respectively in November. In addition,<br />

both these indexes, which are based on a “repeatsale”<br />

method and therefore better adjust for changes<br />

in the home sales sample, suggest the growth<br />

momentum has moderated since the summer. For<br />

example, on a 3-month annualised basis, the 20-<br />

cities index rose by 2.4% in the three months to<br />

November, easing from an average growth rate of<br />

9% recorded between July and September (Chart 5).<br />

The post-credit world<br />

Going forward, housing demand should rebound in<br />

the short term but is likely to stagnate over the<br />

second half of this year. The homebuyers' tax credit<br />

has now been extended until April (for contracts that<br />

close in June) and expanded to include more affluent<br />

and existing home buyers, suggesting resale<br />

volumes should benefit from a new influx of buyers<br />

over the next few months.<br />

The NAR expects around 900k first-time homebuyers<br />

and 1.5 million existing homeowners to take<br />

advantage of the extended programme. However,<br />

these estimates appear rather optimistic, as they<br />

imply that the second “segment” of the tax credit<br />

(December 2009 to April 2010 for contracts that<br />

close by June 2010) is even more successful than<br />

the first segment (January 2009 to November 2009),<br />

when 2 million homebuyers took advantage of the<br />

government programme. Supporting the argument of<br />

a slower pace of housing demand is the fact that the<br />

second segment will be in effect for a shorter time<br />

3<br />

The LoanPerformance HPI is a repeat-sales index that tracks increases and<br />

decreases in sales prices for the same homes over time, which provides a more<br />

accurate "constant-quality" view of pricing trends than basing analysis on all<br />

home sales. This index is used by the Federal Reserve to calculate the value of<br />

real estate assets in the Flow of Funds accounts.<br />

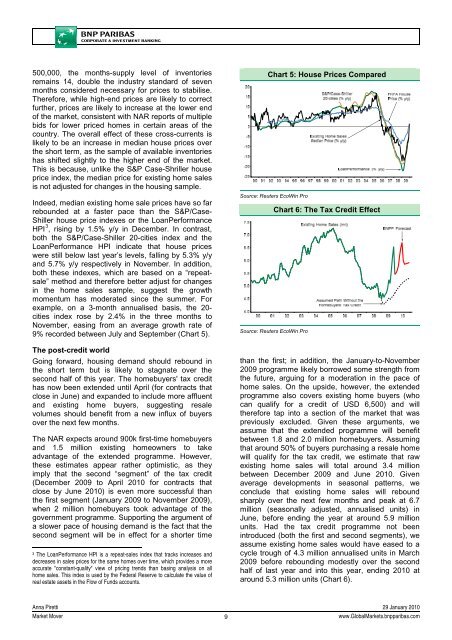

Chart 5: House Prices Compared<br />

Source: Reuters EcoWin Pro<br />

Chart 6: The Tax Credit Effect<br />

Source: Reuters EcoWin Pro<br />

than the first; in addition, the January-to-November<br />

2009 programme likely borrowed some strength from<br />

the future, arguing for a moderation in the pace of<br />

home sales. On the upside, however, the extended<br />

programme also covers existing home buyers (who<br />

can qualify for a credit of USD 6,500) and will<br />

therefore tap into a section of the market that was<br />

previously excluded. Given these arguments, we<br />

assume that the extended programme will benefit<br />

between 1.8 and 2.0 million homebuyers. Assuming<br />

that around 50% of buyers purchasing a resale home<br />

will qualify for the tax credit, we estimate that raw<br />

existing home sales will total around 3.4 million<br />

between December 2009 and June 2010. Given<br />

average developments in seasonal patterns, we<br />

conclude that existing home sales will rebound<br />

sharply over the next few months and peak at 6.7<br />

million (seasonally adjusted, annualised units) in<br />

June, before ending the year at around 5.9 million<br />

units. Had the tax credit programme not been<br />

introduced (both the first and second segments), we<br />

assume existing home sales would have eased to a<br />

cycle trough of 4.3 million annualised units in March<br />

2009 before rebounding modestly over the second<br />

half of last year and into this year, ending 2010 at<br />

around 5.3 million units (Chart 6).<br />

Anna Piretti 29 January 2010<br />

<strong>Market</strong> Mover<br />

9<br />

www.Global<strong>Market</strong>s.bnpparibas.com