G4S Annual Report and Accounts 2011

G4S Annual Report and Accounts 2011

G4S Annual Report and Accounts 2011

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Governance Financial statements Shareholder information<br />

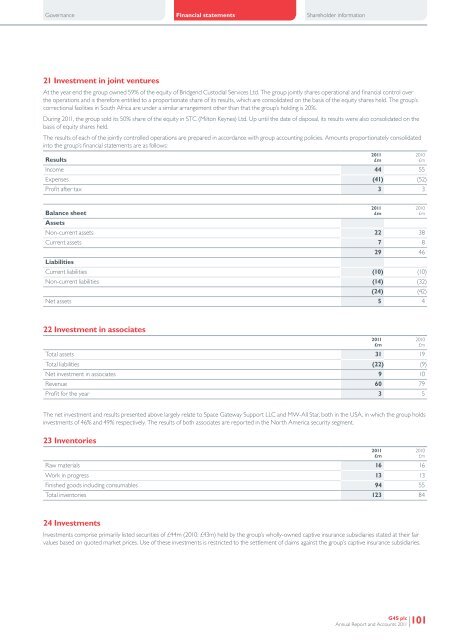

21 Investment in joint ventures<br />

At the year end the group owned 59% of the equity of Bridgend Custodial Services Ltd. The group jointly shares operational <strong>and</strong> financial control over<br />

the operations <strong>and</strong> is therefore entitled to a proportionate share of its results, which are consolidated on the basis of the equity shares held. The group’s<br />

correctional facilities in South Africa are under a similar arrangement other than that the group’s holding is 20%.<br />

During <strong>2011</strong>, the group sold its 50% share of the equity in STC (Milton Keynes) Ltd. Up until the date of disposal, its results were also consolidated on the<br />

basis of equity shares held.<br />

The results of each of the jointly controlled operations are prepared in accordance with group accounting policies. Amounts proportionately consolidated<br />

into the group’s financial statements are as follows:<br />

Results<br />

<strong>2011</strong><br />

2010<br />

£m<br />

£m<br />

Income 44 55<br />

Expenses (41) (52)<br />

Profit after tax 3 3<br />

Balance sheet<br />

<strong>2011</strong><br />

2010<br />

£m<br />

£m<br />

Assets<br />

Non-current assets 22 38<br />

Current assets 7 8<br />

29 46<br />

Liabilities<br />

Current liabilities (10) (10)<br />

Non-current liabilities (14) (32)<br />

(24) (42)<br />

Net assets 5 4<br />

22 Investment in associates<br />

Total assets 31 19<br />

Total liabilities (22) (9)<br />

Net investment in associates 9 10<br />

Revenue 60 79<br />

Profit for the year 3 5<br />

<strong>2011</strong><br />

£m<br />

2010<br />

£m<br />

The net investment <strong>and</strong> results presented above largely relate to Space Gateway Support LLC <strong>and</strong> MW-All Star, both in the USA, in which the group holds<br />

investments of 46% <strong>and</strong> 49% respectively. The results of both associates are reported in the North America security segment.<br />

23 Inventories<br />

Raw materials 16 16<br />

Work in progress 13 13<br />

Finished goods including consumables 94 55<br />

Total inventories 123 84<br />

<strong>2011</strong><br />

£m<br />

2010<br />

£m<br />

24 Investments<br />

Investments comprise primarily listed securities of £44m (2010: £43m) held by the group’s wholly-owned captive insurance subsidiaries stated at their fair<br />

values based on quoted market prices. Use of these investments is restricted to the settlement of claims against the group’s captive insurance subsidiaries.<br />

<strong>G4S</strong> plc<br />

<strong>Annual</strong> <strong>Report</strong> <strong>and</strong> <strong>Accounts</strong> <strong>2011</strong><br />

101