G4S Annual Report and Accounts 2011

G4S Annual Report and Accounts 2011

G4S Annual Report and Accounts 2011

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Governance Financial statements Shareholder information<br />

The PBTA target used for the above scheme is the same as the company’s<br />

budgeted PBTA for the corresponding period (assuming constant exchange<br />

rates). The PBTA target allows for adjustments in respect of any material,<br />

non-budgeted changes which take place during the year, such as acquisitions,<br />

disposals etc. Thus, for example, should a planned disposal not be<br />

completed by the year end, the committee reserves the right to re-insert<br />

the operating profit or loss for the business in question in the actual <strong>and</strong><br />

budgeted PBTA targets.<br />

The Remuneration Committee <strong>and</strong> the executive directors have agreed<br />

that, in light of a number of factors affecting the group in <strong>2011</strong>, it would not<br />

be appropriate to consider the payment of an annual bonus for the<br />

executive directors for this year.<br />

For 2012, the threshold <strong>and</strong> budgeted target bonus opportunity will revert<br />

to 35% <strong>and</strong> 60% of maximum bonus entitlement respectively. This was the<br />

position in previous years; the 50% <strong>and</strong> 75% levels described above having<br />

been adopted for <strong>2011</strong> only.<br />

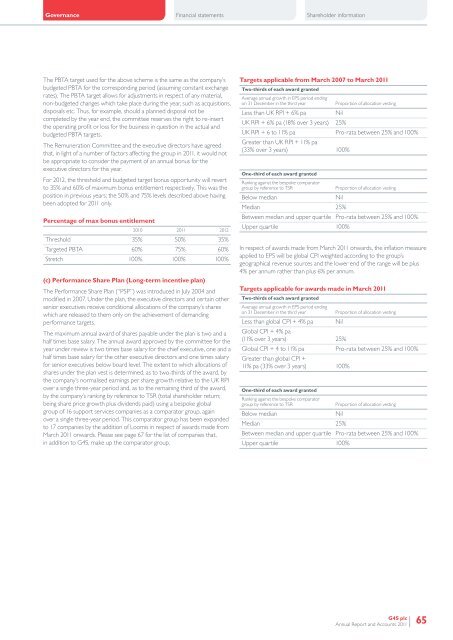

Percentage of max bonus entitlement<br />

2010 <strong>2011</strong> 2012<br />

Threshold 35% 50% 35%<br />

Targeted PBTA 60% 75% 60%<br />

Stretch 100% 100% 100%<br />

(c) Performance Share Plan (Long-term incentive plan)<br />

The Performance Share Plan (“PSP”) was introduced in July 2004 <strong>and</strong><br />

modified in 2007. Under the plan, the executive directors <strong>and</strong> certain other<br />

senior executives receive conditional allocations of the company’s shares<br />

which are released to them only on the achievement of dem<strong>and</strong>ing<br />

performance targets.<br />

The maximum annual award of shares payable under the plan is two <strong>and</strong> a<br />

half times base salary. The annual award approved by the committee for the<br />

year under review is two times base salary for the chief executive, one <strong>and</strong> a<br />

half times base salary for the other executive directors <strong>and</strong> one times salary<br />

for senior executives below board level. The extent to which allocations of<br />

shares under the plan vest is determined, as to two-thirds of the award, by<br />

the company’s normalised earnings per share growth relative to the UK RPI<br />

over a single three-year period <strong>and</strong>, as to the remaining third of the award,<br />

by the company’s ranking by reference to TSR (total shareholder return;<br />

being share price growth plus dividends paid) using a bespoke global<br />

group of 16 support services companies as a comparator group, again<br />

over a single three-year period. This comparator group has been exp<strong>and</strong>ed<br />

to 17 companies by the addition of Loomis in respect of awards made from<br />

March <strong>2011</strong> onwards. Please see page 67 for the list of companies that,<br />

in addition to <strong>G4S</strong>, make up the comparator group.<br />

Targets applicable from March 2007 to March <strong>2011</strong><br />

Two-thirds of each award granted<br />

Average annual growth in EPS period ending<br />

on 31 December in the third year<br />

Proportion of allocation vesting<br />

Less than UK RPI + 6% pa Nil<br />

UK RPI + 6% pa (18% over 3 years) 25%<br />

UK RPI + 6 to 11% pa Pro-rata between 25% <strong>and</strong> 100%<br />

Greater than UK RPI + 11% pa<br />

(33% over 3 years) 100%<br />

One-third of each award granted<br />

Ranking against the bespoke comparator<br />

group by reference to TSR<br />

Proportion of allocation vesting<br />

Below median<br />

Nil<br />

Median 25%<br />

Between median <strong>and</strong> upper quartile Pro-rata between 25% <strong>and</strong> 100%<br />

Upper quartile 100%<br />

In respect of awards made from March <strong>2011</strong> onwards, the inflation measure<br />

applied to EPS will be global CPI weighted according to the group’s<br />

geographical revenue sources <strong>and</strong> the lower end of the range will be plus<br />

4% per annum rather than plus 6% per annum.<br />

Targets applicable for awards made in March <strong>2011</strong><br />

Two-thirds of each award granted<br />

Average annual growth in EPS period ending<br />

on 31 December in the third year<br />

Proportion of allocation vesting<br />

Less than global CPI + 4% pa Nil<br />

Global CPI + 4% pa<br />

(11% over 3 years) 25%<br />

Global CPI + 4 to 11% pa Pro-rata between 25% <strong>and</strong> 100%<br />

Greater than global CPI +<br />

11% pa (33% over 3 years) 100%<br />

One-third of each award granted<br />

Ranking against the bespoke comparator<br />

group by reference to TSR<br />

Proportion of allocation vesting<br />

Below median<br />

Nil<br />

Median 25%<br />

Between median <strong>and</strong> upper quartile Pro-rata between 25% <strong>and</strong> 100%<br />

Upper quartile 100%<br />

<strong>G4S</strong> plc<br />

<strong>Annual</strong> <strong>Report</strong> <strong>and</strong> <strong>Accounts</strong> <strong>2011</strong><br />

65