G4S Annual Report and Accounts 2011

G4S Annual Report and Accounts 2011

G4S Annual Report and Accounts 2011

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Governance Financial statements Shareholder information<br />

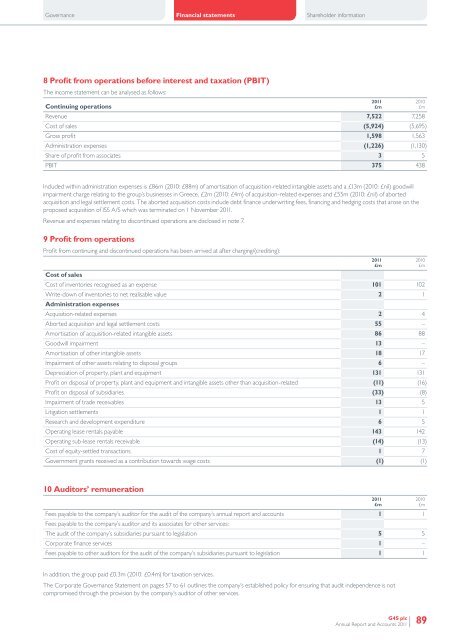

8 Profit from operations before interest <strong>and</strong> taxation (PBIT)<br />

The income statement can be analysed as follows:<br />

Continuing operations<br />

Revenue 7,522 7,258<br />

Cost of sales (5,924) (5,695)<br />

Gross profit 1,598 1,563<br />

Administration expenses (1,226) (1,130)<br />

Share of profit from associates 3 5<br />

PBIT 375 438<br />

<strong>2011</strong><br />

£m<br />

2010<br />

£m<br />

Included within administration expenses is £86m (2010: £88m) of amortisation of acquisition-related intangible assets <strong>and</strong> a £13m (2010: £nil) goodwill<br />

impairment charge relating to the group’s businesses in Greece, £2m (2010: £4m) of acquisition-related expenses <strong>and</strong> £55m (2010: £nil) of aborted<br />

acquisition <strong>and</strong> legal settlement costs. The aborted acquisition costs include debt finance underwriting fees, financing <strong>and</strong> hedging costs that arose on the<br />

proposed acquisition of ISS A/S which was terminated on 1 November <strong>2011</strong>.<br />

Revenue <strong>and</strong> expenses relating to discontinued operations are disclosed in note 7.<br />

9 Profit from operations<br />

Profit from continuing <strong>and</strong> discontinued operations has been arrived at after charging/(crediting):<br />

Cost of sales<br />

Cost of inventories recognised as an expense 101 102<br />

Write-down of inventories to net realisable value 2 1<br />

Administration expenses<br />

Acquisition-related expenses 2 4<br />

Aborted acquisition <strong>and</strong> legal settlement costs 55 –<br />

Amortisation of acquisition-related intangible assets 86 88<br />

Goodwill impairment 13 –<br />

Amortisation of other intangible assets 18 17<br />

Impairment of other assets relating to disposal groups 6 –<br />

Depreciation of property, plant <strong>and</strong> equipment 131 131<br />

Profit on disposal of property, plant <strong>and</strong> equipment <strong>and</strong> intangible assets other than acquisition-related (11) (16)<br />

Profit on disposal of subsidiaries (33) (8)<br />

Impairment of trade receivables 13 5<br />

Litigation settlements 1 1<br />

Research <strong>and</strong> development expenditure 6 5<br />

Operating lease rentals payable 143 142<br />

Operating sub-lease rentals receivable (14) (13)<br />

Cost of equity-settled transactions 1 7<br />

Government grants received as a contribution towards wage costs (1) (1)<br />

<strong>2011</strong><br />

£m<br />

2010<br />

£m<br />

10 Auditors’ remuneration<br />

Fees payable to the company’s auditor for the audit of the company’s annual report <strong>and</strong> accounts 1 1<br />

Fees payable to the company’s auditor <strong>and</strong> its associates for other services:<br />

The audit of the company’s subsidiaries pursuant to legislation 5 5<br />

Corporate finance services 1 –<br />

Fees payable to other auditors for the audit of the company’s subsidiaries pursuant to legislation 1 1<br />

<strong>2011</strong><br />

£m<br />

2010<br />

£m<br />

In addition, the group paid £0.3m (2010: £0.4m) for taxation services.<br />

The Corporate Governance Statement on pages 57 to 61 outlines the company’s established policy for ensuring that audit independence is not<br />

compromised through the provision by the company’s auditor of other services.<br />

<strong>G4S</strong> plc<br />

<strong>Annual</strong> <strong>Report</strong> <strong>and</strong> <strong>Accounts</strong> <strong>2011</strong><br />

89