G4S Annual Report and Accounts 2011

G4S Annual Report and Accounts 2011

G4S Annual Report and Accounts 2011

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Overview Strategic review Performance<br />

Performance<br />

Financial review continued<br />

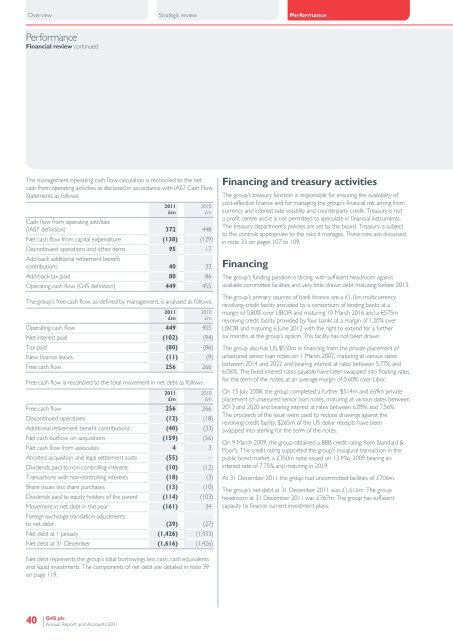

The management operating cash flow calculation is reconciled to the net<br />

cash from operating activities as disclosed in accordance with IAS7 Cash Flow<br />

Statements as follows:<br />

<strong>2011</strong><br />

£m<br />

2010<br />

£m<br />

Cash flow from operating activities<br />

(IAS7 definition) 372 448<br />

Net cash flow from capital expenditure (138) (129)<br />

Discontinued operations <strong>and</strong> other items 95 17<br />

Add-back additional retirement benefit<br />

contributions 40 33<br />

Add-back tax paid 80 86<br />

Operating cash flow (<strong>G4S</strong> definition) 449 455<br />

The group’s free cash flow, as defined by management, is analysed as follows:<br />

<strong>2011</strong><br />

£m<br />

2010<br />

£m<br />

Operating cash flow 449 455<br />

Net interest paid (102) (94)<br />

Tax paid (80) (86)<br />

New finance leases (11) (9)<br />

Free cash flow 256 266<br />

Free cash flow is reconciled to the total movement in net debt as follows:<br />

<strong>2011</strong><br />

£m<br />

2010<br />

£m<br />

Free cash flow 256 266<br />

Discontinued operations (12) (18)<br />

Additional retirement benefit contributions (40) (33)<br />

Net cash outflow on acquisitions (159) (56)<br />

Net cash flow from associates 4 3<br />

Aborted acquisition <strong>and</strong> legal settlement costs (55) –<br />

Dividends paid to non-controlling interests (10) (12)<br />

Transactions with non-controlling interests (18) (3)<br />

Share issues less share purchases (13) (10)<br />

Dividends paid to equity holders of the parent (114) (103)<br />

Movement in net debt in the year (161) 34<br />

Foreign exchange translation adjustments<br />

to net debt (29) (27)<br />

Net debt at 1 January (1,426) (1,433)<br />

Net debt at 31 December (1,616) (1,426)<br />

Financing <strong>and</strong> treasury activities<br />

The group’s treasury function is responsible for ensuring the availability of<br />

cost-effective finance <strong>and</strong> for managing the group’s financial risk arising from<br />

currency <strong>and</strong> interest rate volatility <strong>and</strong> counterparty credit. Treasury is not<br />

a profit centre <strong>and</strong> it is not permitted to speculate in financial instruments.<br />

The treasury department’s policies are set by the board. Treasury is subject<br />

to the controls appropriate to the risks it manages. These risks are discussed<br />

in note 33 on pages 107 to 109.<br />

Financing<br />

The group’s funding position is strong, with sufficient headroom against<br />

available committed facilities <strong>and</strong> very little drawn debt maturing before 2013.<br />

The group’s primary sources of bank finance are a £1.1bn multicurrency<br />

revolving credit facility provided by a consortium of lending banks at a<br />

margin of 0.80% over LIBOR <strong>and</strong> maturing 10 March 2016 <strong>and</strong> a €575m<br />

revolving credit facility provided by four banks at a margin of 1.20% over<br />

LIBOR <strong>and</strong> maturing 6 June 2012 with the right to extend for a further<br />

six months at the group’s option. This facility has not been drawn.<br />

The group also has US $550m in financing from the private placement of<br />

unsecured senior loan notes on 1 March 2007, maturing at various dates<br />

between 2014 <strong>and</strong> 2022 <strong>and</strong> bearing interest at rates between 5.77% <strong>and</strong><br />

6.06%. The fixed interest rates payable have been swapped into floating rates<br />

for the term of the notes, at an average margin of 0.60% over Libor.<br />

On 15 July 2008, the group completed a further $514m <strong>and</strong> £69m private<br />

placement of unsecured senior loan notes, maturing at various dates between<br />

2013 <strong>and</strong> 2020 <strong>and</strong> bearing interest at rates between 6.09% <strong>and</strong> 7.56%.<br />

The proceeds of the issue were used to reduce drawings against the<br />

revolving credit facility. $265m of the US dollar receipts have been<br />

swapped into sterling for the term of the notes.<br />

On 9 March 2009, the group obtained a BBB credit rating from St<strong>and</strong>ard &<br />

Poor’s. This credit rating supported the group’s inaugural transaction in the<br />

public bond market, a £350m note issued on 13 May 2009 bearing an<br />

interest rate of 7.75% <strong>and</strong> maturing in 2019.<br />

At 31 December <strong>2011</strong> the group had uncommitted facilities of £706m.<br />

The group’s net debt at 31 December <strong>2011</strong> was £1,616m. The group<br />

headroom at 31 December <strong>2011</strong> was £767m. The group has sufficient<br />

capacity to finance current investment plans.<br />

Net debt represents the group’s total borrowings less cash, cash equivalents<br />

<strong>and</strong> liquid investments. The components of net debt are detailed in note 39<br />

on page 119.<br />

40<br />

<strong>G4S</strong> plc<br />

<strong>Annual</strong> <strong>Report</strong> <strong>and</strong> <strong>Accounts</strong> <strong>2011</strong>