G4S Annual Report and Accounts 2011

G4S Annual Report and Accounts 2011

G4S Annual Report and Accounts 2011

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Overview Strategic review Performance<br />

Directors’ remuneration report continued<br />

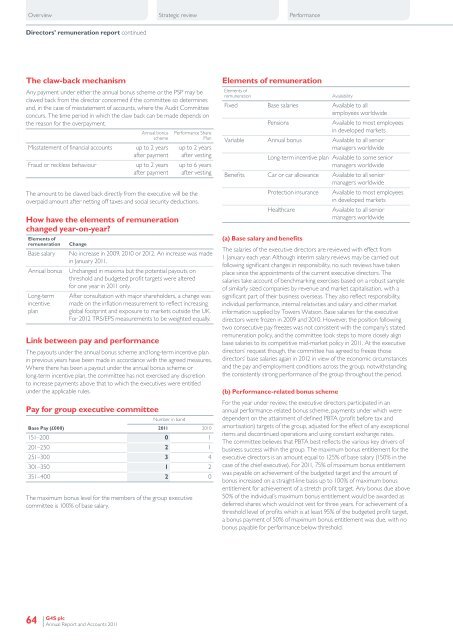

The claw-back mechanism<br />

Any payment under either the annual bonus scheme or the PSP may be<br />

clawed back from the director concerned if the committee so determines<br />

<strong>and</strong>, in the case of misstatement of accounts, where the Audit Committee<br />

concurs. The time period in which the claw back can be made depends on<br />

the reason for the overpayment.<br />

Misstatement of financial accounts<br />

Fraud or reckless behaviour<br />

<strong>Annual</strong> bonus<br />

scheme<br />

up to 2 years<br />

after payment<br />

up to 2 years<br />

after payment<br />

Performance Share<br />

Plan<br />

up to 2 years<br />

after vesting<br />

up to 6 years<br />

after vesting<br />

The amount to be clawed back directly from the executive will be the<br />

overpaid amount after netting off taxes <strong>and</strong> social security deductions.<br />

How have the elements of remuneration<br />

changed year-on-year?<br />

Elements of<br />

remuneration<br />

Base salary<br />

<strong>Annual</strong> bonus<br />

Long-term<br />

incentive<br />

plan<br />

Change<br />

No increase in 2009, 2010 or 2012. An increase was made<br />

in January <strong>2011</strong>.<br />

Unchanged in maxima but the potential payouts on<br />

threshold <strong>and</strong> budgeted profit targets were altered<br />

for one year in <strong>2011</strong> only.<br />

After consultation with major shareholders, a change was<br />

made on the inflation measurement to reflect increasing<br />

global footprint <strong>and</strong> exposure to markets outside the UK.<br />

For 2012 TRS/EPS measurements to be weighted equally.<br />

Link between pay <strong>and</strong> performance<br />

The payouts under the annual bonus scheme <strong>and</strong> long-term incentive plan<br />

in previous years have been made in accordance with the agreed measures.<br />

Where there has been a payout under the annual bonus scheme or<br />

long-term incentive plan, the committee has not exercised any discretion<br />

to increase payments above that to which the executives were entitled<br />

under the applicable rules.<br />

Pay for group executive committee<br />

Number in b<strong>and</strong><br />

Base Pay (£000) <strong>2011</strong> 2010<br />

151–200 0 1<br />

201–250 2 1<br />

251–300 3 4<br />

301–350 1 2<br />

351–400 2 0<br />

The maximum bonus level for the members of the group executive<br />

committee is 100% of base salary.<br />

Elements of remuneration<br />

Elements of<br />

remuneration<br />

Availability<br />

Fixed Base salaries Available to all<br />

employees worldwide<br />

Pensions<br />

Available to most employees<br />

in developed markets<br />

Variable <strong>Annual</strong> bonus Available to all senior<br />

managers worldwide<br />

Long-term incentive plan Available to some senior<br />

managers worldwide<br />

Benefits Car or car allowance Available to all senior<br />

managers worldwide<br />

Protection insurance Available to most employees<br />

in developed markets<br />

Healthcare<br />

Available to all senior<br />

managers worldwide<br />

(a) Base salary <strong>and</strong> benefits<br />

The salaries of the executive directors are reviewed with effect from<br />

1 January each year. Although interim salary reviews may be carried out<br />

following significant changes in responsibility, no such reviews have taken<br />

place since the appointments of the current executive directors. The<br />

salaries take account of benchmarking exercises based on a robust sample<br />

of similarly sized companies by revenue <strong>and</strong> market capitalisation, with a<br />

significant part of their business overseas. They also reflect responsibility,<br />

individual performance, internal relativities <strong>and</strong> salary <strong>and</strong> other market<br />

information supplied by Towers Watson. Base salaries for the executive<br />

directors were frozen in 2009 <strong>and</strong> 2010. However, the position following<br />

two consecutive pay freezes was not consistent with the company’s stated<br />

remuneration policy, <strong>and</strong> the committee took steps to more closely align<br />

base salaries to its competitive mid-market policy in <strong>2011</strong>. At the executive<br />

directors’ request though, the committee has agreed to freeze those<br />

directors’ base salaries again in 2012 in view of the economic circumstances<br />

<strong>and</strong> the pay <strong>and</strong> employment conditions across the group, notwithst<strong>and</strong>ing<br />

the consistently strong performance of the group throughout the period.<br />

(b) Performance-related bonus scheme<br />

For the year under review, the executive directors participated in an<br />

annual performance-related bonus scheme, payments under which were<br />

dependent on the attainment of defined PBTA (profit before tax <strong>and</strong><br />

amortisation) targets of the group, adjusted for the effect of any exceptional<br />

items <strong>and</strong> discontinued operations <strong>and</strong> using constant exchange rates.<br />

The committee believes that PBTA best reflects the various key drivers of<br />

business success within the group. The maximum bonus entitlement for the<br />

executive directors is an amount equal to 125% of base salary (150% in the<br />

case of the chief executive). For <strong>2011</strong>, 75% of maximum bonus entitlement<br />

was payable on achievement of the budgeted target <strong>and</strong> the amount of<br />

bonus increased on a straight-line basis up to 100% of maximum bonus<br />

entitlement for achievement of a stretch profit target. Any bonus due above<br />

50% of the individual’s maximum bonus entitlement would be awarded as<br />

deferred shares which would not vest for three years. For achievement of a<br />

threshold level of profits which is at least 95% of the budgeted profit target,<br />

a bonus payment of 50% of maximum bonus entitlement was due, with no<br />

bonus payable for performance below threshold.<br />

64<br />

<strong>G4S</strong> plc<br />

<strong>Annual</strong> <strong>Report</strong> <strong>and</strong> <strong>Accounts</strong> <strong>2011</strong>