G4S Annual Report and Accounts 2011

G4S Annual Report and Accounts 2011

G4S Annual Report and Accounts 2011

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Overview Strategic review Performance<br />

Strategic review<br />

Marketplace<br />

Chief Executive’s statement continued<br />

From the second half of <strong>2011</strong> onwards, the group has been active in<br />

mobilising a number of major new contracts around the world.<br />

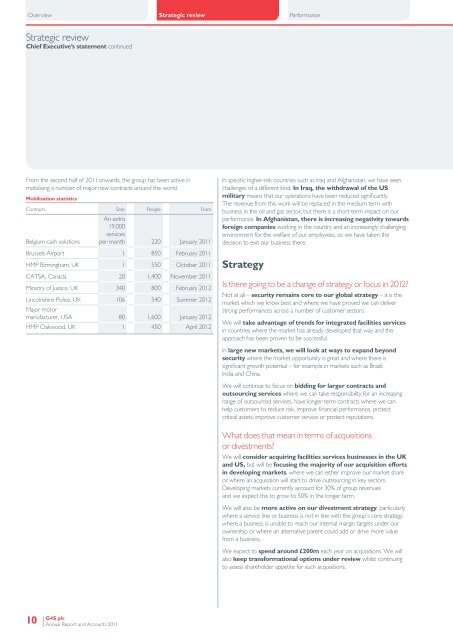

Mobilisation statistics<br />

Contracts Sites People From<br />

Belgium cash solutions<br />

An extra<br />

19,000<br />

services<br />

per month 220 January <strong>2011</strong><br />

Brussels Airport 1 850 February <strong>2011</strong><br />

HMP Birmingham, UK 1 550 October <strong>2011</strong><br />

CATSA, Canada 20 1,400 November <strong>2011</strong><br />

Ministry of Justice, UK 340 800 February 2012<br />

Lincolnshire Police, UK 106 540 Summer 2012<br />

Major motor<br />

manufacturer, USA 80 1,600 January 2012<br />

HMP Oakwood, UK 1 450 April 2012<br />

In specific higher-risk countries such as Iraq <strong>and</strong> Afghanistan, we have seen<br />

challenges of a different kind. In Iraq, the withdrawal of the US<br />

military means that our operations have been reduced significantly.<br />

The revenue from this work will be replaced in the medium term with<br />

business in the oil <strong>and</strong> gas sector, but there is a short-term impact on our<br />

performance. In Afghanistan, there is increasing negativity towards<br />

foreign companies working in the country <strong>and</strong> an increasingly challenging<br />

environment for the welfare of our employees, so we have taken the<br />

decision to exit our business there.<br />

Strategy<br />

Is there going to be a change of strategy or focus in 2012?<br />

Not at all – security remains core to our global strategy – it is the<br />

market which we know best <strong>and</strong> where we have proved we can deliver<br />

strong performances across a number of customer sectors.<br />

We will take advantage of trends for integrated facilities services<br />

in countries where the market has already developed that way <strong>and</strong> the<br />

approach has been proven to be successful.<br />

In large new markets, we will look at ways to exp<strong>and</strong> beyond<br />

security where the market opportunity is great <strong>and</strong> where there is<br />

significant growth potential – for example in markets such as Brazil,<br />

India <strong>and</strong> China.<br />

We will continue to focus on bidding for larger contracts <strong>and</strong><br />

outsourcing services where we can take responsibility for an increasing<br />

range of outsourced services, have longer-term contracts where we can<br />

help customers to reduce risk, improve financial performance, protect<br />

critical assets, improve customer service or protect reputations.<br />

What does that mean in terms of acquisitions<br />

or divestments?<br />

We will consider acquiring facilities services businesses in the UK<br />

<strong>and</strong> US, but will be focusing the majority of our acquisition efforts<br />

in developing markets, where we can either improve our market share<br />

or where an acquisition will start to drive outsourcing in key sectors.<br />

Developing markets currently account for 30% of group revenues<br />

<strong>and</strong> we expect this to grow to 50% in the longer term.<br />

We will also be more active on our divestment strategy, particularly<br />

where a service line or business is not in line with the group’s core strategy,<br />

where a business is unable to reach our internal margin targets under our<br />

ownership or where an alternative parent could add or drive more value<br />

from a business.<br />

We expect to spend around £200m each year on acquisitions. We will<br />

also keep transformational options under review whilst continuing<br />

to assess shareholder appetite for such acquisitions.<br />

10<br />

<strong>G4S</strong> plc<br />

<strong>Annual</strong> <strong>Report</strong> <strong>and</strong> <strong>Accounts</strong> <strong>2011</strong>