G4S Annual Report and Accounts 2011

G4S Annual Report and Accounts 2011

G4S Annual Report and Accounts 2011

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Overview Strategic review Performance<br />

Directors’ remuneration report continued<br />

The revised lower end of the range is CPI +4% per annum, which is still<br />

stretching, but is also achievable. The committee was concerned that the<br />

previous targets were perceived as unachievable <strong>and</strong> were no longer acting<br />

as an incentive to better performance.<br />

The Remuneration Committee continues to believe that a combination of<br />

earnings per share growth <strong>and</strong> total shareholder return targets is the most<br />

appropriate performance measure for the performance share plan, as it<br />

provides a transparent method of assessing the company’s performance,<br />

both in terms of underlying financial performance <strong>and</strong> returns to<br />

shareholders. Other measures, such as Return on Invested Capital,<br />

were considered to be less appropriate for a service company.<br />

The decision to change the lower end of the range was made after an<br />

analysis of growth based on market consensus <strong>and</strong> economic outlook.<br />

The Remuneration Committee also looked at currency movements <strong>and</strong> the<br />

calibration used by other companies in the FTSE 100. Weighted global CPI<br />

was seen as more relevant than UK RPI given the group’s global footprint.<br />

In respect of awards made from 2012 onwards, the committee has decided<br />

that the extent to which allocations of shares under the plan vest will be<br />

determined, as to half of the award, by the company’s normalised earnings<br />

per share growth relative to the global CPI over a single three-year period<br />

<strong>and</strong> half of the award, by the company’s ranking by reference to TSR using<br />

the bespoke global comparator group, again over a single three-year<br />

period. The committee believes that this will help to address the concerns<br />

expressed by some shareholders about over reliance on EPS as a measure<br />

of underlying performance.<br />

Participants in the PSP will receive a further share award with a value<br />

equivalent to the dividends which would have been paid in respect of<br />

future PSP awards vesting at the end of the performance period.<br />

There will only be a transfer of shares under the third (or half in 2012) of the<br />

award attributable to TSR if the Remuneration Committee is satisfied that<br />

the company’s TSR performance is reflective of the company’s underlying<br />

performance.<br />

The company calculates whether the EPS performance targets have been<br />

achieved by reference to the company’s audited accounts which provide<br />

an accessible <strong>and</strong> objective measure of the company’s earnings per share,<br />

whilst TSR ranking will be determined by Towers Watson whose findings<br />

are verified by Alithos.<br />

Awards will not normally vest where an employee ceases to be employed<br />

within the group unless cessation of employment is due to death, injury,<br />

disability, redundancy, retirement or following a change of control of, or sale<br />

outside the group of, his or her employing company. In these situations,<br />

vesting will occur in the normal course <strong>and</strong> the performance targets will<br />

need to be satisfied. Only a proportion of the award, based on the time<br />

which has elapsed from the award date to the end of the last complete<br />

month in which the employee was employed, will vest in these<br />

circumstances in most cases. The Remuneration Committee does however<br />

retain the ability to allow for a greater award to vest if it considers it to be<br />

appropriate in exceptional circumstances.<br />

Share retention<br />

The company’s current policy is to use market purchased shares to satisfy<br />

performance share plan awards.<br />

The committee believes that continued shareholding by executive directors<br />

will strengthen the alignment of their interests with shareholders’ interests.<br />

Accordingly, a formal policy has been adopted under which executive<br />

directors are required to retain 50% of after-tax PSP vestings until a total<br />

shareholding equal to 100% of base salary (150% for the chief executive) is<br />

achieved. This policy has been extended to senior management but the<br />

minimum shareholding is set at a lower level.<br />

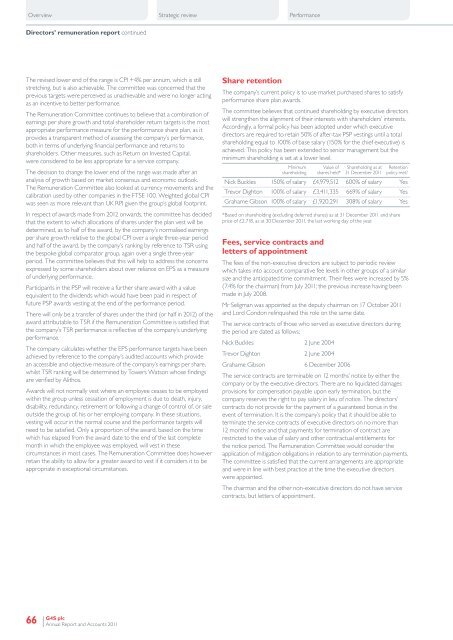

Minimum<br />

shareholding<br />

Value of<br />

shares held*<br />

Shareholding as at<br />

31 December <strong>2011</strong><br />

Retention<br />

policy met?<br />

Nick Buckles 150% of salary £4,979,512 600% of salary Yes<br />

Trevor Dighton 100% of salary £3,411,335 669% of salary Yes<br />

Grahame Gibson 100% of salary £1,920,291 308% of salary Yes<br />

*Based on shareholding (excluding deferred shares) as at 31 December <strong>2011</strong> <strong>and</strong> share<br />

price of £2.718, as at 30 December <strong>2011</strong>, the last working day of the year.<br />

Fees, service contracts <strong>and</strong><br />

letters of appointment<br />

The fees of the non-executive directors are subject to periodic review<br />

which takes into account comparative fee levels in other groups of a similar<br />

size <strong>and</strong> the anticipated time commitment. Their fees were increased by 5%<br />

(7.4% for the chairman) from July <strong>2011</strong>; the previous increase having been<br />

made in July 2008.<br />

Mr Seligman was appointed as the deputy chairman on 17 October <strong>2011</strong><br />

<strong>and</strong> Lord Condon relinquished this role on the same date.<br />

The service contracts of those who served as executive directors during<br />

the period are dated as follows:<br />

Nick Buckles 2 June 2004<br />

Trevor Dighton 2 June 2004<br />

Grahame Gibson 6 December 2006<br />

The service contracts are terminable on 12 months’ notice by either the<br />

company or by the executive directors. There are no liquidated damages<br />

provisions for compensation payable upon early termination, but the<br />

company reserves the right to pay salary in lieu of notice. The directors’<br />

contracts do not provide for the payment of a guaranteed bonus in the<br />

event of termination. It is the company’s policy that it should be able to<br />

terminate the service contracts of executive directors on no more than<br />

12 months’ notice <strong>and</strong> that payments for termination of contract are<br />

restricted to the value of salary <strong>and</strong> other contractual entitlements for<br />

the notice period. The Remuneration Committee would consider the<br />

application of mitigation obligations in relation to any termination payments.<br />

The committee is satisfied that the current arrangements are appropriate<br />

<strong>and</strong> were in line with best practice at the time the executive directors<br />

were appointed.<br />

The chairman <strong>and</strong> the other non-executive directors do not have service<br />

contracts, but letters of appointment.<br />

66<br />

<strong>G4S</strong> plc<br />

<strong>Annual</strong> <strong>Report</strong> <strong>and</strong> <strong>Accounts</strong> <strong>2011</strong>