G4S Annual Report and Accounts 2011

G4S Annual Report and Accounts 2011

G4S Annual Report and Accounts 2011

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Governance Financial statements Shareholder information<br />

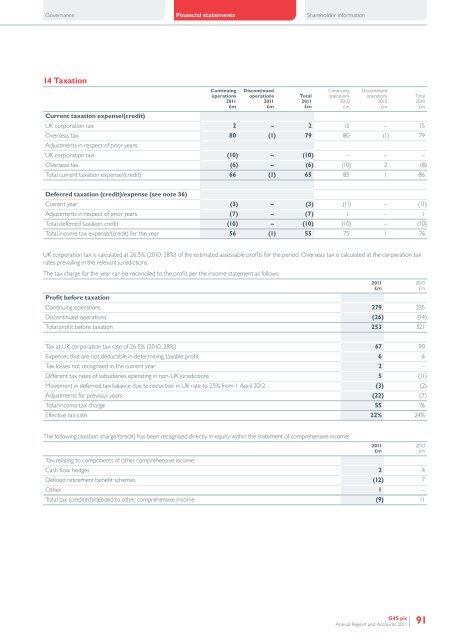

14 Taxation<br />

Current taxation expense/(credit)<br />

Continuing<br />

operations<br />

<strong>2011</strong><br />

£m<br />

Discontinued<br />

operations<br />

<strong>2011</strong><br />

£m<br />

Total<br />

<strong>2011</strong><br />

£m<br />

Continuing<br />

operations<br />

2010<br />

£m<br />

Discontinued<br />

operations<br />

2010<br />

£m<br />

UK corporation tax 2 – 2 15 – 15<br />

Overseas tax 80 (1) 79 80 (1) 79<br />

Adjustments in respect of prior years:<br />

UK corporation tax (10) – (10) – – –<br />

Overseas tax (6) – (6) (10) 2 (8)<br />

Total current taxation expense/(credit) 66 (1) 65 85 1 86<br />

Total<br />

2010<br />

£m<br />

Deferred taxation (credit)/expense (see note 36)<br />

Current year (3) – (3) (11) – (11)<br />

Adjustments in respect of prior years (7) – (7) 1 – 1<br />

Total deferred taxation credit (10) – (10) (10) – (10)<br />

Total income tax expense/(credit) for the year 56 (1) 55 75 1 76<br />

UK corporation tax is calculated at 26.5% (2010: 28%) of the estimated assessable profits for the period. Overseas tax is calculated at the corporation tax<br />

rates prevailing in the relevant jurisdictions.<br />

The tax charge for the year can be reconciled to the profit per the income statement as follows:<br />

Profit before taxation<br />

Continuing operations 279 335<br />

Discontinued operations (26) (14)<br />

Total profit before taxation 253 321<br />

<strong>2011</strong><br />

£m<br />

2010<br />

£m<br />

Tax at UK corporation tax rate of 26.5% (2010: 28%) 67 90<br />

Expenses that are not deductible in determining taxable profit 6 6<br />

Tax losses not recognised in the current year 2 –<br />

Different tax rates of subsidiaries operating in non-UK jurisdictions 5 (11)<br />

Movement in deferred tax balance due to reduction in UK rate to 25% from 1 April 2012 (3) (2)<br />

Adjustments for previous years (22) (7)<br />

Total income tax charge 55 76<br />

Effective tax rate 22% 24%<br />

The following taxation charge/(credit) has been recognised directly in equity within the statement of comprehensive income:<br />

Tax relating to components of other comprehensive income:<br />

Cash flow hedges 2 4<br />

Defined retirement benefit schemes (12) 7<br />

Other 1 –<br />

Total tax (credited)/debited to other comprehensive income (9) 11<br />

<strong>2011</strong><br />

£m<br />

2010<br />

£m<br />

<strong>G4S</strong> plc<br />

<strong>Annual</strong> <strong>Report</strong> <strong>and</strong> <strong>Accounts</strong> <strong>2011</strong><br />

91