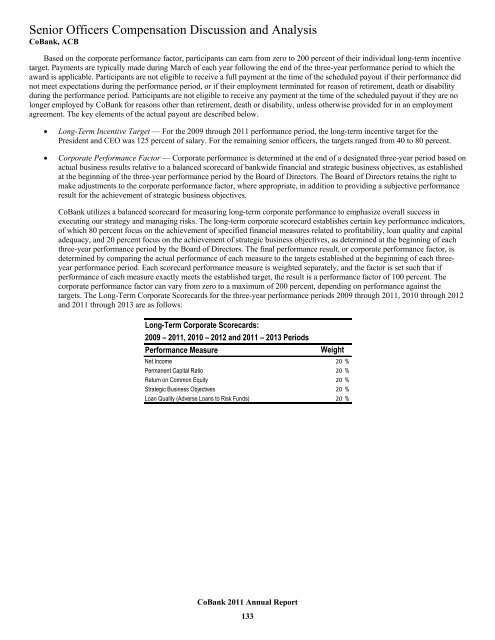

Senior Officers Compensation Discussion and Analysis<strong>CoBank</strong>, ACBBased on the corporate performance factor, participants can earn from zero to 200 percent of their individual long-term incentivetarget. Payments are typically made during March of each year following the end of the three-year performance period to which theaward is applicable. Participants are not eligible to receive a full payment at the time of the scheduled payout if their performance didnot meet expectations during the performance period, or if their employment terminated for reason of retirement, death or disabilityduring the performance period. Participants are not eligible to receive any payment at the time of the scheduled payout if they are nolonger employed by <strong>CoBank</strong> for reasons other than retirement, death or disability, unless otherwise provided for in an employmentagreement. The key elements of the actual payout are described below.Long-Term Incentive Target — For the 2009 through 2011 performance period, the long-term incentive target for thePresident and CEO was 125 percent of salary. For the remaining senior officers, the targets ranged from 40 to 80 percent.Corporate Performance Factor — Corporate performance is determined at the end of a designated three-year period based onactual business results relative to a balanced scorecard of bankwide financial and strategic business objectives, as establishedat the beginning of the three-year performance period by the Board of Directors. The Board of Directors retains the right tomake adjustments to the corporate performance factor, where appropriate, in addition to providing a subjective performanceresult for the achievement of strategic business objectives.<strong>CoBank</strong> utilizes a balanced scorecard for measuring long-term corporate performance to emphasize overall success inexecuting our strategy and managing risks. The long-term corporate scorecard establishes certain key performance indicators,of which 80 percent focus on the achievement of specified financial measures related to profitability, loan quality and capitaladequacy, and 20 percent focus on the achievement of strategic business objectives, as determined at the beginning of eachthree-year performance period by the Board of Directors. The final performance result, or corporate performance factor, isdetermined by comparing the actual performance of each measure to the targets established at the beginning of each threeyearperformance period. Each scorecard performance measure is weighted separately, and the factor is set such that ifperformance of each measure exactly meets the established target, the result is a performance factor of 100 percent. Thecorporate performance factor can vary from zero to a maximum of 200 percent, depending on performance against thetargets. The Long-Term Corporate Scorecards for the three-year performance periods 2009 through 2011, 2010 through 2012and 2011 through 2013 are as follows:Long-Term Corporate Scorecards:2009 – 2011, 2010 – 2012 and 2011 – 2013 PeriodsPerformance MeasureWeightNet Income 20 %Permanent Capital Ratio 20 %Return on Common Equity 20 %Strategic Business Objectives 20 %Loan Quality (Adverse Loans to Risk Funds) 20 %<strong>CoBank</strong> 2011 <strong>Annual</strong> <strong>Report</strong>133

Senior Officers Compensation Discussion and Analysis<strong>CoBank</strong>, ACBThe actual long-term incentive awards for 2011, 2010 and 2009 for the President and CEO and other senior officers are presentedin the Summary Compensation Table on page 137.Terms of Senior Officers’ Employment AgreementsAs of December 31, 2011, two of our senior officers, including the President and CEO, are employed pursuant to employmentagreements, which provide specified compensation and related benefits to these senior officers in the event their employment isterminated, except for termination for cause. In the event of termination except for cause, the employment agreements provide for (a)payment of the officer’s prorated salary and incentives through the date of the termination, (b) semi-monthly payments aggregatingtwo to three times the sum of the officer’s base compensation and short-term incentives at target, (c) enhanced retirement benefits ifthe termination results from a change in control, (d) the continued participation in the Bank’s health and welfare benefits over a two orthree year period, and (e) certain other benefits over a two or three year period to the same extent as such benefits were being providedon the date of termination. The employment agreements also provide certain limited payments upon death or disability of the officer.To receive payments and other benefits under the agreements, the officer must sign a release agreeing to give up any claims, actions orlawsuits against the Bank that relate to his or her employment with the Bank. The agreements also provide for non-competition andnon-solicitation by the officers over the term of the payments, and the payments are considered taxable income, without anyconsideration or provision for “gross-up” for tax purposes.Retirement BenefitsOverviewWe have employer-funded qualified defined benefit pension plans, which are noncontributory and cover employees hired prior toJanuary 1, 2007. Depending on the date of hire, benefits are determined either by a formula based on years of service and final averagepay, or by the accumulation of a cash balance with interest credits and contribution credits based on years of service and eligiblecompensation. We also have a noncontributory, unfunded, nonqualified supplemental executive retirement plan (SERP) covering allbut two senior officers employed at December 31, 2011, as well as specified other senior managers. In addition, as more fullydiscussed below, we have a noncontributory, unfunded nonqualified executive retirement plan (ERP) designed to provide enhancedretirement benefits to the two senior officers employed pursuant to employment agreements, including the President and CEO. Allemployees are also eligible to participate in a 401(k) retirement savings plan, which includes employer matching contributions.Employees hired on or after January 1, 2007, receive additional, non-elective employer contributions to the 401(k) retirement savingsplan. All retirement-eligible employees, including senior officers, are also currently eligible for other postretirement benefits, whichprimarily include access to health care benefits. Substantially all participants pay the full premiums associated with these otherpostretirement health care benefits.Defined Benefit Pension PlansSenior officers hired prior to January 1, 2007 are participants in the defined benefit pension plan. Pursuant to this plan, thebenefits, including those of the President and CEO, are determined based on years of service and final average pay. Eligiblecompensation, as defined under the final average pay formula, is the highest 60 consecutive-month average, which includes salary andincentive compensation measured over a period of one year or less, but excludes long-term incentive awards, expense reimbursements,taxable fringe benefits, relocation allowance, short- and long-term disability payments, nonqualified deferred compensationdistributions, lump sum vacation payouts and all severance payments. Retirement benefits are calculated assuming payment in theform of a single life annuity with five years certain and retirement at age 65. However, the actual form and timing of payments arebased on participant elections. The plan requires five years of service to become vested. All senior officers participating in the definedbenefit pension plan have been employed for more than five years and, as such, are fully vested in the plan. The benefit formula is thesum of 1.5 percent of eligible compensation up to Social Security covered compensation plus 1.75 percent of eligible compensation inexcess of Social Security covered compensation, multiplied by the years of eligible benefit service. Social Security coveredcompensation is the 35 year average of the Social Security taxable wage bases up to the participant’s Social Security retirement age.Federal laws limit the amount of compensation we may consider when determining benefits payable under the qualified definedbenefit pension plans. We maintain a SERP that pays the excess pension benefits that would have been payable under our qualifieddefined benefit pension plans.<strong>CoBank</strong> 2011 <strong>Annual</strong> <strong>Report</strong>134

- Page 4 and 5:

Everett DobrinskiChairmanRobert B.

- Page 6 and 7:

“ We firmly believe the combined

- Page 8 and 9:

associations are partnering with Co

- Page 11 and 12:

2012 BOARD OF DIRECTORSOccupation:F

- Page 13 and 14:

“WE ARE COMMITTEDTO GOOD GOVERNAN

- Page 15 and 16:

U.S. AgBank CEO Darryl Rhodes (fron

- Page 17 and 18:

KansasNew MexicoUtahFC of Ness City

- Page 19 and 20:

CorporateCitizenshipAT COBANKSuppor

- Page 21 and 22:

StrategicRelationshipsFarm Credit o

- Page 23 and 24:

RegionalAgribusinessBANKING GROUPCe

- Page 25 and 26:

CorporateAgribusinessBANKING GROUPK

- Page 27 and 28:

ElectricDistributionBANKING DIVISIO

- Page 29 and 30:

Power SupplyBANKING DIVISIONTri-Sta

- Page 31 and 32:

IndustryPortfoliosCoBank ended 2011

- Page 33 and 34:

CoBank is a financially strong,depe

- Page 35 and 36:

30COBANK 2011ANNUAL REPORTbuilding

- Page 37 and 38:

The information and disclosures con

- Page 39 and 40:

Financial Condition andResults of O

- Page 41 and 42:

Provision for Loan Losses and Reser

- Page 43 and 44:

Purchased services expense decrease

- Page 45 and 46:

AgribusinessOverviewThe Agribusines

- Page 47 and 48:

Rural InfrastructureOverviewThe Rur

- Page 49 and 50:

Credit ApprovalThe most critical el

- Page 51 and 52:

Total nonaccrual loans were $134.9

- Page 53 and 54:

Basis RiskBasis risk arises due to

- Page 55 and 56:

Our net interest income is lower in

- Page 57 and 58:

The notional amount of our derivati

- Page 59 and 60:

Reputation Risk ManagementReputatio

- Page 61 and 62:

Investment Securities ($ in Million

- Page 63 and 64:

In accordance with the Farm Credit

- Page 65 and 66:

Critical Accounting EstimatesManage

- Page 67 and 68:

Business OutlookWe closed our merge

- Page 69 and 70:

Consolidated Income StatementsCoBan

- Page 71 and 72:

Consolidated Statements of Cash Flo

- Page 73 and 74:

Consolidated Statements of Changes

- Page 75 and 76:

LoansWe report loans, excluding lea

- Page 77 and 78:

If we determine that a derivative n

- Page 79 and 80:

Reserve for Credit ExposureThe foll

- Page 81 and 82:

The information in the tables under

- Page 83 and 84:

The following tables present inform

- Page 85 and 86:

At December 31, 2011, gross minimum

- Page 87 and 88: For impaired investment securities,

- Page 89 and 90: At December 31, 2011, the assets of

- Page 91 and 92: Preferred StockThe following table

- Page 93 and 94: The following table provides a summ

- Page 95 and 96: AssumptionsWe measure plan obligati

- Page 97 and 98: Incentive Compensation PlansWe have

- Page 99 and 100: Note 11 - Derivative FinancialInstr

- Page 101 and 102: A summary of the impact of derivati

- Page 103 and 104: Due to the uncertainty of expected

- Page 105 and 106: Assets and Liabilities Measured atF

- Page 107 and 108: Note 14 - Segment Financial Informa

- Page 109 and 110: Note 15 - Commitments and Contingen

- Page 111 and 112: Note 18 - Subsequent Events (Unaudi

- Page 113 and 114: Supplemental District Financial Inf

- Page 115 and 116: Supplemental District Financial Inf

- Page 117 and 118: Report of Independent AuditorsCoBan

- Page 119 and 120: Management’s Report on Internal C

- Page 121 and 122: Annual Report to Shareholders Discl

- Page 123 and 124: Board of Directors Disclosure as of

- Page 125 and 126: Board of Directors Disclosure as of

- Page 127 and 128: Board of Directors Disclosure as of

- Page 129 and 130: Board of Directors Disclosure as of

- Page 131 and 132: Senior OfficersCoBank, ACBRobert B.

- Page 133 and 134: Senior Officers Compensation Discus

- Page 135 and 136: Senior Officers Compensation Discus

- Page 137: Senior Officers Compensation Discus

- Page 141 and 142: Senior Officers Compensation Discus

- Page 143 and 144: Senior Officers Compensation Discus

- Page 145 and 146: Code of EthicsCoBank, ACBCoBank set

- Page 147 and 148: CERTIFICATIONI, Robert B. Engel, Pr

- Page 149 and 150: LeadershipCoBank, ACBRobert B. Enge

- Page 151 and 152: OfficeLocationsCoBank National Offi