6 - Vicat

6 - Vicat

6 - Vicat

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

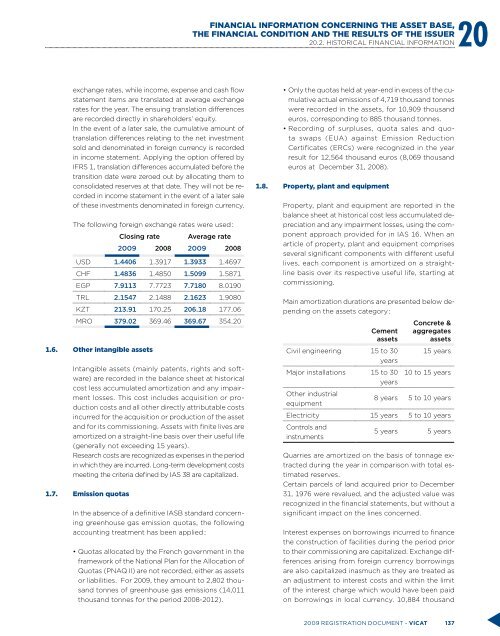

Financial information concerning the asset base,20the financial condition and the results of the issuer20.2. HISTORICAL FINANCIAL INFORMATIONexchange rates, while income, expense and cash flowstatement items are translated at average exchangerates for the year. The ensuing translation differencesare recorded directly in shareholders’ equity.In the event of a later sale, the cumulative amount oftranslation differences relating to the net investmentsold and denominated in foreign currency is recordedin income statement. Applying the option offered byIFRS 1, translation differences accumulated before thetransition date were zeroed out by allocating them toconsolidated reserves at that date. They will not be recordedin income statement in the event of a later saleof these investments denominated in foreign currency.The following foreign exchange rates were used :Closing rate Average rate2009 2008 2009 2008USD 1.4406 1.3917 1.3933 1.4697CHF 1.4836 1.4850 1.5099 1.5871EGP 7.9113 7.7723 7.7180 8.0190TRL 2.1547 2.1488 2.1623 1.9080KZT 213.91 170.25 206.18 177.06MRO 379.02 369.46 369.67 354.201.6. Other intangible assetsIntangible assets (mainly patents, rights and software)are recorded in the balance sheet at historicalcost less accumulated amortization and any impairmentlosses. This cost includes acquisition or productioncosts and all other directly attributable costsincurred for the acquisition or production of the assetand for its commissioning. Assets with finite lives areamortized on a straight-line basis over their useful life(generally not exceeding 15 years).Research costs are recognized as expenses in the periodin which they are incurred. Long-term development costsmeeting the criteria defined by IAS 38 are capitalized.1.7. Emission quotasIn the absence of a definitive IASB standard concerninggreenhouse gas emission quotas, the followingaccounting treatment has been applied :• Quotas allocated by the French government in theframework of the National Plan for the Allocation ofQuotas (PNAQ II) are not recorded, either as assetsor liabilities. For 2009, they amount to 2,802 thousandtonnes of greenhouse gas emissions (14,011thousand tonnes for the period 2008-2012).• Only the quotas held at year-end in excess of the cumulativeactual emissions of 4,719 thousand tonneswere recorded in the assets, for 10,909 thousandeuros, corresponding to 885 thousand tonnes.• Recording of surpluses, quota sales and quotaswaps (EUA) against Emission ReductionCertificates (ERCs) were recognized in the yearresult for 12,564 thousand euros (8,069 thousandeuros at December 31, 2008).1.8. Property, plant and equipmentProperty, plant and equipment are reported in thebalance sheet at historical cost less accumulated depreciationand any impairment losses, using the componentapproach provided for in IAS 16. When anarticle of property, plant and equipment comprisesseveral significant components with different usefullives, each component is amortized on a straightlinebasis over its respective useful life, starting atcommissioning.Main amortization durations are presented below dependingon the assets category :CementassetsCivil engineering 15 to 30yearsMajor installations 15 to 30yearsOther industrialequipmentConcrete &aggregatesassets15 years10 to 15 years8 years 5 to 10 yearsElectricity 15 years 5 to 10 yearsControls andinstruments5 years 5 yearsQuarries are amortized on the basis of tonnage extractedduring the year in comparison with total estimatedreserves.Certain parcels of land acquired prior to December31, 1976 were revalued, and the adjusted value wasrecognized in the financial statements, but without asignificant impact on the lines concerned.Interest expenses on borrowings incurred to financethe construction of facilities during the period priorto their commissioning are capitalized. Exchange differencesarising from foreign currency borrowingsare also capitalized inasmuch as they are treated asan adjustment to interest costs and within the limitof the interest charge which would have been paidon borrowings in local currency. 10,884 thousand2009 registration document - VICAT 137