20Financial information concerning the asset base,the financial condition and the results of the issuer20.2. HISTORICAL FINANCIAL INFORMATIONNOTE 27NET CASH FLOWS GENERATED FROM OPERATIONSNet cash flows from operating transactions conductedby the Group in 2009 amounted to 383million euros, compared with 385 million euros in2008.This stability in cash flows generated by operatingactivities between 2008 and 2009 results from a (15)million euros decrease of the cash flow offset by a13 million euros improvement in the change of theworking capital requirement.The working capital requirement (WCR) brokendown by type is as follows :(in thousands of euros)WCR atDecember31, 2007Change inWCRin 2008Otherchanges(1)WCR atDecember31, 2008Change inWCRin 2009Otherchanges(1)WCR atDecember31, 2009Inventories 249,164 64,224 (932) 312,456 (15,407) (1,909) 295,140Other WCRcomponents 186,753 (46,813) (31,012) 108,928 19,667 (10,063) 118,532WCR 435,917 17,411 (31,944) 421,384 4,260 (11,972) 413,672(1)Exchange rates, consolidation scope and miscellaneous.NOTE 28NET CASH FLOWS FROM INVESTMENT ACTIVITIESNet cash flows linked to Group transactions in 2009amounted to (280) million euros, compared with(464) million euros in 2008.Acquisitions of intangible and tangible assetsThese include outflows corresponding to industrialinvestments, which amounted to (270) million euros,compared with (395) million euros in 2008.The main intangible and tangible investments in2009mainly correspond to the continuation of the investmentsrealised under the “Performance 2010” plan,principally in France, Senegal and Switzerland, andthe increase of the investment in Kazakhstan.The main intangible and tangible investments in2008 reflect the investments completed under the“Performance 2010” plan, in particular in France,Turkey, Egypt and Senegal, and to the acquisitionof the assets of the Walker Group in the USA in May2008. Planned investments under this plan in theSouth and East of the USA were delayed consideringthe economic environment.Acquisition / disposal of shares of consolidatedcompaniesConsolidated company share acquisitions during2009 resulted in a total outflow of (4) million euros,corresponding to the net impact in the year in theabsence of disposals.The principal outflows from the Group during the yearmainly correspond to the acquisition of Swiss companies,in particular in the Concrete & Aggregates andConcrete Precasting sectors, and to the acquisition ofadditional shares in companies already consolidated.In 2008, operations linked to changes in the consolidationscope had resulted in :• an overall inflow of 19.7 millions euros, correspondingmainly to the disposal of certain Astrada sitesin Switzerland,• an overall outflow of (85.7) millions euros, correspondingmainly to the balance of the payment inconnection with the acquisition at the end of 2007of a 60 % stake in a Kazakh company that manufacturesand sells cement, to the amount paid for theacquisition of 65 % of the capital of the Mauritaniancompany BSA Ciment SA, as well as to the acquisitionof various concrete and aggregate companiesin France and Switzerland.for a total net flow of (66,0) million euros.162 VICAT - 2009 registration document

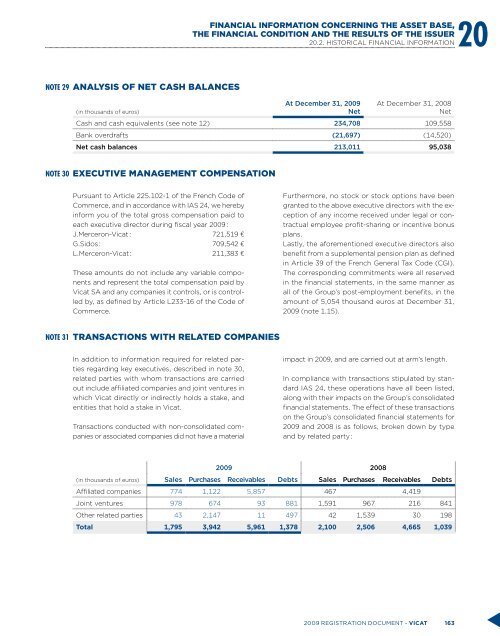

Financial information concerning the asset base,20the financial condition and the results of the issuer20.2. HISTORICAL FINANCIAL INFORMATIONNOTE 29ANALYSIS OF NET CASH BALANCES(in thousands of euros)At December 31, 2009NetAt December 31, 2008NetCash and cash equivalents (see note 12) 234,708 109,558Bank overdrafts (21,697) (14,520)Net cash balances 213,011 95,038NOTE 30EXECUTIVE MANAGEMENT COMPENSATIONPursuant to Article 225.102-1 of the French Code ofCommerce, and in accordance with IAS 24, we herebyinform you of the total gross compensation paid toeach executive director during fiscal year 2009 :J.Merceron-<strong>Vicat</strong> : 721,519 €G.Sidos : 709,542 €L.Merceron-<strong>Vicat</strong> : 211,383 €These amounts do not include any variable componentsand represent the total compensation paid by<strong>Vicat</strong> SA and any companies it controls, or is controlledby, as defined by Article L233-16 of the Code ofCommerce.Furthermore, no stock or stock options have beengranted to the above executive directors with the exceptionof any income received under legal or contractualemployee profit-sharing or incentive bonusplans.Lastly, the aforementioned executive directors alsobenefit from a supplemental pension plan as definedin Article 39 of the French General Tax Code (CGI).The corresponding commitments were all reservedin the financial statements, in the same manner asall of the Group’s post-employment benefits, in theamount of 5,054 thousand euros at December 31,2009 (note 1.15).NOTE 31 TRANSACTIONS WITH RELATED COMPANIESIn addition to information required for related partiesregarding key executives, described in note 30,related parties with whom transactions are carriedout include affiliated companies and joint ventures inwhich <strong>Vicat</strong> directly or indirectly holds a stake, andentities that hold a stake in <strong>Vicat</strong>.Transactions conducted with non-consolidated companiesor associated companies did not have a materialimpact in 2009, and are carried out at arm’s length.In compliance with transactions stipulated by standardIAS 24, these operations have all been listed,along with their impacts on the Group’s consolidatedfinancial statements. The effect of these transactionson the Group’s consolidated financial statements for2009 and 2008 is as follows, broken down by typeand by related party :2009 2008(in thousands of euros) Sales Purchases Receivables Debts Sales Purchases Receivables DebtsAffiliated companies 774 1,122 5,857 467 4,419Joint ventures 978 674 93 881 1,591 967 216 841Other related parties 43 2,147 11 497 42 1,539 30 198Total 1,795 3,942 5,961 1,378 2,100 2,506 4,665 1,0392009 registration document - VICAT 163