6 - Vicat

6 - Vicat

6 - Vicat

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

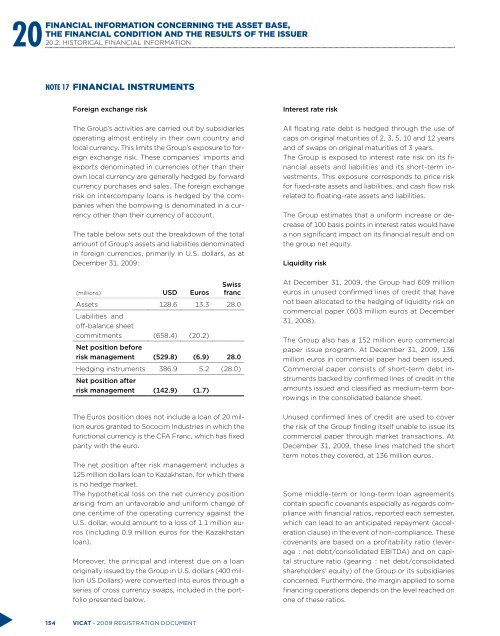

20Financial information concerning the asset base,the financial condition and the results of the issuer20.2. HISTORICAL FINANCIAL INFORMATIONNOTE 17 FINANCIAL INSTRUMENTSForeign exchange riskThe Group’s activities are carried out by subsidiariesoperating almost entirely in their own country andlocal currency. This limits the Group’s exposure to foreignexchange risk. These companies’ imports andexports denominated in currencies other than theirown local currency are generally hedged by forwardcurrency purchases and sales. The foreign exchangerisk on intercompany loans is hedged by the companieswhen the borrowing is denominated in a currencyother than their currency of account.The table below sets out the breakdown of the totalamount of Group’s assets and liabilities denominatedin foreign currencies, primarily in U.S. dollars, as atDecember 31, 2009 :(millions) USD EurosSwissfrancAssets 128.6 13.3 28.0Liabilities andoff-balance sheetcommitments (658.4) (20.2)Net position beforerisk management (529.8) (6.9) 28.0Hedging instruments 386.9 5.2 (28.0)Net position afterrisk management (142.9) (1.7)The Euros position does not include a loan of 20 millioneuros granted to Sococim Industries in which thefunctional currency is the CFA Franc, which has fixedparity with the euro.The net position after risk management includes a125 million dollars loan to Kazakhstan, for which thereis no hedge market.The hypothetical loss on the net currency positionarising from an unfavorable and uniform change ofone centime of the operating currency against theU.S. dollar, would amount to a loss of 1.1 million euros(including 0.9 million euros for the Kazakhstanloan).Moreover, the principal and interest due on a loanoriginally issued by the Group in U.S. dollars (400 millionUS Dollars) were converted into euros through aseries of cross currency swaps, included in the portfoliopresented below.Interest rate riskAll floating rate debt is hedged through the use ofcaps on original maturities of 2, 3, 5, 10 and 12 yearsand of swaps on original maturities of 3 years.The Group is exposed to interest rate risk on its financialassets and liabilities and its short-term investments.This exposure corresponds to price riskfor fixed-rate assets and liabilities, and cash flow riskrelated to floating-rate assets and liabilities.The Group estimates that a uniform increase or decreaseof 100 basis points in interest rates would havea non significant impact on its financial result and onthe group net equity.Liquidity riskAt December 31, 2009, the Group had 609 millioneuros in unused confirmed lines of credit that havenot been allocated to the hedging of liquidity risk oncommercial paper (603 million euros at December31, 2008).The Group also has a 152 million euro commercialpaper issue program. At December 31, 2009, 136million euros in commercial paper had been issued.Commercial paper consists of short-term debt instrumentsbacked by confirmed lines of credit in theamounts issued and classified as medium-term borrowingsin the consolidated balance sheet.Unused confirmed lines of credit are used to coverthe risk of the Group finding itself unable to issue itscommercial paper through market transactions. AtDecember 31, 2009, these lines matched the shortterm notes they covered, at 136 million euros.Some middle-term or long-term loan agreementscontain specific covenants especially as regards compliancewith financial ratios, reported each semester,which can lead to an anticipated repayment (accelerationclause) in the event of non-compliance. Thesecovenants are based on a profitability ratio (leverage: net debt/consolidated EBITDA) and on capitalstructure ratio (gearing : net debt/consolidatedshareholders’ equity) of the Group or its subsidiariesconcerned. Furthermore, the margin applied to somefinancing operations depends on the level reached onone of these ratios.154 VICAT - 2009 registration document