6 - Vicat

6 - Vicat

6 - Vicat

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

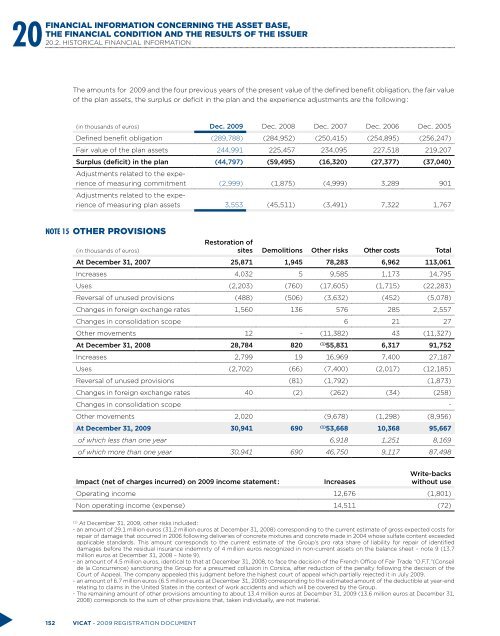

20Financial information concerning the asset base,the financial condition and the results of the issuer20.2. HISTORICAL FINANCIAL INFORMATIONThe amounts for 2009 and the four previous years of the present value of the defined benefit obligation, the fair valueof the plan assets, the surplus or deficit in the plan and the experience adjustments are the following :(in thousands of euros) Dec. 2009 Dec. 2008 Dec. 2007 Dec. 2006 Dec. 2005Defined benefit obligation (289,788) (284,952) (250,415) (254,895) (256,247)Fair value of the plan assets 244,991 225,457 234,095 227,518 219,207Surplus (deficit) in the plan (44,797) (59,495) (16,320) (27,377) (37,040)Adjustments related to the experienceof measuring commitment (2,999) (1,875) (4,999) 3,289 901Adjustments related to the experienceof measuring plan assets 3,553 (45,511) (3,491) 7,322 1,767NOTE 15 OTHER PROVISIONS(in thousands of euros)Restoration ofsites Demolitions Other risks Other costs TotalAt December 31, 2007 25,871 1,945 78,283 6,962 113,061Increases 4,032 5 9,585 1,173 14,795Uses (2,203) (760) (17,605) (1,715) (22,283)Reversal of unused provisions (488) (506) (3,632) (452) (5,078)Changes in foreign exchange rates 1,560 136 576 285 2,557Changes in consolidation scope 6 21 27Other movements 12 - (11,382) 43 (11,327)At December 31, 2008 28,784 820(1)55,831 6,317 91,752Increases 2,799 19 16,969 7,400 27,187Uses (2,702) (66) (7,400) (2,017) (12,185)Reversal of unused provisions (81) (1,792) (1,873)Changes in foreign exchange rates 40 (2) (262) (34) (258)Changes in consolidation scope -Other movements 2,020 (9,678) (1,298) (8,956)At December 31, 2009 30,941 690(1)53,668 10,368 95,667of which less than one year 6,918 1,251 8,169of which more than one year 30,941 690 46,750 9,117 87,498Impact (net of charges incurred) on 2009 income statement :IncreasesWrite-backswithout useOperating income 12,676 (1,801)Non operating income (expense) 14,511 (72)(1)At December 31, 2009, other risks included :- an amount of 29.1 million euros (31.2 million euros at December 31, 2008) corresponding to the current estimate of gross expected costs forrepair of damage that occurred in 2006 following deliveries of concrete mixtures and concrete made in 2004 whose sulfate content exceededapplicable standards. This amount corresponds to the current estimate of the Group’s pro rata share of liability for repair of identifieddamages before the residual insurance indemnity of 4 million euros recognized in non-current assets on the balance sheet – note 9 (13.7million euros at December 31, 2008 – Note 9).- an amount of 4.5 million euros, identical to that at December 31, 2008, to face the decision of the French Office of Fair Trade “O.F.T.”(Conseilde la Concurrence) sanctioning the Group for a presumed collusion in Corsica, after reduction of the penalty following the decision of theCourt of Appeal. The company appealed this judgment before the highest court of appeal which partially rejected it in July 2009.- an amount of 6.7 million euros (6.5 million euros at December 31, 2008) corresponding to the estimated amount of the deductible at year-endrelating to claims in the United States in the context of work accidents and which will be covered by the Group.- The remaining amount of other provisions amounting to about 13.4 million euros at December 31, 2009 (13.6 million euros at December 31,2008) corresponds to the sum of other provisions that, taken individually, are not material.152 VICAT - 2009 registration document