6 - Vicat

6 - Vicat

6 - Vicat

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

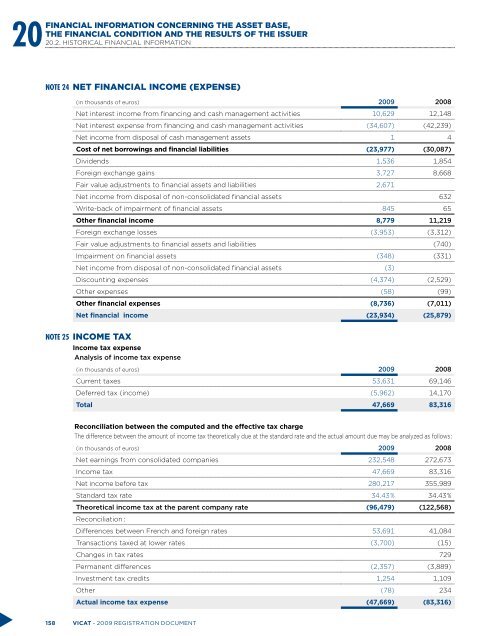

20Financial information concerning the asset base,the financial condition and the results of the issuer20.2. HISTORICAL FINANCIAL INFORMATIONNOTE 24 NET FINANCIAL INCOME (EXPENSE)(in thousands of euros) 2009 2008Net interest income from financing and cash management activities 10,629 12,148Net interest expense from financing and cash management activities (34,607) (42,239)Net income from disposal of cash management assets 1 4Cost of net borrowings and financial liabilities (23,977) (30,087)Dividends 1,536 1,854Foreign exchange gains 3,727 8,668Fair value adjustments to financial assets and liabilities 2,671Net income from disposal of non-consolidated financial assets 632Write-back of impairment of financial assets 845 65Other financial income 8,779 11,219Foreign exchange losses (3,953) (3,312)Fair value adjustments to financial assets and liabilities (740)Impairment on financial assets (348) (331)Net income from disposal of non-consolidated financial assets (3)Discounting expenses (4,374) (2,529)Other expenses (58) (99)Other financial expenses (8,736) (7,011)Net financial income (23,934) (25,879)NOTE 25 INCOME TAXIncome tax expenseAnalysis of income tax expense(in thousands of euros) 2009 2008Current taxes 53,631 69,146Deferred tax (income) (5,962) 14,170Total 47,669 83,316Reconciliation between the computed and the effective tax chargeThe difference between the amount of income tax theoretically due at the standard rate and the actual amount due may be analyzed as follows :(in thousands of euros) 2009 2008Net earnings from consolidated companies 232,548 272,673Income tax 47,669 83,316Net income before tax 280,217 355,989Standard tax rate 34.43 % 34.43 %Theoretical income tax at the parent company rate (96,479) (122,568)Reconciliation :Differences between French and foreign rates 53,691 41,084Transactions taxed at lower rates (3,700) (15)Changes in tax rates 729Permanent differences (2,357) (3,889)Investment tax credits 1,254 1,109Other (78) 234Actual income tax expense (47,669) (83,316)158 VICAT - 2009 registration document