6 - Vicat

6 - Vicat

6 - Vicat

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

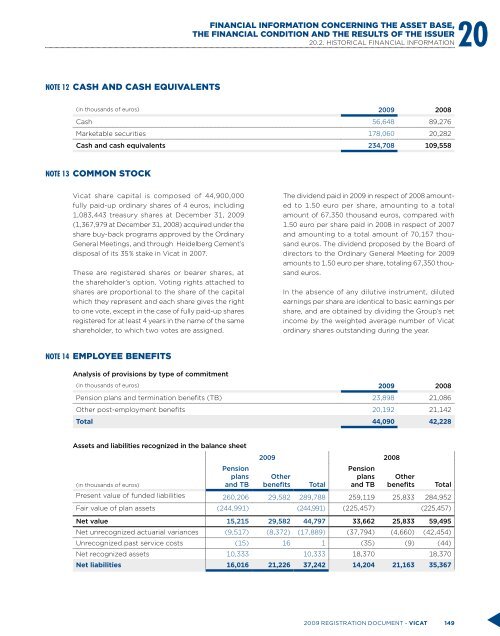

Financial information concerning the asset base,20the financial condition and the results of the issuer20.2. HISTORICAL FINANCIAL INFORMATIONNOTE 12 CASH AND CASH EQUIVALENTS(in thousands of euros) 2009 2008Cash 56,648 89,276Marketable securities 178,060 20,282Cash and cash equivalents 234,708 109,558NOTE 13 COMMON STOCK<strong>Vicat</strong> share capital is composed of 44,900,000fully paid-up ordinary shares of 4 euros, including1,083,443 treasury shares at December 31, 2009(1,367,979 at December 31, 2008) acquired under theshare buy-back programs approved by the OrdinaryGeneral Meetings, and through Heidelberg Cement’sdisposal of its 35 % stake in <strong>Vicat</strong> in 2007.These are registered shares or bearer shares, atthe shareholder’s option. Voting rights attached toshares are proportional to the share of the capitalwhich they represent and each share gives the rightto one vote, except in the case of fully paid-up sharesregistered for at least 4 years in the name of the sameshareholder, to which two votes are assigned.The dividend paid in 2009 in respect of 2008 amountedto 1.50 euro per share, amounting to a totalamount of 67,350 thousand euros, compared with1.50 euro per share paid in 2008 in respect of 2007and amounting to a total amount of 70,157 thousandeuros. The dividend proposed by the Board ofdirectors to the Ordinary General Meeting for 2009amounts to 1.50 euro per share, totaling 67,350 thousandeuros.In the absence of any dilutive instrument, dilutedearnings per share are identical to basic earnings pershare, and are obtained by dividing the Group’s netincome by the weighted average number of <strong>Vicat</strong>ordinary shares outstanding during the year.NOTE 14EMPLOYEE BENEFITSAnalysis of provisions by type of commitment(in thousands of euros) 2009 2008Pension plans and termination benefits (TB) 23,898 21,086Other post-employment benefits 20,192 21,142Total 44,090 42,228Assets and liabilities recognized in the balance sheet2009 2008(in thousands of euros)Pensionplans and TBOtherbenefits TotalPensionplans and TBOtherbenefits TotalPresent value of funded liabilities 260,206 29,582 289,788 259,119 25,833 284,952Fair value of plan assets (244,991) (244,991) (225,457) (225,457)Net value 15,215 29,582 44,797 33,662 25,833 59,495Net unrecognized actuarial variances (9,517) (8,372) (17,889) (37,794) (4,660) (42,454)Unrecognized past service costs (15) 16 1 (35) (9) (44)Net recognized assets 10,333 10,333 18,370 18,370Net liabilities 16,016 21,226 37,242 14,204 21,163 35,3672009 registration document - VICAT 149