6 - Vicat

6 - Vicat

6 - Vicat

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

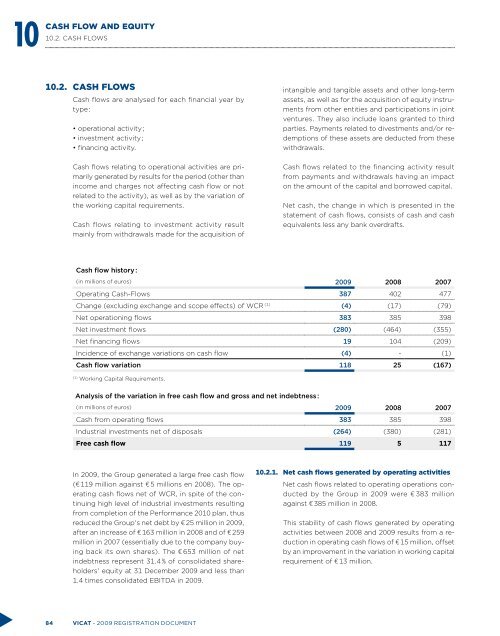

1010.2.CASH FLOW AND EQUITYCASH FLOWS10.2. CASH FLOWSCash flows are analysed for each financial year bytype :• operational activity ;• investment activity ;• financing activity.Cash flows relating to operational activities are primarilygenerated by results for the period (other thanincome and charges not affecting cash flow or notrelated to the activity), as well as by the variation ofthe working capital requirements.Cash flows relating to investment activity resultmainly from withdrawals made for the acquisition ofintangible and tangible assets and other long-termassets, as well as for the acquisition of equity instrumentsfrom other entities and participations in jointventures. They also include loans granted to thirdparties. Payments related to divestments and/or redemptionsof these assets are deducted from thesewithdrawals.Cash flows related to the financing activity resultfrom payments and withdrawals having an impacton the amount of the capital and borrowed capital.Net cash, the change in which is presented in thestatement of cash flows, consists of cash and cashequivalents less any bank overdrafts.Cash flow history :(in millions of euros) 2009 2008 2007Operating Cash-Flows 387 402 477Change (excluding exchange and scope effects) of WCR (1) (4) (17) (79)Net operationing flows 383 385 398Net investment flows (280) (464) (355)Net financing flows 19 104 (209)Incidence of exchange variations on cash flow (4) - (1)Cash flow variation 118 25 (167)(1)Working Capital Requirements.Analysis of the variation in free cash flow and gross and net indebtness :(in millions of euros) 2009 2008 2007Cash from operating flows 383 385 398Industrial investments net of disposals (264) (380) (281)Free cash flow 119 5 117In 2009, the Group generated a large free cash flow(€ 119 million against € 5 millions en 2008). The operatingcash flows net of WCR, in spite of the continuinghigh level of industrial investments resultingfrom completion of the Performance 2010 plan, thusreduced the Group's net debt by € 25 million in 2009,after an increase of € 163 million in 2008 and of € 259million in 2007 (essentially due to the company buyingback its own shares). The € 653 million of netindebtness represent 31.4 % of consolidated shareholders'equity at 31 December 2009 and less than1.4 times consolidated EBITDA in 2009.10.2.1. Net cash flows generated by operating activitiesNet cash flows related to operating operations conductedby the Group in 2009 were € 383 millionagainst € 385 million in 2008.This stability of cash flows generated by operatingactivities between 2008 and 2009 results from a reductionin operating cash flows of € 15 million, offsetby an improvement in the variation in working capitalrequirement of € 13 million.84 VICAT - 2009 registration document