6 - Vicat

6 - Vicat

6 - Vicat

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

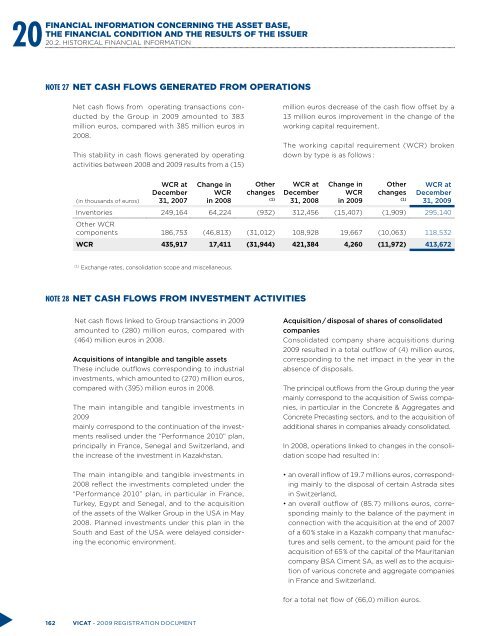

20Financial information concerning the asset base,the financial condition and the results of the issuer20.2. HISTORICAL FINANCIAL INFORMATIONNOTE 27NET CASH FLOWS GENERATED FROM OPERATIONSNet cash flows from operating transactions conductedby the Group in 2009 amounted to 383million euros, compared with 385 million euros in2008.This stability in cash flows generated by operatingactivities between 2008 and 2009 results from a (15)million euros decrease of the cash flow offset by a13 million euros improvement in the change of theworking capital requirement.The working capital requirement (WCR) brokendown by type is as follows :(in thousands of euros)WCR atDecember31, 2007Change inWCRin 2008Otherchanges(1)WCR atDecember31, 2008Change inWCRin 2009Otherchanges(1)WCR atDecember31, 2009Inventories 249,164 64,224 (932) 312,456 (15,407) (1,909) 295,140Other WCRcomponents 186,753 (46,813) (31,012) 108,928 19,667 (10,063) 118,532WCR 435,917 17,411 (31,944) 421,384 4,260 (11,972) 413,672(1)Exchange rates, consolidation scope and miscellaneous.NOTE 28NET CASH FLOWS FROM INVESTMENT ACTIVITIESNet cash flows linked to Group transactions in 2009amounted to (280) million euros, compared with(464) million euros in 2008.Acquisitions of intangible and tangible assetsThese include outflows corresponding to industrialinvestments, which amounted to (270) million euros,compared with (395) million euros in 2008.The main intangible and tangible investments in2009mainly correspond to the continuation of the investmentsrealised under the “Performance 2010” plan,principally in France, Senegal and Switzerland, andthe increase of the investment in Kazakhstan.The main intangible and tangible investments in2008 reflect the investments completed under the“Performance 2010” plan, in particular in France,Turkey, Egypt and Senegal, and to the acquisitionof the assets of the Walker Group in the USA in May2008. Planned investments under this plan in theSouth and East of the USA were delayed consideringthe economic environment.Acquisition / disposal of shares of consolidatedcompaniesConsolidated company share acquisitions during2009 resulted in a total outflow of (4) million euros,corresponding to the net impact in the year in theabsence of disposals.The principal outflows from the Group during the yearmainly correspond to the acquisition of Swiss companies,in particular in the Concrete & Aggregates andConcrete Precasting sectors, and to the acquisition ofadditional shares in companies already consolidated.In 2008, operations linked to changes in the consolidationscope had resulted in :• an overall inflow of 19.7 millions euros, correspondingmainly to the disposal of certain Astrada sitesin Switzerland,• an overall outflow of (85.7) millions euros, correspondingmainly to the balance of the payment inconnection with the acquisition at the end of 2007of a 60 % stake in a Kazakh company that manufacturesand sells cement, to the amount paid for theacquisition of 65 % of the capital of the Mauritaniancompany BSA Ciment SA, as well as to the acquisitionof various concrete and aggregate companiesin France and Switzerland.for a total net flow of (66,0) million euros.162 VICAT - 2009 registration document