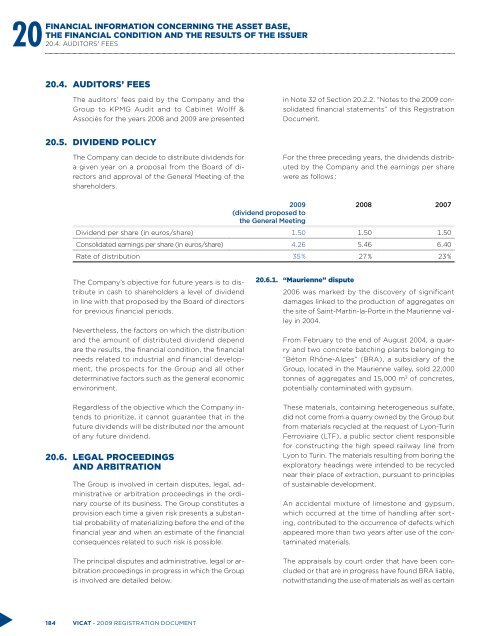

information concerning the asset base,the financial condition and the results of the issuer20Financial20.4. Auditors' fees20.4. AUDITORS’ FEESThe auditors’ fees paid by the Company and theGroup to KPMG Audit and to Cabinet Wolff &Associés for the years 2008 and 2009 are presentedin Note 32 of Section 20.2.2. “Notes to the 2009 consolidatedfinancial statements” of this RegistrationDocument.20.5. DIVIDEND POLICYThe Company can decide to distribute dividends fora given year on a proposal from the Board of directorsand approval of the General Meeting of theshareholders.For the three preceding years, the dividends distributedby the Company and the earnings per sharewere as follows :20092008 2007(dividend proposed tothe General MeetingDividend per share (in euros/share) 1.50 1.50 1.50Consolidated earnings per share (in euros/share) 4.26 5.46 6.40Rate of distribution 35 % 27 % 23 %The Company’s objective for future years is to distributein cash to shareholders a level of dividendin line with that proposed by the Board of directorsfor previous financial periods.Nevertheless, the factors on which the distributionand the amount of distributed dividend dependare the results, the financial condition, the financialneeds related to industrial and financial development,the prospects for the Group and all otherdeterminative factors such as the general economicenvironment.Regardless of the objective which the Company intendsto prioritize, it cannot guarantee that in thefuture dividends will be distributed nor the amountof any future dividend.20.6. LEGAL PROCEEDINGSAND ARBITRATIONThe Group is involved in certain disputes, legal, administrativeor arbitration proceedings in the ordinarycourse of its business. The Group constitutes aprovision each time a given risk presents a substantialprobability of materializing before the end of thefinancial year and when an estimate of the financialconsequences related to such risk is possible.The principal disputes and administrative, legal or arbitrationproceedings in progress in which the Groupis involved are detailed below.20.6.1. “Maurienne” dispute2006 was marked by the discovery of significantdamages linked to the production of aggregates onthe site of Saint-Martin-la-Porte in the Maurienne valleyin 2004.From February to the end of August 2004, a quarryand two concrete batching plants belonging to“Béton Rhône-Alpes” (BRA), a subsidiary of theGroup, located in the Maurienne valley, sold 22,000tonnes of aggregates and 15,000 m 3 of concretes,potentially contaminated with gypsum.These materials, containing heterogeneous sulfate,did not come from a quarry owned by the Group butfrom materials recycled at the request of Lyon-TurinFerroviaire (LTF), a public sector client responsiblefor constructing the high speed railway line fromLyon to Turin. The materials resulting from boring theexploratory headings were intended to be recyclednear their place of extraction, pursuant to principlesof sustainable development.An accidental mixture of limestone and gypsum,which occurred at the time of handling after sorting,contributed to the occurrence of defects whichappeared more than two years after use of the contaminatedmaterials.The appraisals by court order that have been concludedor that are in progress have found BRA liable,notwithstanding the use of materials as well as certain184 VICAT - 2009 registration document

Financial information concerning the asset base,the financial condition and the results of the issuer20.6. LEGAL PROCEEDINGS AND ARBITRATION20internal or project construction checks by some firmsthat frequently did not comply with standards andbest technical practice, which could have triggered,accelerated or amplified the defects.BRA is using these implementation or verificationfaults as a basis to negotiate shared liability. Protocolscovered by a confidentiality obligation are being developedbetween BRA and certain firms. Likewise,to put a halt to claims, whether unjustified or clearlyexaggerated, construction industry economists assistedby experts certified with the Cour de cassation(French Supreme Court of Appeal) are examining allthe documents alleging material or consequentialdamages.This examination and a critical analysis of the periodunder investigation led BRA to recognize as atDecember 31, 2009 a net expense of 16.6 millioneuros, owing to either an increase in the costs expectedto cover the damages, the changes in BRA’sestimated share of responsibility, or the emergenceof new claims.Usually, these two concrete batching plants atMaurienne, like all the Group’s plants, use materialsextracted from quarries with properly identified deposits,that are checked regularly and rigorously soas to avoid this type of risk.Reinforced quality control measures have been implementedin order to prevent the recurrence of suchevents and these have resulted in the Concrete &Aggregates business in France being awarded ISO9001-2000 certification at the beginning of 2009.20.6.2. Competition litigation in CorsicaBy the ruling of March 12, 2007, the FrenchCompetition Commission fined the Company 8 millioneuros, as well as imposing fines on another Frenchcement manufacturer and the Corsican cementdealers’ network. According to the Commission, thepractices in respect of which the fine was imposedwere intended to restrict the supply of cement to theisland to the two cement manufacturers and to blockimports, in particular from Italy and Greece.Under a judgment of May 6, 2008, the Paris Courtof Appeal overturned the deferred decision of theCompetition Commission, but only in respect of theamount of the sanctions imposed, and in particularreduced the amount of the fine imposed on theCompany to 4.5 million euros.Under a judgment of July 7, 2009, the CommercialDivision of the Cour de Cassation (Supreme Court ofAppeal) ruled that the Court of Appeal had not justifiedits judgment in law “since it had not investigatedif, in the absence of agreements concluded withtheir customers, the companies Lafarge and <strong>Vicat</strong>,would have been able to act on the market in questionto a significant extent independently of theircompetitors, their customers and the consumers”.Consequently, the Cour de Cassation quashed andpartially annulled the judgment of May 6, 2008, andsent the parties back to the Paris Court of Appeal,differently constituted.The Company regrets the fact that the CompetitionCommission and the Court of Appeal have, from itspoint of view, misunderstood the general contextof the supply and distribution of cement in Corsica,as well as the very particular circumstances havingled to the conclusion, in a fully transparent manner,of various agreements today under sanction andthe beneficial effects resulting from the same forCorsican consumers.The plan was instituted many years ago under pressurefrom the public authorities without either thecustomers or the competitors allegedly discriminatedagainst petitioning the Competition authorities.In 1991, the Chamber of Commerce and Industryof Upper Corsica requested <strong>Vicat</strong> and Lafarge to financea refurbished silo facility at the port of Bastia,capable of receiving cement meeting French standardsin bulk, and required the two suppliers to entrustthe exclusive operation to the GIE GroupementLogistique Ciments Haute-Corse, an exclusivity nowdisputed by the Commission.Until 1998, the State subsidized the transport of cementin bulk by 2.3 million euros per year under theprinciple of continuity of supply to the area. When thissubsidy was withdrawn, <strong>Vicat</strong> S.A., Lafarge Cimentsand the dealers’ association on the island sought ameans to rationalize the conditions of supply of cementto the island. They had to make significant effortsto maintain continuous and regular supplies ofcement meeting French standards to Corsica, withouta rise in the cost of transport for the dealers, thusallowing unchanged cement selling prices despite thewithdrawal of a significant State subsidy.During the period in question, foreign imports toCorsica grew by almost 50 %. Consequently, the2009 registration document - VICAT 185