6 - Vicat

6 - Vicat

6 - Vicat

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

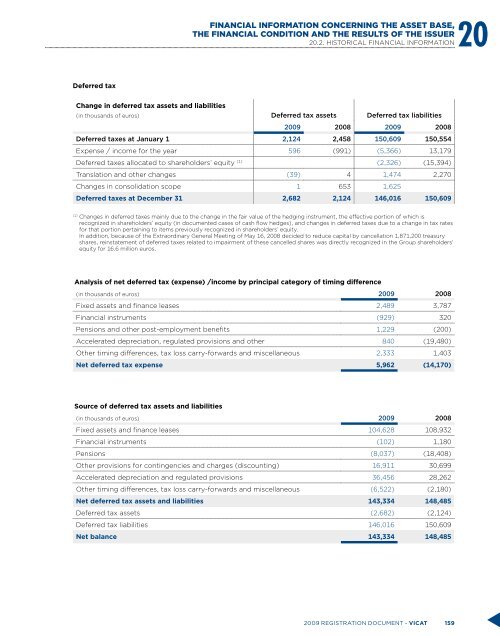

Financial information concerning the asset base,20the financial condition and the results of the issuer20.2. HISTORICAL FINANCIAL INFORMATIONDeferred taxChange in deferred tax assets and liabilities(in thousands of euros) Deferred tax assets Deferred tax liabilities2009 2008 2009 2008Deferred taxes at January 1 2,124 2,458 150,609 150,554Expense / income for the year 596 (991) (5,366) 13,179Deferred taxes allocated to shareholders’ equity (1) (2,326) (15,394)Translation and other changes (39) 4 1,474 2,270Changes in consolidation scope 1 653 1,625Deferred taxes at December 31 2,682 2,124 146,016 150,609(1)Changes in deferred taxes mainly due to the change in the fair value of the hedging instrument, the effective portion of which isrecognized in shareholders’ equity (in documented cases of cash flow hedges), and changes in deferred taxes due to a change in tax ratesfor that portion pertaining to items previously recognized in shareholders’ equity.In addition, because of the Extraordinary General Meeting of May 16, 2008 decided to reduce capital by cancellation 1,871,200 treasuryshares, reinstatement of deferred taxes related to impairment of these cancelled shares was directly recognized in the Group shareholders’equity for 16.6 million euros.Analysis of net deferred tax (expense) /income by principal category of timing difference(in thousands of euros) 2009 2008Fixed assets and finance leases 2,489 3,787Financial instruments (929) 320Pensions and other post-employment benefits 1,229 (200)Accelerated depreciation, regulated provisions and other 840 (19,480)Other timing differences, tax loss carry-forwards and miscellaneous 2,333 1,403Net deferred tax expense 5,962 (14,170)Source of deferred tax assets and liabilities(in thousands of euros) 2009 2008Fixed assets and finance leases 104,628 108,932Financial instruments (102) 1,180Pensions (8,037) (18,408)Other provisions for contingencies and charges (discounting) 16,911 30,699Accelerated depreciation and regulated provisions 36,456 28,262Other timing differences, tax loss carry-forwards and miscellaneous (6,522) (2,180)Net deferred tax assets and liabilities 143,334 148,485Deferred tax assets (2,682) (2,124)Deferred tax liabilities 146,016 150,609Net balance 143,334 148,4852009 registration document - VICAT 159