6 - Vicat

6 - Vicat

6 - Vicat

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

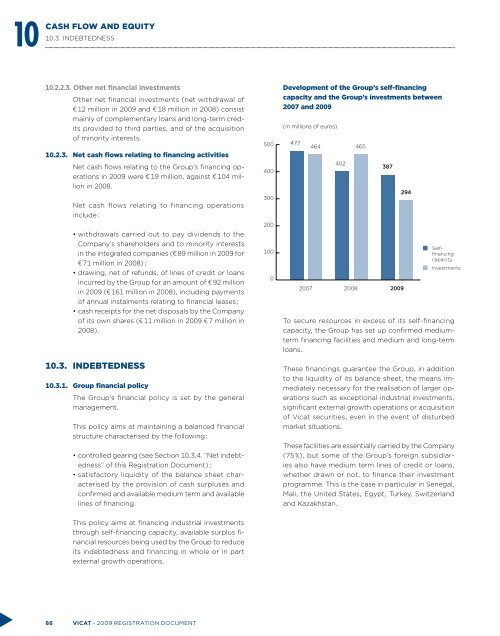

1010.3.CASH FLOW AND EQUITYINDEBTEDNESS10.2.2.3. Other net financial investmentsOther net financial investments (net withdrawal of€ 12 million in 2009 and € 18 million in 2008) consistmainly of complementary loans and long-term creditsprovided to third parties, and of the acquisitionof minority interests.10.2.3. Net cash flows relating to financing activitiesNet cash flows relating to the Group’s financing operationsin 2009 were € 19 million, against € 104 millionin 2008.Net cash flows relating to financing operationsinclude :• withdrawals carried out to pay dividends to theCompany’s shareholders and to minority interestsin the integrated companies (€ 89 million in 2009 for€ 71 million in 2008) ;• drawing, net of refunds, of lines of credit or loansincurred by the Group for an amount of € 92 millionin 2009 (€ 161 million in 2008), including paymentsof annual instalments relating to financial leases ;• cash receipts for the net disposals by the Companyof its own shares (€ 11 million in 2009 € 7 million in2008).10.3. INDEBTEDNESS10.3.1. Group financial policyThe Group’s financial policy is set by the generalmanagement.This policy aims at maintaining a balanced financialstructure characterised by the following :• controlled gearing (see Section 10.3.4. “Net indebtedness”of this Registration Document) ;• satisfactory liquidity of the balance sheet characterisedby the provision of cash surpluses andconfirmed and available medium term and availablelines of financing.5004003002001000Development of the Group’s self-financingcapacity and the Group’s investments between2007 and 2009(in millions of euros)47720074644024653872008 2009294SelffinancingcapacityInvestmentsTo secure resources in excess of its self-financingcapacity, the Group has set up confirmed mediumtermfinancing facilities and medium and long-termloans.These financings guarantee the Group, in additionto the liquidity of its balance sheet, the means immediatelynecessary for the realisation of larger operationssuch as exceptional industrial investments,significant external growth operations or acquisitionof <strong>Vicat</strong> securities, even in the event of disturbedmarket situations.These facilities are essentially carried by the Company(75 %), but some of the Group’s foreign subsidiariesalso have medium term lines of credit or loans,whether drawn or not, to finance their investmentprogramme. This is the case in particular in Senegal,Mali, the United States, Egypt, Turkey, Switzerlandand Kazakhstan.This policy aims at financing industrial investmentsthrough self-financing capacity, available surplus financialresources being used by the Group to reduceits indebtedness and financing in whole or in partexternal growth operations.86 VICAT - 2009 registration document