6 - Vicat

6 - Vicat

6 - Vicat

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

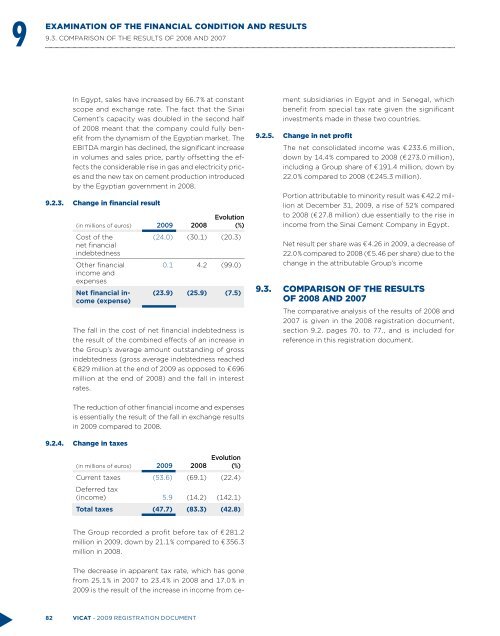

9EXAMINATION OF THE FINANCIAL CONDITION AND RESULTS9.3. Comparison of the results of 2008 and 2007In Egypt, sales have increased by 66.7 % at constantscope and exchange rate. The fact that the SinaiCement’s capacity was doubled in the second halfof 2008 meant that the company could fully benefitfrom the dynamism of the Egyptian market. TheEBITDA margin has declined, the significant increasein volumes and sales price, partly offsetting the effectsthe considerable rise in gas and electricity pricesand the new tax on cement production introducedby the Egyptian government in 2008.9.2.3. Change in financial result(in millions of euros) 2009 2008Evolution(%)Cost of thenet financialindebtedness(24.0) (30.1) (20.3)Other financialincome andexpensesNet financial income(expense)0.1 4.2 (99.0)(23.9) (25.9) (7.5)The fall in the cost of net financial indebtedness isthe result of the combined effects of an increase inthe Group’s average amount outstanding of grossindebtedness (gross average indebtedness reached€ 829 million at the end of 2009 as opposed to € 696million at the end of 2008) and the fall in interestrates.The decrease in apparent tax rate, which has gonefrom 25.1 % in 2007 to 23.4 % in 2008 and 17.0 % in2009 is the result of the increase in income from cementsubsidiaries in Egypt and in Senegal, whichbenefit from special tax rate given the significantinvestments made in these two countries.9.2.5. Change in net profitThe net consolidated income was € 233.6 million,down by 14.4 % compared to 2008 (€ 273.0 million),including a Group share of € 191.4 million, down by22.0 % compared to 2008 (€ 245.3 million).Portion attributable to minority result was € 42.2 millionat December 31, 2009, a rise of 52 % comparedto 2008 (€ 27.8 million) due essentially to the rise inincome from the Sinai Cement Company in Egypt.Net result per share was € 4.26 in 2009, a decrease of22.0 % compared to 2008 (€ 5.46 per share) due to thechange in the attributable Group’s income9.3. Comparison of the resultsof 2008 and 2007The comparative analysis of the results of 2008 and2007 is given in the 2008 registration document,section 9.2. pages 70. to 77., and is included forreference in this registration document.The reduction of other financial income and expensesis essentially the result of the fall in exchange resultsin 2009 compared to 2008.9.2.4. Change in taxes(in millions of euros) 2009 2008Evolution(%)Current taxes (53.6) (69.1) (22.4)Deferred tax(income) 5.9 (14.2) (142.1)Total taxes (47.7) (83.3) (42.8)The Group recorded a profit before tax of € 281.2million in 2009, down by 21.1 % compared to € 356.3million in 2008.82 VICAT - 2009 registration document