The ATP Group Annual Report 2012

The ATP Group Annual Report 2012

The ATP Group Annual Report 2012

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

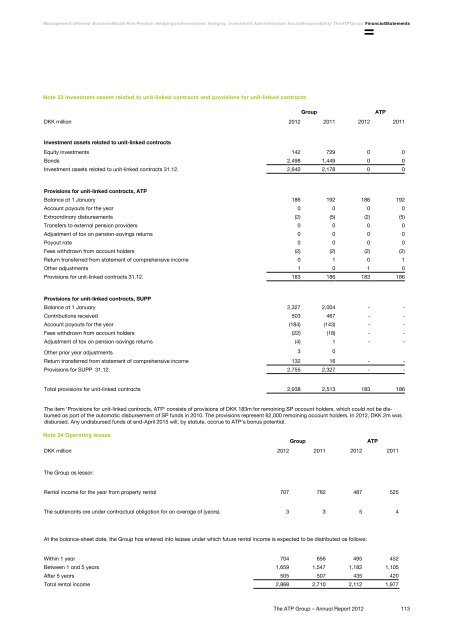

Management's Review Business Model Risk Pension Hedging and Investment Hedging Investment Administration Social Responsibility <strong>The</strong> <strong>ATP</strong> <strong>Group</strong> Financial StatementsNote 33 Investment assets related to unit-linked contracts and provisions for unit-linked contracts<strong>Group</strong> <strong>ATP</strong>DKK million <strong>2012</strong> 2011 <strong>2012</strong> 2011Investment assets related to unit-linked contractsEquity investments 142 729 0 0Bonds 2,498 1,449 0 0Investment assets related to unit-linked contracts 31.12. 2,640 2,178 0 0Provisions for unit-linked contracts, <strong>ATP</strong>Balance at 1 January 186 192 186 192Account payouts for the year 0 0 0 0Extraordinary disbursements (2) (5) (2) (5)Transfers to external pension providers 0 0 0 0Adjustment of tax on pension-savings returns 0 0 0 0Payout rate 0 0 0 0Fees withdrawn from account holders (2) (2) (2) (2)Return transferred from statement of comprehensive income 0 1 0 1Other adjustments 1 0 1 0Provisions for unit-linked contracts 31.12. 183 186 183 186Provisions for unit-linked contracts, SUPPBalance at 1 January 2,327 2,004 - -Contributions received 503 467 - -Account payouts for the year (184) (143) - -Fees withdrawn from account holders (22) (18) - -Adjustment of tax on pension-savings returns (4) 1 - -Other prior year adjustments 3 0Return transferred from statement of comprehensive income 132 16 - -Provisions for SUPP 31.12. 2,755 2,327 - -Total provisions for unit-linked contracts 2,938 2,513 183 186<strong>The</strong> item 'Provisions for unit-linked contracts, <strong>ATP</strong>' consists of provisions of DKK 183m for remaining SP account holders, which could not be disbursedas part of the automatic disbursement of SP funds in 2010. <strong>The</strong> provisions represent 62,000 remaining account holders. In <strong>2012</strong>, DKK 2m wasdisbursed. Any undisbursed funds at end-April 2015 will, by statute, accrue to <strong>ATP</strong>'s bonus potential.Note 34 Operating leases<strong>Group</strong> <strong>ATP</strong>DKK million <strong>2012</strong> 2011 <strong>2012</strong> 2011<strong>The</strong> <strong>Group</strong> as lessor:Rental income for the year from property rental 707 762 487 525<strong>The</strong> subtenants are under contractual obligation for an average of (years). 3 3 5 4At the balance-sheet date, the <strong>Group</strong> has entered into leases under which future rental income is expected to be distributed as follows:Within 1 year 704 656 495 452Between 1 and 5 years 1,659 1,547 1,182 1,105After 5 years 505 507 435 420Total rental income 2,868 2,710 2,112 1,977<strong>The</strong> <strong>ATP</strong> <strong>Group</strong> – <strong>Annual</strong> <strong>Report</strong> <strong>2012</strong>113