The ATP Group Annual Report 2012

The ATP Group Annual Report 2012

The ATP Group Annual Report 2012

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

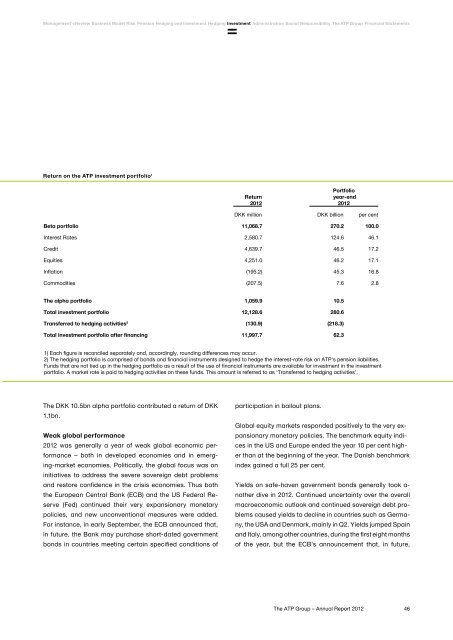

Management's Review Business Model Risk Pension Hedging and investment Hedging Investment Administration Social Responsibility <strong>The</strong> <strong>ATP</strong> <strong>Group</strong> Financial StatementsReturn on the <strong>ATP</strong> investment portfolio 1Return<strong>2012</strong>Portfolioyear-end<strong>2012</strong>DKK million DKK billion per centBeta portfolio 11,068.7 270.2 100.0Interest Rates 2,580.7 124.6 46.1Credit 4,639.7 46.5 17.2Equities 4,251.0 46.2 17.1Inflation (195.2) 45.3 16.8Commodities (207.5) 7.6 2.8<strong>The</strong> alpha portfolio 1,059.9 10.5Total investment portfolio 12,128.6 280.6Transferred to hedging activities 2 (130.9) (218.3)Total investment portfolio after financing 11,997.7 62.31) Each figure is reconciled separately and, accordingly, rounding differences may occur.2) <strong>The</strong> hedging portfolio is comprised of bonds and financial instruments designed to hedge the interest-rate risk on <strong>ATP</strong>'s pension liabilities.Funds that are not tied up in the hedging portfolio as a result of the use of financial instruments are available for investment in the investmentportfolio. A market rate is paid to hedging activities on these funds. This amount is referred to as ‘Transferred to hedging activities’.<strong>The</strong> DKK 10.5bn alpha portfolio contributed a return of DKK1.1bn.Weak global performance<strong>2012</strong> was generally a year of weak global economic performance– both in developed economies and in emerging-marketeconomies. Politically, the global focus was oninitiatives to address the severe sovereign debt problemsand restore confidence in the crisis economies. Thus boththe European Central Bank (ECB) and the US Federal Reserve(Fed) continued their very expansionary monetarypolicies, and new unconventional measures were added.For instance, in early September, the ECB announced that,in future, the Bank may purchase short-dated governmentbonds in countries meeting certain specified conditions ofparticipation in bailout plans.Global equity markets responded positively to the very expansionarymonetary policies. <strong>The</strong> benchmark equity indicesin the US and Europe ended the year 10 per cent higherthan at the beginning of the year. <strong>The</strong> Danish benchmarkindex gained a full 25 per cent.Yields on safe-haven government bonds generally took a-nother dive in <strong>2012</strong>. Continued uncertainty over the overallmacroeconomic outlook and continued sovereign debt problemscaused yields to decline in countries such as Germany,the USA and Denmark, mainly in Q2. Yields jumped Spainand Italy, among other countries, during the first eight monthsof the year, but the ECB's announcement that, in future,<strong>The</strong> <strong>ATP</strong> <strong>Group</strong> – <strong>Annual</strong> <strong>Report</strong> <strong>2012</strong>46