The ATP Group Annual Report 2012

The ATP Group Annual Report 2012

The ATP Group Annual Report 2012

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

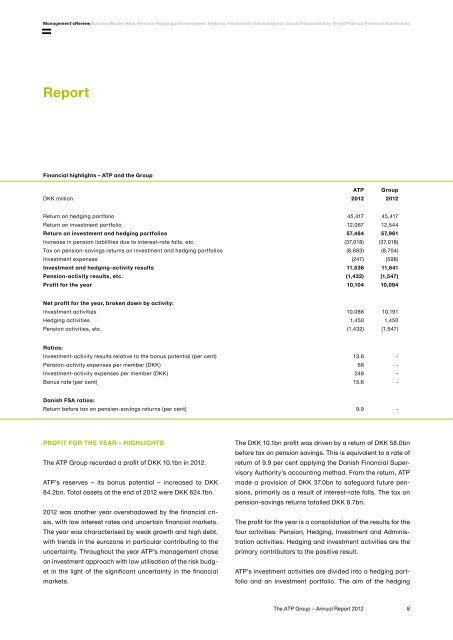

Management's Review Business Model Risk Pension Hedging and Investment Hedging Investment Administration Social Responsibility <strong>The</strong> <strong>ATP</strong> <strong>Group</strong> Financial Statements<strong>Report</strong>Financial highlights – <strong>ATP</strong> and the <strong>Group</strong><strong>ATP</strong> <strong>Group</strong>DKK million <strong>2012</strong> <strong>2012</strong>Return on hedging portfolio 45,417 45,417Return on investment portfolio 12,067 12,544Return on investment and hedging portfolios 57,484 57,961Increase in pension liabilities due to interest-rate falls, etc. (37,018) (37,018)Tax on pension-savings returns on investment and hedging portfolios (8,683) (8,704)Investment expenses (247) (598)Investment and hedging-activity results 11,536 11,641Pension-activity results, etc. (1,432) (1,547)Profit for the year 10,104 10,094Net profit for the year, broken down by activity:Investment activities 10,086 10,191Hedging activities 1,450 1,450Pension activities, etc. (1,432) (1,547)Ratios:Investment-activity results relative to the bonus potential (per cent) 13.6 -Pension-activity expenses per member (DKK) 68 -Investment-activity expenses per member (DKK) 248 -Bonus rate (per cent) 15.6 -Danish FSA ratios:Return before tax on pension-savings returns (per cent) 9.9 -PROFIT FOR THE YEAR – HIGHLIGHTS<strong>The</strong> <strong>ATP</strong> <strong>Group</strong> recorded a profit of DKK 10.1bn in <strong>2012</strong>.<strong>ATP</strong>’s reserves – its bonus potential – increased to DKK84.2bn. Total assets at the end of <strong>2012</strong> were DKK 624.1bn.<strong>2012</strong> was another year overshadowed by the financial crisis,with low interest rates and uncertain financial markets.<strong>The</strong> year was characterised by weak growth and high debt,with trends in the eurozone in particular contributing to theuncertainty. Throughout the year <strong>ATP</strong>’s management chosean investment approach with low utilisation of the risk budgetin the light of the significant uncertainty in the financialmarkets.<strong>The</strong> DKK 10.1bn profit was driven by a return of DKK 58.0bnbefore tax on pension savings. This is equivalent to a rate ofreturn of 9.9 per cent applying the Danish Financial SupervisoryAuthority’s accounting method. From the return, <strong>ATP</strong>made a provision of DKK 37.0bn to safeguard future pensions,primarily as a result of interest-rate falls. <strong>The</strong> tax onpension-savings returns totalled DKK 8.7bn.<strong>The</strong> profit for the year is a consolidation of the results for thefour activities: Pension, Hedging, Investment and Administrationactivities. Hedging and investment activities are theprimary contributors to the positive result.<strong>ATP</strong>’s investment activities are divided into a hedging portfolioand an investment portfolio. <strong>The</strong> aim of the hedging<strong>The</strong> <strong>ATP</strong> <strong>Group</strong> – <strong>Annual</strong> <strong>Report</strong> <strong>2012</strong>8