The ATP Group Annual Report 2012

The ATP Group Annual Report 2012

The ATP Group Annual Report 2012

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

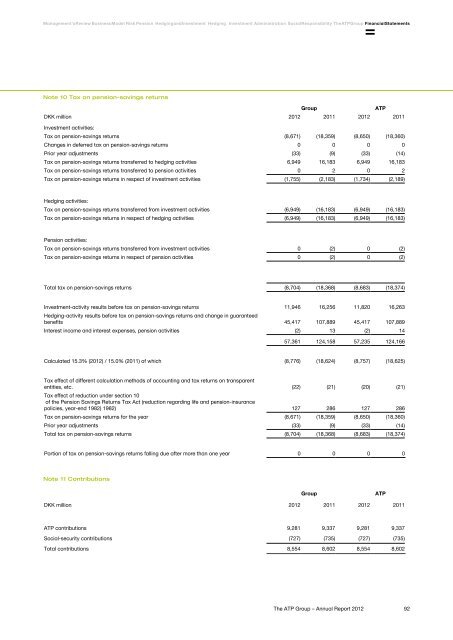

Management's Review Business Model Risk Pension Hedging and Investment Hedging Investment Administration Social Responsibility <strong>The</strong> <strong>ATP</strong> <strong>Group</strong> Financial StatementsNote 10 Tax on pension-savings returns<strong>Group</strong> <strong>ATP</strong>DKK million <strong>2012</strong> 2011 <strong>2012</strong> 2011Investment activities:Tax on pension-savings returns (8,671) (18,359) (8,650) (18,360)Changes in deferred tax on pension-savings returns 0 0 0 0Prior year adjustments (33) (9) (33) (14)Tax on pension-savings returns transferred to hedging activities 6,949 16,183 6,949 16,183Tax on pension-savings returns transferred to pension activities 0 2 0 2Tax on pension-savings returns in respect of investment activities (1,755) (2,183) (1,734) (2,189)Hedging activities:Tax on pension-savings returns transferred from investment activities (6,949) (16,183) (6,949) (16,183)Tax on pension-savings returns in respect of hedging activities (6,949) (16,183) (6,949) (16,183)Pension activities:Tax on pension-savings returns transferred from investment activities 0 (2) 0 (2)Tax on pension-savings returns in respect of pension activities 0 (2) 0 (2)Total tax on pension-savings returns (8,704) (18,368) (8,683) (18,374)Investment-activity results before tax on pension-savings returns 11,946 16,256 11,820 16,263Hedging-activity results before tax on pension-savings returns and change in guaranteedbenefits 45,417 107,889 45,417 107,889Interest income and interest expenses, pension activities (2) 13 (2) 1457,361 124,158 57,235 124,166Calculated 15.3% (<strong>2012</strong>) / 15.0% (2011) of which (8,776) (18,624) (8,757) (18,625)Tax effect of different calculation methods of accounting and tax returns on transparententities, etc. (22) (21) (20) (21)Tax effect of reduction under section 10of the Pension Savings Returns Tax Act (reduction regarding life and pension-insurancepolicies, year-end 1982) 1982) 127 286 127 286Tax on pension-savings returns for the year (8,671) (18,359) (8,650) (18,360)Prior year adjustments (33) (9) (33) (14)Total tax on pension-savings returns (8,704) (18,368) (8,683) (18,374)Portion of tax on pension-savings returns falling due after more than one year 0 0 0 0Note 11 Contributions<strong>Group</strong> <strong>ATP</strong>DKK million <strong>2012</strong> 2011 <strong>2012</strong> 2011<strong>ATP</strong> contributions 9,281 9,337 9,281 9,337Social-security contributions (727) (735) (727) (735)Total contributions 8,554 8,602 8,554 8,602<strong>The</strong> <strong>ATP</strong> <strong>Group</strong> – <strong>Annual</strong> <strong>Report</strong> <strong>2012</strong>92