The ATP Group Annual Report 2012

The ATP Group Annual Report 2012

The ATP Group Annual Report 2012

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

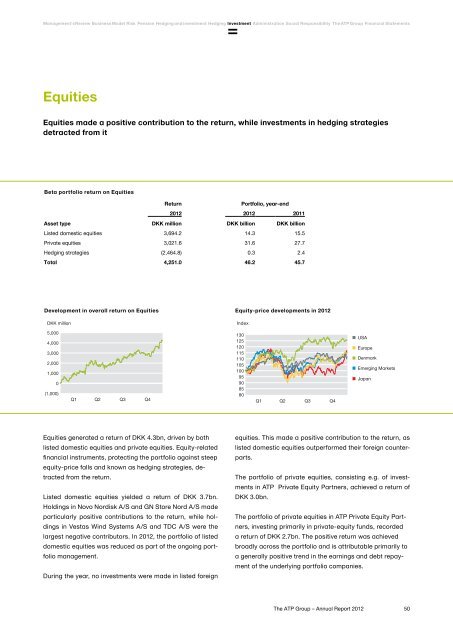

Management's Review Business Model Risk Pension Hedging and investment Hedging Investment Administration Social Responsibility <strong>The</strong> <strong>ATP</strong> <strong>Group</strong> Financial StatementsEquitiesEquities made a positive contribution to the return, while investments in hedging strategiesdetracted from itBeta portfolio return on EquitiesReturnPortfolio, year-end<strong>2012</strong> <strong>2012</strong> 2011Asset type DKK million DKK billion DKK billionListed domestic equities 3,694.2 14.3 15.5Private equities 3,021.6 31.6 27.7Hedging strategies (2,464.8) 0.3 2.4Total 4,251.0 46.2 45.7Development in overall return on Equities Equity-price developments in <strong>2012</strong>DKK millionIndex5,0004,0003,0002,0001,0000(1,000)Q1 Q2 Q3 Q413012512011511010510095908580Q1 Q2 Q3 Q4USAEuropeDenmarkEmerging MarketsJapanEquities generated a return of DKK 4.3bn, driven by bothlisted domestic equities and private equities. Equity-relatedfinancial instruments, protecting the portfolio against steepequity-price falls and known as hedging strategies, detractedfrom the return.Listed domestic equities yielded a return of DKK 3.7bn.Holdings in Novo Nordisk A/S and GN Store Nord A/S madeparticularly positive contributions to the return, while holdingsin Vestas Wind Systems A/S and TDC A/S were thelargest negative contributors. In <strong>2012</strong>, the portfolio of listeddomestic equities was reduced as part of the ongoing portfoliomanagement.During the year, no investments were made in listed foreignequities. This made a positive contribution to the return, aslisted domestic equities outperformed their foreign counterparts.<strong>The</strong> portfolio of private equities, consisting e.g. of investmentsin <strong>ATP</strong> Private Equity Partners, achieved a return ofDKK 3.0bn.<strong>The</strong> portfolio of private equities in <strong>ATP</strong> Private Equity Partners,investing primarily in private-equity funds, recordeda return of DKK 2.7bn. <strong>The</strong> positive return was achievedbroadly across the portfolio and is attributable primarily toa generally positive trend in the earnings and debt repaymentof the underlying portfolio companies.<strong>The</strong> <strong>ATP</strong> <strong>Group</strong> – <strong>Annual</strong> <strong>Report</strong> <strong>2012</strong>50