The ATP Group Annual Report 2012

The ATP Group Annual Report 2012

The ATP Group Annual Report 2012

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

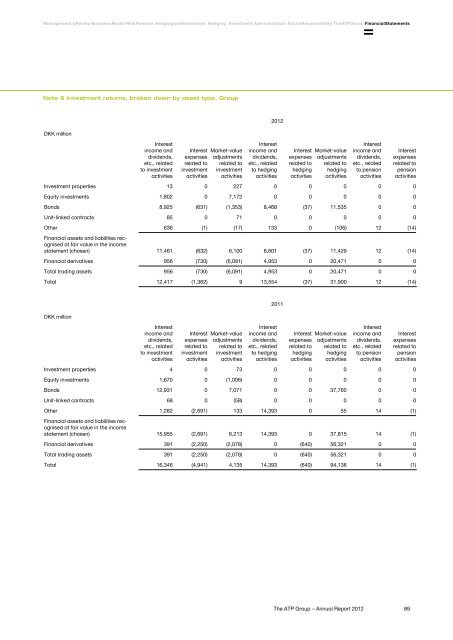

Management's Review Business Model Risk Pension Hedging and Investment Hedging Investment Administration Social Responsibility <strong>The</strong> <strong>ATP</strong> <strong>Group</strong> Financial StatementsNote 8 Investment returns, broken down by asset type, <strong>Group</strong>DKK millionInterestincome anddividends,etc., relatedto investmentactivitiesInterestexpensesrelated toinvestmentactivitiesMarket-valueadjustmentsrelated toinvestmentactivities<strong>2012</strong>Interestincome anddividends,etc., relatedto hedgingactivitiesInterestexpensesrelated tohedgingactivitiesMarket-valueadjustmentsrelated tohedgingactivitiesInterestincome anddividends,etc., relatedto pensionactivitiesInterestexpensesrelated topensionactivitiesInvestment properties 13 0 227 0 0 0 0 0Equity investments 1,802 0 7,172 0 0 0 0 0Bonds 8,925 (631) (1,353) 8,468 (37) 11,535 0 0Unit-linked contracts 85 0 71 0 0 0 0 0Other 636 (1) (17) 133 0 (106) 12 (14)Financial assets and liabilities recognisedat fair value in the incomestatement (chosen) 11,461 (632) 6,100 8,601 (37) 11,429 12 (14)Financial derivatives 956 (730) (6,091) 4,953 0 20,471 0 0Total trading assets 956 (730) (6,091) 4,953 0 20,471 0 0Total 12,417 (1,362) 9 13,554 (37) 31,900 12 (14)DKK millionInterestincome anddividends,etc., relatedto investmentactivitiesInterestexpensesrelated toinvestmentactivitiesMarket-valueadjustmentsrelated toinvestmentactivities2011Interestincome anddividends,etc., relatedto hedgingactivitiesInterestexpensesrelated tohedgingactivitiesMarket-valueadjustmentsrelated tohedgingactivitiesInterestincome anddividends,etc., relatedto pensionactivitiesInterestexpensesrelated topensionactivitiesInvestment properties 4 0 73 0 0 0 0 0Equity investments 1,670 0 (1,006) 0 0 0 0 0Bonds 12,931 0 7,071 0 0 37,760 0 0Unit-linked contracts 68 0 (58) 0 0 0 0 0Other 1,282 (2,691) 133 14,393 0 55 14 (1)Financial assets and liabilities recognisedat fair value in the incomestatement (chosen) 15,955 (2,691) 6,213 14,393 0 37,815 14 (1)Financial derivatives 391 (2,250) (2,078) 0 (640) 56,321 0 0Total trading assets 391 (2,250) (2,078) 0 (640) 56,321 0 0Total 16,346 (4,941) 4,135 14,393 (640) 94,136 14 (1)<strong>The</strong> <strong>ATP</strong> <strong>Group</strong> – <strong>Annual</strong> <strong>Report</strong> <strong>2012</strong>89