Management's Review Business Model Risk Pension Hedging and investment Hedging Investment Administration Social Responsibility <strong>The</strong> <strong>ATP</strong> <strong>Group</strong> Financial StatementsPredictable pension – for lifeMost elderly Danes only have <strong>ATP</strong> Lifelong Pension to supplement their state funded old-age pension<strong>ATP</strong> members at year-end <strong>2012</strong>Average annual <strong>ATP</strong> Lifelong PensionTotal number of members 4,782,900No. of members above pensionable age 997,100- of whom receiving a current pension 879,400- of whom paying contributions in <strong>2012</strong> 88,500<strong>Annual</strong> pension in DKK20,00015,00010,0005,000All pensioners65-year-old pensionersNo. of members below pensionable age 3,785,800- of whom paying contributions in <strong>2012</strong> 3,013,5000Women Men Total<strong>ATP</strong> Lifelong Pension helps to provide basic financial securityfor virtually all Danish pensioners. For more than 50 percent of Danish old-age pensioners, <strong>ATP</strong> Lifelong Pension istheir only source of supplementary pension income. For thegreater part of other pensioners, <strong>ATP</strong> is part of the foundationupon which other pensions rest.viders have decided to end or weaken pensions. <strong>The</strong> guaranteeelement is as a fundamental prerequisite for the basicsecurity that <strong>ATP</strong> is to help provide. <strong>The</strong>refore, <strong>ATP</strong> LifelongPension remains a guaranteed, predictable pension.<strong>ATP</strong> has demonstrated that guarantees and high returns arenot mutually exclusive.More than 91 per cent of the Danish population aged 25-60 years paid <strong>ATP</strong> contributions in <strong>2012</strong>, thus accruing <strong>ATP</strong>Lifelong Pension rights. One in five Danes aged between 25and 60 do not contribute to pension schemes other than<strong>ATP</strong>.About 86 per cent of Denmark's more than 1m old-age pensionersreceive <strong>ATP</strong> Lifelong Pension.In <strong>2012</strong>, <strong>ATP</strong>'s payouts totalled just under DKK 11,9bn, withcurrent pension benefits accounting for DKK 11.0bn. <strong>ATP</strong> receivedcontributions totalling DKK 8.6bn from wage earnersand recipients of transfer income.In recent years, payouts have been exceeding contributions,which is a reflection of the maturing of the <strong>ATP</strong> scheme. <strong>The</strong>maturing process will continue over the coming decades,and, other things being equal, the gap between <strong>ATP</strong>'s contributionsand payouts will gradually widen.<strong>ATP</strong> is committed to guaranteesDuring recent years, an increasing number of pension pro-DKK 11bn paid in pension benefitsIn <strong>2012</strong>, eight in ten old-age pensioners were able to supplementtheir state old-age pension with <strong>ATP</strong> Lifelong Pension.<strong>ATP</strong> paid a total of DKK 11bn in lifelong old-age pensionsand, at end-<strong>2012</strong>, 879,400 <strong>ATP</strong> members were receiving lifelongpensions from <strong>ATP</strong>.<strong>The</strong> full <strong>ATP</strong> Lifelong Pension for a 65-year-old pensioneramounted to DKK 24,300 in <strong>2012</strong>, equivalent to 35 per centof the basic amount of the state funded old-age pension.<strong>The</strong> full <strong>ATP</strong> Lifelong Pension was paid to members who hadpaid the full <strong>ATP</strong> contribution from 1964 until retirement.<strong>The</strong> average <strong>ATP</strong> Lifelong Pension was approximately DKK13,000 a year. <strong>ATP</strong> members retiring at age 65 in <strong>2012</strong> received<strong>ATP</strong> Lifelong Pension benefits averaging DKK 15,700a year.<strong>The</strong>re is fairly significant variance in the <strong>ATP</strong> benefits paidto members. Younger pensioners, in general, receive morethan older pensioners because they have been able to accruepension rights over a longer period of their working<strong>The</strong> <strong>ATP</strong> <strong>Group</strong> – <strong>Annual</strong> <strong>Report</strong> <strong>2012</strong>28

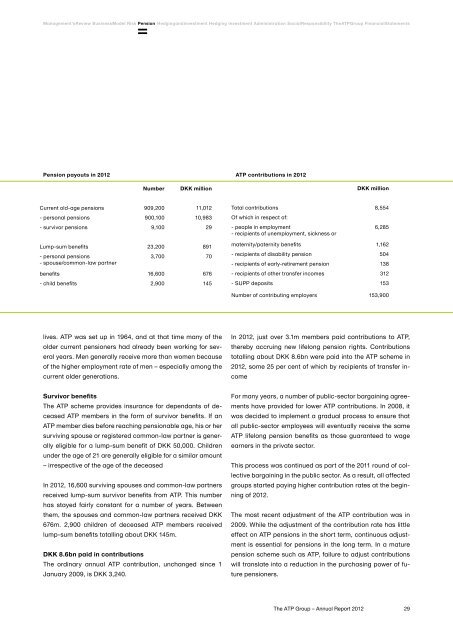

Management's Review Business Model Risk Pension Hedging and investment Hedging Investment Administration Social Responsibility <strong>The</strong> <strong>ATP</strong> <strong>Group</strong> Financial StatementsPension payouts in <strong>2012</strong><strong>ATP</strong> contributions in <strong>2012</strong>NumberDKK millionDKK millionCurrent old-age pensions 909,200 11,012- personal pensions 900,100 10,983- survivor pensions 9,100 29Lump-sum benefits 23,200 891- personal pensions 3,700 70- spouse/common-law partnerbenefits 16,600 676- child benefits 2,900 145Total contributions 8,554Of which in respect of:- people in employment 6,285- recipients of unemployment, sickness ormaternity/paternity benefits 1,162- recipients of disability pension 504- recipients of early-retirement pension 138- recipients of other transfer incomes 312- SUPP deposits 153Number of contributing employers 153,900lives. <strong>ATP</strong> was set up in 1964, and at that time many of theolder current pensioners had already been working for severalyears. Men generally receive more than women becauseof the higher employment rate of men – especially among thecurrent older generations.In <strong>2012</strong>, just over 3.1m members paid contributions to <strong>ATP</strong>,thereby accruing new lifelong pension rights. Contributionstotalling about DKK 8.6bn were paid into the <strong>ATP</strong> scheme in<strong>2012</strong>, some 25 per cent of which by recipients of transfer incomeSurvivor benefits<strong>The</strong> <strong>ATP</strong> scheme provides insurance for dependants of deceased<strong>ATP</strong> members in the form of survivor benefits. If an<strong>ATP</strong> member dies before reaching pensionable age, his or hersurviving spouse or registered common-law partner is generallyeligible for a lump-sum benefit of DKK 50,000. Childrenunder the age of 21 are generally eligible for a similar amount– irrespective of the age of the deceasedIn <strong>2012</strong>, 16,600 surviving spouses and common-law partnersreceived lump-sum survivor benefits from <strong>ATP</strong>. This numberhas stayed fairly constant for a number of years. Betweenthem, the spouses and common-law partners received DKK676m. 2,900 children of deceased <strong>ATP</strong> members receivedlump-sum benefits totalling about DKK 145m.DKK 8.6bn paid in contributions<strong>The</strong> ordinary annual <strong>ATP</strong> contribution, unchanged since 1January 2009, is DKK 3,240.For many years, a number of public-sector bargaining agreementshave provided for lower <strong>ATP</strong> contributions. In 2008, itwas decided to implement a gradual process to ensure thatall public-sector employees will eventually receive the same<strong>ATP</strong> lifelong pension benefits as those guaranteed to wageearners in the private sector.This process was continued as part of the 2011 round of collectivebargaining in the public sector. As a result, all affectedgroups started paying higher contribution rates at the beginningof <strong>2012</strong>.<strong>The</strong> most recent adjustment of the <strong>ATP</strong> contribution was in2009. While the adjustment of the contribution rate has littleeffect on <strong>ATP</strong> pensions in the short term, continuous adjustmentis essential for pensions in the long term. In a maturepension scheme such as <strong>ATP</strong>, failure to adjust contributionswill translate into a reduction in the purchasing power of futurepensioners.<strong>The</strong> <strong>ATP</strong> <strong>Group</strong> – <strong>Annual</strong> <strong>Report</strong> <strong>2012</strong>29