The ATP Group Annual Report 2012

The ATP Group Annual Report 2012

The ATP Group Annual Report 2012

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

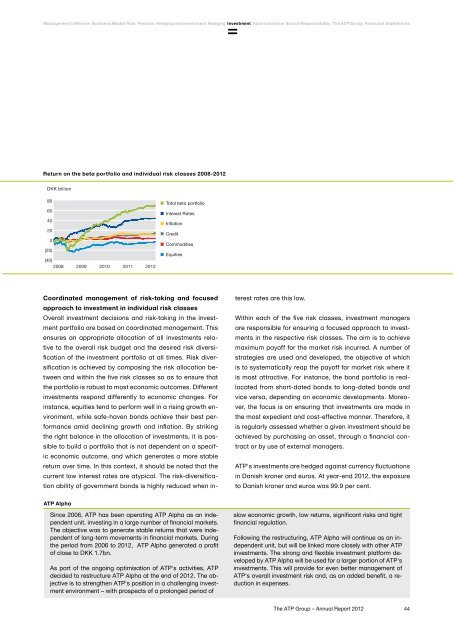

Management's Review Business Model Risk Pension Hedging and investment Hedging Investment Administration Social Responsibility <strong>The</strong> <strong>ATP</strong> <strong>Group</strong> Financial StatementsReturn on the beta portfolio and individual risk classes 2008-<strong>2012</strong>DKK billion806040200(20)(40)2008 2009 2010 2011 <strong>2012</strong>Total beta portfolioInterest RatesInflationCreditCommoditiesEquitiesCoordinated management of risk-taking and focusedapproach to investment in individual risk classesOverall investment decisions and risk-taking in the investmentportfolio are based on coordinated management. Thisensures an appropriate allocation of all investments relativeto the overall risk budget and the desired risk diversificationof the investment portfolio at all times. Risk diversificationis achieved by composing the risk allocation betweenand within the five risk classes so as to ensure thatthe portfolio is robust to most economic outcomes. Differentinvestments respond differently to economic changes. Forinstance, equities tend to perform well in a rising growth environment,while safe-haven bonds achieve their best performanceamid declining growth and inflation. By strikingthe right balance in the allocation of investments, it is possibleto build a portfolio that is not dependent on a specificeconomic outcome, and which generates a more stablereturn over time. In this context, it should be noted that thecurrent low interest rates are atypical. <strong>The</strong> risk-diversificationability of government bonds is highly reduced when interestrates are this low.Within each of the five risk classes, investment managersare responsible for ensuring a focused approach to investmentsin the respective risk classes. <strong>The</strong> aim is to achievemaximum payoff for the market risk incurred. A number ofstrategies are used and developed, the objective of whichis to systematically reap the payoff for market risk where itis most attractive. For instance, the bond portfolio is reallocatedfrom short-dated bonds to long-dated bonds andvice versa, depending on economic developments. Moreover,the focus is on ensuring that investments are made inthe most expedient and cost-effective manner. <strong>The</strong>refore, itis regularly assessed whether a given investment should beachieved by purchasing an asset, through a financial contractor by use of external managers.<strong>ATP</strong>'s investments are hedged against currency fluctuationsin Danish kroner and euros. At year-end <strong>2012</strong>, the exposureto Danish kroner and euros was 99.9 per cent.<strong>ATP</strong> AlphaSince 2006, <strong>ATP</strong> has been operating <strong>ATP</strong> Alpha as an independentunit, investing in a large number of financial markets.<strong>The</strong> objective was to generate stable returns that were independentof long-term movements in financial markets. Duringthe period from 2006 to <strong>2012</strong>, <strong>ATP</strong> Alpha generated a profitof close to DKK 1.7bn.As part of the ongoing optimisation of <strong>ATP</strong>'s activities, <strong>ATP</strong>decided to restructure <strong>ATP</strong> Alpha at the end of <strong>2012</strong>. <strong>The</strong> objectiveis to strengthen <strong>ATP</strong>'s position in a challenging investmentenvironment – with prospects of a prolonged period ofslow economic growth, low returns, significant risks and tightfinancial regulation.Following the restructuring, <strong>ATP</strong> Alpha will continue as an independentunit, but will be linked more closely with other <strong>ATP</strong>investments. <strong>The</strong> strong and flexible investment platform developedby <strong>ATP</strong> Alpha will be used for a larger portion of <strong>ATP</strong>'sinvestments. This will provide for even better management of<strong>ATP</strong>'s overall investment risk and, as an added benefit, a reductionin expenses.<strong>The</strong> <strong>ATP</strong> <strong>Group</strong> – <strong>Annual</strong> <strong>Report</strong> <strong>2012</strong>44