The ATP Group Annual Report 2012

The ATP Group Annual Report 2012

The ATP Group Annual Report 2012

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

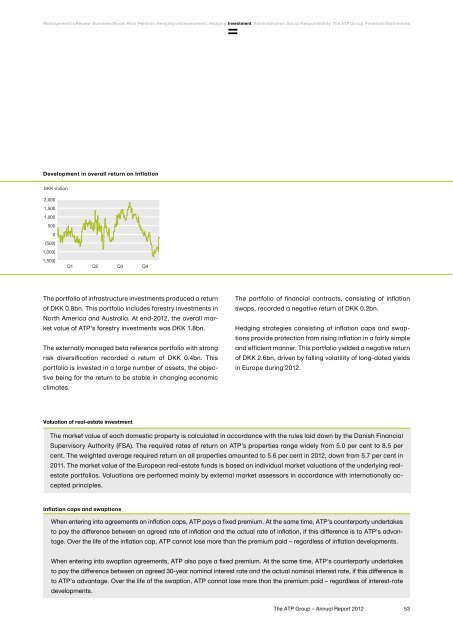

Management's Review Business Model Risk Pension Hedging and investment Hedging Investment Administration Social Responsibility <strong>The</strong> <strong>ATP</strong> <strong>Group</strong> Financial StatementsDevelopment in overall return on InflationDKK milion2,0001,5001,0005000(500)(1,000)(1,500)Q1 Q2 Q3 Q4<strong>The</strong> portfolio of infrastructure investments produced a returnof DKK 0.8bn. This portfolio includes forestry investments inNorth America and Australia. At end-<strong>2012</strong>, the overall marketvalue of <strong>ATP</strong>'s forestry investments was DKK 1.8bn.<strong>The</strong> externally managed beta reference portfolio with strongrisk diversification recorded a return of DKK 0.4bn. Thisportfolio is invested in a large number of assets, the objectivebeing for the return to be stable in changing economicclimates.<strong>The</strong> portfolio of financial contracts, consisting of inflationswaps, recorded a negative return of DKK 0.2bn.Hedging strategies consisting of inflation caps and swaptionsprovide protection from rising inflation in a fairly simpleand efficient manner. This portfolio yielded a negative returnof DKK 2.6bn, driven by falling volatility of long-dated yieldsin Europe during <strong>2012</strong>.Valuation of real-estate investment<strong>The</strong> market value of each domestic property is calculated in accordance with the rules laid down by the Danish FinancialSupervisory Authority (FSA). <strong>The</strong> required rates of return on <strong>ATP</strong>’s properties range widely from 5.0 per cent to 8.5 percent. <strong>The</strong> weighted average required return on all properties amounted to 5.6 per cent in <strong>2012</strong>, down from 5.7 per cent in2011. <strong>The</strong> market value of the European real-estate funds is based on individual market valuations of the underlying realestateportfolios. Valuations are performed mainly by external market assessors in accordance with internationally acceptedprinciples.Inflation caps and swaptionsWhen entering into agreements on inflation caps, <strong>ATP</strong> pays a fixed premium. At the same time, <strong>ATP</strong>'s counterparty undertakesto pay the difference between an agreed rate of inflation and the actual rate of inflation, if this difference is to <strong>ATP</strong>'s advantage.Over the life of the inflation cap, <strong>ATP</strong> cannot lose more than the premium paid – regardless of inflation developments.When entering into swaption agreements, <strong>ATP</strong> also pays a fixed premium. At the same time, <strong>ATP</strong>'s counterparty undertakesto pay the difference between an agreed 30-year nominal interest rate and the actual nominal interest rate, if this difference isto <strong>ATP</strong>'s advantage. Over the life of the swaption, <strong>ATP</strong> cannot lose more than the premium paid – regardless of interest-ratedevelopments.<strong>The</strong> <strong>ATP</strong> <strong>Group</strong> – <strong>Annual</strong> <strong>Report</strong> <strong>2012</strong>53