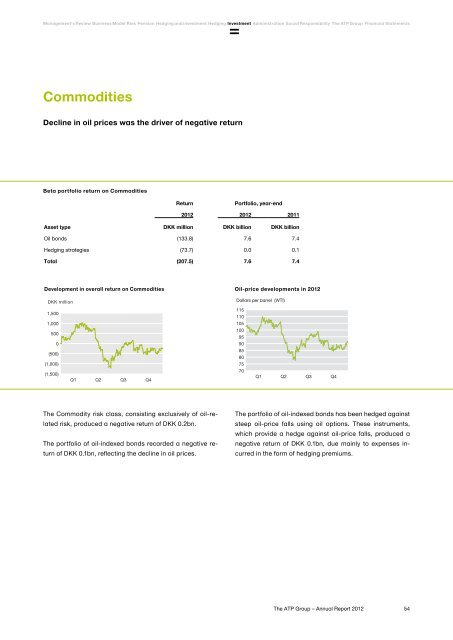

Management's Review Business Model Risk Pension Hedging and investment Hedging Investment Administration Social Responsibility <strong>The</strong> <strong>ATP</strong> <strong>Group</strong> Financial StatementsCommoditiesDecline in oil prices was the driver of negative returnBeta portfolio return on CommoditiesReturnPortfolio, year-end<strong>2012</strong> <strong>2012</strong> 2011Asset type DKK million DKK billion DKK billionOil bonds (133.8) 7.6 7.4Hedging strategies (73.7) 0.0 0.1Total (207.5) 7.6 7.4Development in overall return on Commodities Oil-price developments in <strong>2012</strong>DKK millionDollars per barrel (WTI)1,5001151101,00010550010095090(500)(1,000)858075(1,500)Q1 Q2 Q3 Q470Q1 Q2 Q3 Q4<strong>The</strong> Commodity risk class, consisting exclusively of oil-relatedrisk, produced a negative return of DKK 0.2bn.<strong>The</strong> portfolio of oil-indexed bonds recorded a negative returnof DKK 0.1bn, reflecting the decline in oil prices.<strong>The</strong> portfolio of oil-indexed bonds has been hedged againststeep oil-price falls using oil options. <strong>The</strong>se instruments,which provide a hedge against oil-price falls, produced anegative return of DKK 0.1bn, due mainly to expenses incurredin the form of hedging premiums.<strong>The</strong> <strong>ATP</strong> <strong>Group</strong> – <strong>Annual</strong> <strong>Report</strong> <strong>2012</strong>54

Management's Review Business Model Risk Pension Hedging and investment Hedging Investment Administration Social Responsibility <strong>The</strong> <strong>ATP</strong> <strong>Group</strong> Financial StatementsSUPP<strong>The</strong> SUPP portfolio generated an overall return of 6.2 per centSUPP – portfolio and returnPortfolioyear-end <strong>2012</strong>Return<strong>2012</strong>DKK million per cent DKK million per cent 1SUPP 2,755 100.0 150.8 6.2SUPP Lav Risiko ('SUPP Low Risk') 1,126 40.9 44.6 4.4SUPP Høj Risiko ('SUPP High Risk') 1,558 56.5 106.1 8.0Cash and cash equivalents 2 71 2.6 0.1 0.11) <strong>ATP</strong> uses daily, time-weighted rates of return.2) <strong>The</strong> portfolio of cash and cash equivalents is comprised of social-security contributions payable and funds that are yet to be allocated to SUPP LavRisiko and SUPP Høj Risiko.<strong>The</strong> SUPP investment portfolio<strong>ATP</strong> manages the Supplementary Labour Market PensionScheme for Disability Pensioners (SUPP). In <strong>2012</strong>, the SUPPscheme achieved an overall market return on investment ofDKK 151m before tax, equivalent to a rate of return of 6.2per cent.In <strong>2012</strong>, the SUPP scheme’s investments were placed intwo sub-portfolios: SUPP Lav Risiko (‘SUPP Low Risk’) andSUPP Høj Risiko (‘SUPP High Risk’) to achieve the most appropriateasset mix for each member, based on their age.For SUPP members up to age 45, investments were placedexclusively in SUPP Høj Risiko ('SUPP High Risk'), the investmentstrategy of which was return-seeking and fairlyrisky. For SUPP members aged over 45, the risk was scaleddown each year by reallocating some of the member's assetsto SUPP Lav Risiko ('SUPP Low Risk'), entailing that allof his or her SUPP assets were placed in SUPP Lav Risiko,the investment strategy of which is conservative, by the timehe or she reached retirement age (65).Bond and equity markets both generated positive returnsin <strong>2012</strong>.<strong>The</strong> equity portfolio was comprised of listed domestic andforeign equities and equity futures. In <strong>2012</strong>, all investmenttypes achieved positive returns, but the portfolio of domesticequities, in particular, boosted the overall return.<strong>The</strong> bond portfolio consisted of domestic mortgage bondsand domestic and German government bonds. All investmenttypes in the bond portfolio also delivered positive returnsin <strong>2012</strong>.Equity markets generally outperformed bond markets. Accordingly,the highest returns (in percentage terms) wereachieved for the youngest SUPP members, having the highestportfolio allocation in SUPP Høj Risiko, as the risk of thissub-fund is higher due to its higher equity allocation.SUPP's assets to be pooled with <strong>ATP</strong>'s assetsIn December <strong>2012</strong>, the Danish Parliament adopted a numberof amendments to the SUPP scheme, to become effectiveas of 1 January 2013. 1. <strong>The</strong>se amendments are describedin detail in the article "Improved options for disabilitypensioners" in the Pension chapter. Investment-wise,these amendments entail that SUPP's assets are pooledwith <strong>ATP</strong>’s far larger assets and will be managed as partof <strong>ATP</strong>'s asset management in future. This provides for lessexpensive investment and greater risk diversification, theaim being to achieve a higher return. At the same time, individualmembers will benefit from more predictable pensionthrough the <strong>ATP</strong> guarantee element. Against this backdrop,the sub-portfolios SUPP Høj Risiko and SUPP Lav Risikowere adjusted to <strong>ATP</strong>'s portfolio at year-end.<strong>The</strong> <strong>ATP</strong> <strong>Group</strong> – <strong>Annual</strong> <strong>Report</strong> <strong>2012</strong>55