The ATP Group Annual Report 2012

The ATP Group Annual Report 2012

The ATP Group Annual Report 2012

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

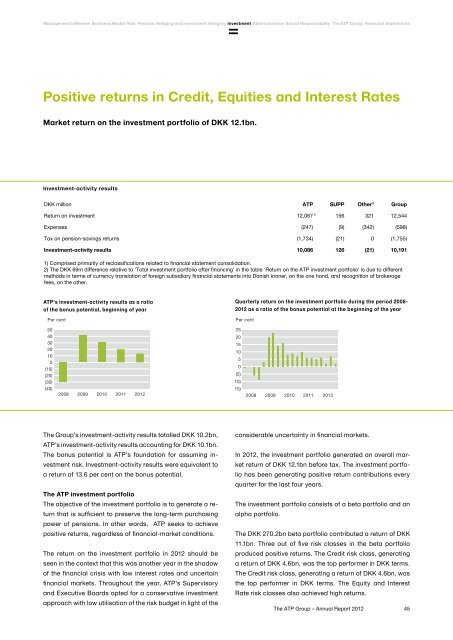

Management's Review Business Model Risk Pension Hedging and investment Hedging Investment Administration Social Responsibility <strong>The</strong> <strong>ATP</strong> <strong>Group</strong> Financial StatementsPositive returns in Credit, Equities and Interest RatesMarket return on the investment portfolio of DKK 12.1bn.Investment-activity resultsDKK million <strong>ATP</strong> SUPP Other¹ <strong>Group</strong>Return on investment 12,067 2 156 321 12,544Expenses (247) (9) (342) (598)Tax on pension-savings returns (1,734) (21) 0 (1,755)Investment-activity results 10,086 126 (21) 10,1911) Comprised primarily of reclassifications related to financial statement consolidation.2) <strong>The</strong> DKK 69m difference relative to 'Total investment portfolio after financing' in the table 'Return on the <strong>ATP</strong> investment portfolio' is due to differentmethods in terms of currency translation of foreign subsidiary financial statements into Danish kroner, on the one hand, and recognition of brokeragefees, on the other.<strong>ATP</strong>'s investment-activity results as a ratioof the bonus potential, beginning of yearPer centQuarterly return on the investment portfolio during the period 2008-<strong>2012</strong> as a ratio of the bonus potential at the beginning of the yearPer cent50403020100(10)(20)(30)(40)2008 2009 2010 2011 <strong>2012</strong>2520151050(5)(10)(15)2008 2009 2010 2011 <strong>2012</strong><strong>The</strong> <strong>Group</strong>’s investment-activity results totalled DKK 10.2bn,<strong>ATP</strong>’s investment-activity results accounting for DKK 10.1bn.<strong>The</strong> bonus potential is <strong>ATP</strong>’s foundation for assuming investmentrisk. Investment-activity results were equivalent toa return of 13.6 per cent on the bonus potential.<strong>The</strong> <strong>ATP</strong> investment portfolio<strong>The</strong> objective of the investment portfolio is to generate a returnthat is sufficient to preserve the long-term purchasingpower of pensions. In other words, <strong>ATP</strong> seeks to achievepositive returns, regardless of financial-market conditions.<strong>The</strong> return on the investment portfolio in <strong>2012</strong> should beseen in the context that this was another year in the shadowof the financial crisis with low interest rates and uncertainfinancial markets. Throughout the year, <strong>ATP</strong>’s Supervisoryand Executive Boards opted for a conservative investmentapproach with low utilisation of the risk budget in light of theconsiderable uncertainty in financial markets.In <strong>2012</strong>, the investment portfolio generated an overall marketreturn of DKK 12.1bn before tax. <strong>The</strong> investment portfoliohas been generating positive return contributions everyquarter for the last four years.<strong>The</strong> investment portfolio consists of a beta portfolio and analpha portfolio.<strong>The</strong> DKK 270.2bn beta portfolio contributed a return of DKK11.1bn. Three out of five risk classes in the beta portfolioproduced positive returns. <strong>The</strong> Credit risk class, generatinga return of DKK 4.6bn, was the top performer in DKK terms.<strong>The</strong> Credit risk class, generating a return of DKK 4.6bn, wasthe top performer in DKK terms. <strong>The</strong> Equity and InterestRate risk classes also achieved high returns.<strong>The</strong> <strong>ATP</strong> <strong>Group</strong> – <strong>Annual</strong> <strong>Report</strong> <strong>2012</strong>45