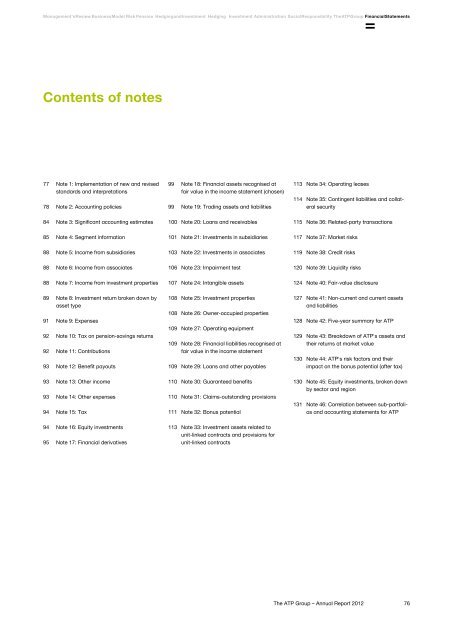

Management's Review Business Model Risk Pension Hedging and Investment Hedging Investment A d m i n i s t r a t i o n S o c i a l R e s p o n s i b i l i t y T h e AT P G r o u p Financial StatementsContents of notes77 Note 1: Implementation of new and revisedstandards and interpretations78 Note 2: Accounting policies99 Note 18: Financial assets recognised atfair value in the income statement (chosen)99 Note 19: Trading assets and liabilities113 Note 34: Operating leases114 Note 35: Contingent liabilities and collateralsecurity84 Note 3: Significant accounting estimates100 Note 20: Loans and receivables115 Note 36: Related-party transactions85 Note 4: Segment information101 Note 21: Investments in subsidiaries117 Note 37: Market risks88 Note 5: Income from subsidiaries103 Note 22: Investments in associates119 Note 38: Credit risks88 Note 6: Income from associates106 Note 23: Impairment test120 Note 39: Liquidity risks88 Note 7: Income from investment properties107 Note 24: Intangible assets124 Note 40: Fair-value disclosure89 Note 8: Investment return broken down byasset type91 Note 9: Expenses92 Note 10: Tax on pension-savings returns92 Note 11: Contributions93 Note 12: Benefit payouts108 Note 25: Investment properties108 Note 26: Owner-occupied properties109 Note 27: Operating equipment109 Note 28: Financial liabilities recognised atfair value in the income statement109 Note 29: Loans and other payables127 Note 41: Non-current and current assetsand liabilities128 Note 42: Five-year summary for <strong>ATP</strong>129 Note 43: Breakdown of <strong>ATP</strong>'s assets andtheir returns at market value130 Note 44: <strong>ATP</strong>'s risk factors and theirimpact on the bonus potential (after tax)93 Note 13: Other income93 Note 14: Other expenses94 Note 15: Tax110 Note 30: Guaranteed benefits110 Note 31: Claims-outstanding provisions111 Note 32: Bonus potential130 Note 45: Equity investments, broken downby sector and region131 Note 46: Correlation between sub-portfoliosand accounting statements for <strong>ATP</strong>94 Note 16: Equity investments95 Note 17: Financial derivatives113 Note 33: Investment assets related tounit-linked contracts and provisions forunit-linked contracts<strong>The</strong> <strong>ATP</strong> <strong>Group</strong> – <strong>Annual</strong> <strong>Report</strong> <strong>2012</strong>76

Management's Review Business Model Risk Pension Hedging and Investment Hedging Investment A d m i n i s t r a t i o n S o c i a l R e s p o n s i b i l i t y T h e AT P G r o u p Financial StatementsNotesNote 1 Implementation of new and revised standardsand interpretations<strong>The</strong> IASB and the EU have adopted the following new accountingstandards and interpretations, effective from <strong>2012</strong>, which have beenimplemented by the <strong>ATP</strong> <strong>Group</strong> with effect from 1 January <strong>2012</strong>:Standards and interpretations that affect the results for theyear or the financial position<strong>The</strong> implementation of new and revised standards in the consolidatedfinancial statements for <strong>2012</strong> has not resulted in any changesin accounting policies that affect the comprehensive income for theyear or the bonus potential.Revised IFRS 7, Financial Instruments: <strong>The</strong> revised IFRS 7 enhancesthe disclosure requirements for transfer transactions of financial assetswhere the transferor has some continued involvement with theasset transferred, whether the asset is derecognised or not.Standards and interpretations that have not yet taken effectAt the time of the publication of this annual report, a number of newor revised standards and interpretations have not yet taken effectand, therefore, have not been incorporated into the consolidated financialstatements. <strong>The</strong> following new or revised standards and interpretationsmay result in changes in comprehensive income andbonus potential or the disclosures in the notes:Revised IAS 1, Presentation of Financial Statements (June2011): Under the revised standard, items presented under othercomprehensive income are to be classified as items which, underother standards, are later to be reclassified (recycled) from othercomprehensive income to profit or loss, respectively items that arenot later reclassified. <strong>The</strong> amendments are effective for financial periodsbeginning on or after 1 July <strong>2012</strong>.IFRS 12, Disclosure of Interests in Other Entities (May 2011):IFRS12 contains disclosure requirements on consolidated entities andentities that are unconsolidated but in which the reporting entity isinvolved. <strong>The</strong> standard contains increased requirements in terms ofdisclosure of minority interests, etc., and disclosure on entities inwhich the entity is involved but which are unconsolidated. Apart froman increase in the scope of information in notes, this standard is notexpected to have any significant impact on the consolidated financialstatements in future financial years. <strong>The</strong> standard is effective forfinancial periods beginning on or after 1 January 2013. <strong>The</strong> standardhas not yet been adopted by the EU.IFRS 13, Fair Value Measurement (May 2011): This standard consolidatesfair value measurement guidance from across various individualIFRSs into a single standard. IFRS 13 thus ensures a uniformdefinition of fair value across other standards and uniform guidanceand disclosure requirements in terms of fair value measurement.This standard is not expected to have any significant impact onthe consolidated financial statements in future financial years. <strong>The</strong>standard is effective for financial periods beginning on or after 1January 2013. <strong>The</strong> standard has not yet been adopted by the EU.IFRS 9, Financial Instruments: Classification and Measurement(Financial Liabilities) (October 2010): <strong>The</strong> revised IFRS 9 addsprovisions on classification and measurement of financial liabilitiesand derecognition. Most of the provisions of IAS 39 on recognitionand measurement of financial liabilities are transferred to IFRS 9 unchanged.However, IFRS 9 contains the following amendments tothe provisions of IAS 39: <strong>The</strong> exception in IAS 39 under which derivativesrelated to unquoted equity instruments could, in some cases,be measured at cost, is eliminated. <strong>The</strong> standard is not expected tohave any significant impact on the consolidated financial statementsin future financial years. IFRS 9 is effective for financial periods beginningon or after 1 January 2013. <strong>The</strong> standard has not yet beenadopted by the EU.IFRS 10, Consolidated Financial Statements (May 2011): Thisstandard replaces the sections on consolidated financial statementsin the current IAS 27, Consolidated and Separate Financial Statements,and SIC-12, Consolidation – Special Purpose Entities. In certainrespects, the new standard provides significantly more guidancewhen it comes to determining whether an entity controls anotherentity. IFRS 10 also establishes the principles for preparation andpresentation of consolidated financial statements when an entitycontrols one or more other entities. An examination will be conductedto establish resulting changes of the new standard. <strong>The</strong> standardis effective for financial periods beginning on or after 1 January2013. <strong>The</strong> standard has not yet been adopted by the EU.IFRS 9, Financial Instruments: Classification and Measurement(Financial Assets) (November 2009):I FRS 9 deals with theaccounting treatment of financial assets in relation to classificationand measurement. In accordance with IFRS 9, the classifications of'held to maturity' and 'available for sale' are eliminated. A new, optionalclassification is established for equity instruments that are notheld with a view to sale and which, on initial recognition, are classifiedunder 'fair value with value adjustment through other comprehensiveincome'. In future, financial assets are thus to be classifiedeither as 'measurement at amortised cost' or 'fair value through results'or – where equity instruments are concerned that comply withthe criteria to this effect – as 'fair value through other comprehen-<strong>The</strong> <strong>ATP</strong> <strong>Group</strong> – <strong>Annual</strong> <strong>Report</strong> <strong>2012</strong>77