- Page 5 and 6:

Municipal Study 2011Executive Summa

- Page 7 and 8:

Municipal Study 2011BrantfordSurvey

- Page 9 and 10:

Municipal Study 20112011 Comparison

- Page 11 and 12: Municipal Study 2011SECTION 1: Intr

- Page 13 and 14: Municipal Study 2011Age and Conditi

- Page 15 and 16: Municipal Study 2011Asset Consumpti

- Page 17 and 18: Municipal Study 2011Net municipal l

- Page 19 and 20: Municipal Study 2011SECTION 7: Comp

- Page 21 and 22: Municipal Study 2011SECTION 8: Comp

- Page 23 and 24: Municipal Study 2011Introduction1

- Page 25 and 26: Municipal Study 2011Municipal Study

- Page 27 and 28: Municipal Study 2011Municipalities

- Page 29 and 30: Municipal Study 2011Socio Economic

- Page 31 and 32: Municipal Study 2011Population Stat

- Page 33 and 34: Municipal Study 2011Simcoe/Muskoka/

- Page 35 and 36: Municipal Study 2011Niagara/Hamilto

- Page 37 and 38: Municipal Study 2011Northern——%

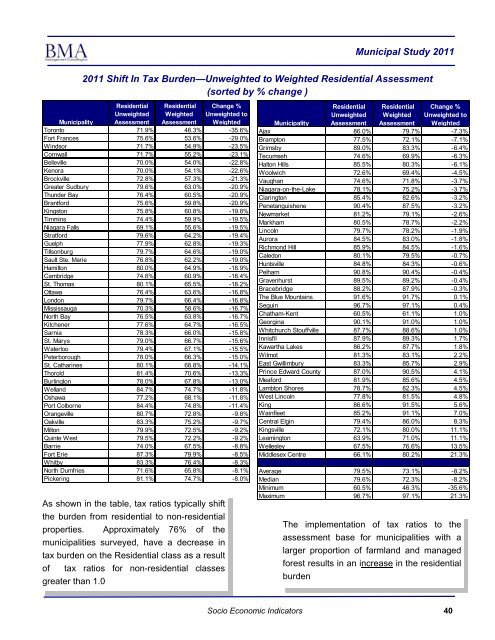

- Page 39 and 40: Municipal Study 2011Ontario Populat

- Page 41 and 42: Municipal Study 2011Age Demographic

- Page 43 and 44: Municipal Study 2011% of Dwellings

- Page 45 and 46: Municipal Study 2011Average Househo

- Page 47 and 48: Municipal Study 2011Land Area and D

- Page 49 and 50: Municipal Study 2011Land Area and D

- Page 51 and 52: Municipal Study 2011Assessment Per

- Page 53 and 54: Municipal Study 2011Taxable Assessm

- Page 55 and 56: Municipal Study 2011Unweighted Asse

- Page 57 and 58: Unweighted Assessment Composition (

- Page 59 and 60: Municipal Study 2011Unweighted Asse

- Page 61: Municipal Study 2011Top 10 Municipa

- Page 65 and 66: Municipal Study 2011Building Permit

- Page 67 and 68: Municipal Study 2011Municipal Finan

- Page 69 and 70: Municipal Study 2011Evaluating a Mu

- Page 71 and 72: Financial Position Per Capita—Tre

- Page 73 and 74: Municipal Study 2011Operating Surpl

- Page 75 and 76: Municipal Study 20112010 Operating

- Page 77 and 78: Municipal Study 2011ReservesReserve

- Page 79 and 80: Municipal Study 2011Discretionary R

- Page 81 and 82: Municipal Study 2011Tax Debt Intere

- Page 83 and 84: Municipal Study 2011Debt To Reserve

- Page 85 and 86: Municipal Study 2011Debt Outstandin

- Page 87 and 88: Municipal Study 2011Net Financial L

- Page 89 and 90: Municipal Study 2011Revenue and Exp

- Page 91 and 92: Municipal Study 2011Environmental S

- Page 93 and 94: Municipal Study 2011Net Municipal L

- Page 95 and 96: Municipal Study 20112011 Net Munici

- Page 97 and 98: Municipal Study 2011Net Municipal L

- Page 99 and 100: Municipal Study 2011Net Municipal L

- Page 101 and 102: Municipal Study 20112011 Net Munici

- Page 103 and 104: Municipal Study 20112011 Net Munici

- Page 105 and 106: General Government(Sorted by Net Co

- Page 107 and 108: Municipal Study 2011FireThe goal of

- Page 109 and 110: Municipal Study 2011Fire Statistics

- Page 111 and 112: Municipal Study 2011Fire Costs (con

- Page 113 and 114:

Municipal Study 2011Police(Sorted b

- Page 115 and 116:

Municipal Study 2011Court Security

- Page 117 and 118:

Municipal Study 2011Protective Insp

- Page 119 and 120:

Municipal Study 2011Roads ServicesA

- Page 121 and 122:

Municipal Study 2011Roadways—Pave

- Page 123 and 124:

Municipal Study 2011Roadways—Pave

- Page 125 and 126:

Roadways—Bridges and Culverts(Sor

- Page 127 and 128:

Roadways—Traffic Operations(Sorte

- Page 129 and 130:

Winter Control—Except Sidewalks,

- Page 131 and 132:

Winter Control—Sidewalks, Parking

- Page 133 and 134:

Municipal Study 2011Transit Service

- Page 135 and 136:

Municipal Study 2011ParkingParking

- Page 137 and 138:

Street Lighting(Sorted by Net Costs

- Page 139 and 140:

Storm Sewer - Urban(Sorted by Net C

- Page 141 and 142:

Storm Sewer - Rural(Sorted by Net C

- Page 143 and 144:

Waste Collection(Sorted by Net Cost

- Page 145 and 146:

Waste Diversion(Sorted by Net Costs

- Page 147 and 148:

Public Health Services(Sorted by Ne

- Page 149 and 150:

Municipal Study 2011Ambulance Servi

- Page 151 and 152:

Municipal Study 2011Emergency Measu

- Page 153 and 154:

Municipal Study 2011General Assista

- Page 155 and 156:

Assistance to the Aged(Sorted by Ne

- Page 157 and 158:

Municipal Study 2011Social HousingS

- Page 159 and 160:

Municipal Study 2011Social Housing(

- Page 161 and 162:

Social Housing(Sorted by Total Net

- Page 163 and 164:

Parks(Sorted by Net Costs per $100,

- Page 165 and 166:

Municipal Study 2011Sports and Recr

- Page 167 and 168:

Recreation Programming Cont’d(Sor

- Page 169 and 170:

Recreation Facilities—Other(sorte

- Page 171 and 172:

Recreation Facilities and Programmi

- Page 173 and 174:

Municipal Study 2011LibraryPARTNERI

- Page 175 and 176:

Municipal Study 2011Library (cont

- Page 177 and 178:

Municipal Study 2011Cultural Servic

- Page 179 and 180:

Municipal Study 2011PlanningMunicip

- Page 181 and 182:

Commercial and Industrial(Sorted by

- Page 183 and 184:

Municipal Study 2011User FeesAnalyz

- Page 185 and 186:

Municipal Study 2011SingleDetachedD

- Page 187 and 188:

2011 Development Charges—Grouped

- Page 189 and 190:

SingleDetachedDwellingsper unitToro

- Page 191 and 192:

2011 Building Permit Fees (sorted a

- Page 193 and 194:

2011 Building Permit Fees (sorted b

- Page 195 and 196:

Municipal Study 20112011 Transit Fa

- Page 197 and 198:

Municipal Study 2011Tax PoliciesThe

- Page 199 and 200:

Municipal Study 2011Multi-Residenti

- Page 201 and 202:

Municipal Study 2011Industrial (res

- Page 203 and 204:

Municipal Study 2011New Multi-Resid

- Page 205 and 206:

Municipal Study 2011Comparison of R

- Page 207 and 208:

Municipal Study 2011General Introdu

- Page 209 and 210:

Municipal Study 20112011 Total Prop

- Page 211 and 212:

Municipal Study 20112011 Education

- Page 213 and 214:

2011 Municipal Rates (Upper and Low

- Page 215 and 216:

Municipal Study 2011Presentation of

- Page 217 and 218:

Municipal Study 2011Residential Com

- Page 219 and 220:

Municipal Study 2011Residential Com

- Page 221 and 222:

Municipal Study 2011Residential Com

- Page 223 and 224:

Municipal Study 2011Residential Com

- Page 225 and 226:

Municipal Study 2011Residential Com

- Page 227 and 228:

Municipal Study 2011Residential Com

- Page 229 and 230:

Municipal Study 2011Residential Com

- Page 231 and 232:

Multi-Residential Walk-Ups(taxes ca

- Page 233 and 234:

Municipal Study 2011Multi-Residenti

- Page 235 and 236:

Multi-Residential Comparisons - Wal

- Page 237 and 238:

Municipal Study 2011Multi-Residenti

- Page 239 and 240:

Municipal Study 2011Multi-Residenti

- Page 241 and 242:

Municipal Study 2011Multi-Residenti

- Page 243 and 244:

Municipal Study 2011Multi-Residenti

- Page 245 and 246:

Commercial Comparisons - Office Bui

- Page 247 and 248:

Municipal Study 2011Commercial Comp

- Page 249 and 250:

Municipal Study 2011Commercial Comp

- Page 251 and 252:

Municipal Study 2011Commercial Comp

- Page 253 and 254:

Commercial Comparisons - Neighbourh

- Page 255 and 256:

Municipal Study 2011Commercial Comp

- Page 257 and 258:

Municipal Study 2011Commercial Comp

- Page 259 and 260:

Municipal Study 2011Commercial Comp

- Page 261 and 262:

Municipal Study 2011Commercial Comp

- Page 263 and 264:

Municipal Study 2011Commercial Comp

- Page 265 and 266:

Commercial Comparisons - Hotel—by

- Page 267 and 268:

Commercial Comparisons - Hotel—by

- Page 269 and 270:

Municipal Study 2011Commercial Comp

- Page 271 and 272:

Commercial Comparisons - Motel—by

- Page 273 and 274:

Municipal Study 2011Commercial Comp

- Page 275 and 276:

Commercial Comparisons - Motel—by

- Page 277 and 278:

Municipal Study 2011Commercial Summ

- Page 279 and 280:

Commercial Comparisons - Summary (c

- Page 281 and 282:

Municipal Study 2011Industrial Comp

- Page 283 and 284:

Municipal Study 2011Standard Indust

- Page 285 and 286:

Municipal Study 2011$3.00Standard I

- Page 287 and 288:

Municipal Study 2011Standard Indust

- Page 289 and 290:

Municipal Study 2011Large Industria

- Page 291 and 292:

Municipal Study 2011Large Industria

- Page 293 and 294:

Municipal Study 2011Large Industria

- Page 295 and 296:

Municipal Study 2011Large Industria

- Page 297 and 298:

Industrial Comparisons - Industrial

- Page 299 and 300:

Municipal Study 2011Industrial Comp

- Page 301 and 302:

Municipal Study 2011Industrial Comp

- Page 303 and 304:

Municipal Study 2011Industrial Comp

- Page 305 and 306:

Municipal Study 2011Industrial Summ

- Page 307 and 308:

Municipal Study 2011Industrial Summ

- Page 309 and 310:

Municipal Study 2011Water/Wastewate

- Page 311 and 312:

Municipal Study 2011Water and Waste

- Page 313 and 314:

Municipal Study 2011Comparison of R

- Page 315 and 316:

Municipal Study 2011Comparison of T

- Page 317 and 318:

Municipal Study 2011Comparison of W

- Page 319 and 320:

Municipal Study 2011Comparison of W

- Page 321 and 322:

Municipal Study 2011Comparison of W

- Page 323 and 324:

Water/Wastewater Costs as a Percent

- Page 325 and 326:

Municipal Study 2011Water and Waste

- Page 327 and 328:

Municipal Study 2011Water and Waste

- Page 329 and 330:

Municipal Study 2011Wastewater Oper

- Page 331 and 332:

Municipal Study 2011Wastewater Asse

- Page 333 and 334:

Municipal Study 2011Water Reserves

- Page 335 and 336:

Municipal Study 2011Wastewater Rese

- Page 337 and 338:

Municipal Study 2011Wastewater Debt

- Page 339 and 340:

Municipal Study 2011Water Net Finan

- Page 341 and 342:

Municipal Study 2011Wastewater Net

- Page 343 and 344:

Municipal Study 2011Water MPMPs Con

- Page 345 and 346:

Municipal Study 2011Wastewater MPMP

- Page 347 and 348:

Municipal Study 2011Taxes and Water

- Page 349 and 350:

Average Household Income and Dwelli

- Page 351 and 352:

Property Taxes as a Percentage of I

- Page 353 and 354:

Municipal Study 2011Total Municipal

- Page 355 and 356:

Municipal Study 2011Total Municipal

- Page 357 and 358:

Municipal Study 2011Economic Develo

- Page 359 and 360:

Municipal Study 2011Section 4 of th

- Page 361 and 362:

Municipal Study 2011Business Retent

- Page 363 and 364:

Municipal Study 2011Business Retent

- Page 365 and 366:

Municipal Study 2011Business Retent

- Page 367 and 368:

Municipal Study 2011Business Retent

- Page 369 and 370:

Municipal Study 2011Business Retent

- Page 371 and 372:

Municipal Study 2011Business Retent

- Page 373 and 374:

Municipal Study 2011Business Retent

- Page 375 and 376:

Municipal Study 2011Business Retent

- Page 377 and 378:

Municipal Study 2011Business Retent

- Page 379 and 380:

Municipal Study 2011Business Retent

- Page 381 and 382:

Municipal Study 2011Business Retent

- Page 383 and 384:

Municipal Study 2011Business Retent

- Page 385 and 386:

Municipal Study 2011Downtown/Area S

- Page 387 and 388:

Municipal Study 2011Downtown/Area S

- Page 389 and 390:

Municipal Study 2011Downtown/Area S

- Page 391 and 392:

Municipal Study 2011MunicipalityCor

- Page 393 and 394:

Municipal Study 2011MunicipalityKit

- Page 395 and 396:

Municipal Study 2011Downtown/Area S

- Page 397 and 398:

Municipal Study 2011Downtown/Area S

- Page 399 and 400:

Municipal Study 2011Downtown/Area S

- Page 401 and 402:

Municipal Study 2011WellandWhitbyWh

- Page 403 and 404:

Municipal Study 2011Brownfield Rede

- Page 405 and 406:

Municipal Study 2011Brownfield Rede

- Page 407 and 408:

Municipal Study 2011Brownfield Rede

- Page 409 and 410:

Industrial ParksMunicipal Study 201

- Page 411:

Industrial ParksMunicipal Study 201