CASE STUDIES FROM AFRICA

30769-doc-services_exports_for_growth_and_development_africa

30769-doc-services_exports_for_growth_and_development_africa

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

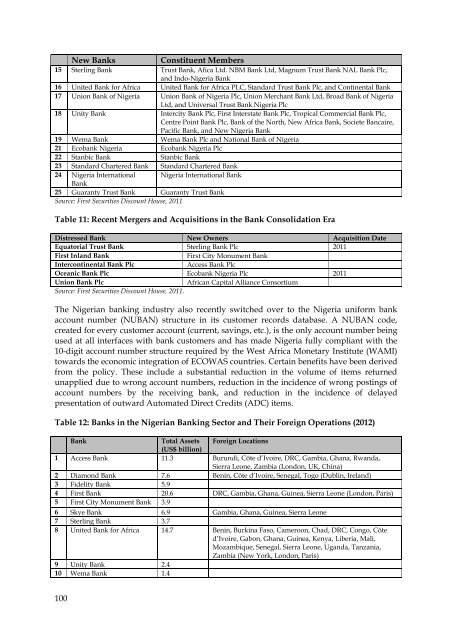

New Banks<br />

Constituent Members<br />

15 Sterling Bank Trust Bank, Afica Ltd. NBM Bank Ltd, Magnum Trust Bank NAL Bank Plc,<br />

and Indo-Nigeria Bank<br />

16 United Bank for Africa United Bank for Africa PLC, Standard Trust Bank Plc, and Continental Bank<br />

17 Union Bank of Nigeria Union Bank of Nigeria Plc, Union Merchant Bank Ltd, Broad Bank of Nigeria<br />

Ltd, and Universal Trust Bank Nigeria Plc<br />

18 Unity Bank Intercity Bank Plc, First Interstate Bank Plc, Tropical Commercial Bank Plc,<br />

Centre Point Bank Plc, Bank of the North, New Africa Bank, Societe Bancaire,<br />

Pacific Bank, and New Nigeria Bank<br />

19 Wema Bank Wema Bank Plc and National Bank of Nigeria<br />

21 Ecobank Nigeria Ecobank Nigeria Plc<br />

22 Stanbic Bank Stanbic Bank<br />

23 Standard Chartered Bank Standard Chartered Bank<br />

24 Nigeria International Nigeria International Bank<br />

Bank<br />

25 Guaranty Trust Bank Guaranty Trust Bank<br />

Source: First Securities Discount House, 2011<br />

Table 11: Recent Mergers and Acquisitions in the Bank Consolidation Era<br />

Distressed Bank New Owners Acquisition Date<br />

Equatorial Trust Bank Sterling Bank Plc 2011<br />

First Inland Bank<br />

First City Monument Bank<br />

Intercontinental Bank Plc<br />

Access Bank Plc<br />

Oceanic Bank Plc Ecobank Nigeria Plc 2011<br />

Union Bank Plc<br />

African Capital Alliance Consortium<br />

Source: First Securities Discount House, 2011.<br />

The Nigerian banking industry also recently switched over to the Nigeria uniform bank<br />

account number (NUBAN) structure in its customer records database. A NUBAN code,<br />

created for every customer account (current, savings, etc.), is the only account number being<br />

used at all interfaces with bank customers and has made Nigeria fully compliant with the<br />

10-digit account number structure required by the West Africa Monetary Institute (WAMI)<br />

towards the economic integration of ECOWAS countries. Certain benefits have been derived<br />

from the policy. These include a substantial reduction in the volume of items returned<br />

unapplied due to wrong account numbers, reduction in the incidence of wrong postings of<br />

account numbers by the receiving bank, and reduction in the incidence of delayed<br />

presentation of outward Automated Direct Credits (ADC) items.<br />

Table 12: Banks in the Nigerian Banking Sector and Their Foreign Operations (2012)<br />

Bank<br />

Total Assets Foreign Locations<br />

(US$ billion)<br />

1 Access Bank 11.3 Burundi, Côte d’Ivoire, DRC, Gambia, Ghana, Rwanda,<br />

Sierra Leone, Zambia (London, UK, China)<br />

2 Diamond Bank 7.6 Benin, Côte d’Ivoire, Senegal, Togo (Dublin, Ireland)<br />

3 Fidelity Bank 5.9<br />

4 First Bank 20.6 DRC, Gambia, Ghana, Guinea, Sierra Leone (London, Paris)<br />

5 First City Monument Bank 3.9<br />

6 Skye Bank 6.9 Gambia, Ghana, Guinea, Sierra Leone<br />

7 Sterling Bank 3.7<br />

8 United Bank for Africa 14.7 Benin, Burkina Faso, Cameroon, Chad, DRC, Congo, Côte<br />

d’Ivoire, Gabon, Ghana, Guinea, Kenya, Liberia, Mali,<br />

Mozambique, Senegal, Sierra Leone, Uganda, Tanzania,<br />

Zambia (New York, London, Paris)<br />

9 Unity Bank 2.4<br />

10 Wema Bank 1.4<br />

100