- Page 1 and 2:

SERVICES EXPORTS FOR GROWTH AND DEV

- Page 4 and 5:

CONTENTS Acronyms and Abbreviations

- Page 6 and 7:

ACRONYMS AND ABBREVIATIONS ACP ADC

- Page 8 and 9:

FESPACO Festival Panafricain du Cin

- Page 10: TVET TWA UACE UAE UBA UCL UEMOA UEP

- Page 13 and 14: Each of the five case studies was t

- Page 15 and 16: xiv

- Page 17 and 18: Scope and Coverage of Case Studies

- Page 19 and 20: transferring technology, skills, an

- Page 21 and 22: Government Policies that Made a Dif

- Page 23 and 24: availability of hotel accommodation

- Page 25 and 26: 2. Successful exports in one mode o

- Page 27 and 28: TYPOLOGY OF FOUR MODES OF EXPORTING

- Page 29 and 30: areas of the service, for example,

- Page 31 and 32: to become the market leader in the

- Page 33 and 34: Data from international organisatio

- Page 35 and 36: Figure 1: Share of Services Subsect

- Page 37 and 38: Figure 2: Structural Decomposition

- Page 39 and 40: Air Transport Services Coverage in

- Page 41 and 42: GTP on Air Transport Services Regar

- Page 43 and 44: Table 6: Aviation Sector Performanc

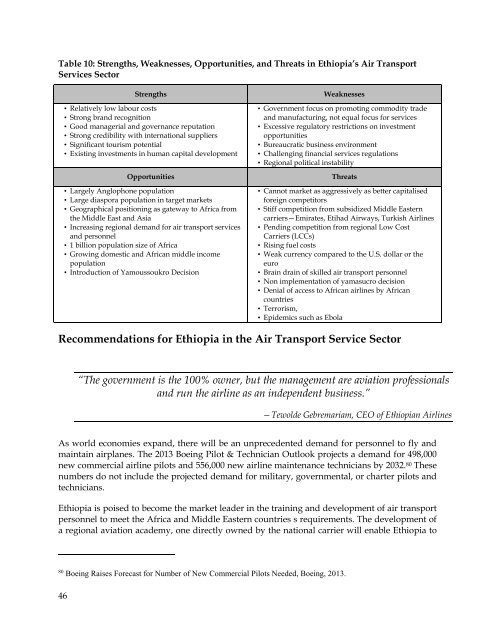

- Page 45 and 46: Ethiopia’s consideration of the s

- Page 47 and 48: Definition Selected for This Study

- Page 49 and 50: Boeing 767-200ER. EAL made history

- Page 51 and 52: other construction and navigation f

- Page 53 and 54: Market Structure International pass

- Page 55 and 56: Ethiopian destinations. Revenue gen

- Page 57 and 58: tourism, as well as the transaction

- Page 59: independently, and are intermediate

- Page 63 and 64: Yamoussoukro Decision, the guidelin

- Page 65 and 66: Geographical Positioning and Human

- Page 67 and 68: EAL has remained flexible when nece

- Page 69 and 70: South Africa, Zambia, and Tanzania.

- Page 71 and 72: Bibliography Abeyratne, Ruwantissa

- Page 73 and 74: Ethiopian Ministry of Finance and E

- Page 75 and 76: Annex 1: Questionnaire Used for the

- Page 77 and 78: Annex 2: Pictorial Representations

- Page 79 and 80: 64

- Page 82 and 83: 3. BANKING SERVICES: A CASE STUDY O

- Page 84 and 85: institutions are in charge of servi

- Page 86 and 87: witnessed a decline between 2007 an

- Page 88 and 89: hand, the eight countries of the Un

- Page 90 and 91: (f) Evaluate the opportunities for

- Page 92 and 93: significant share of services outpu

- Page 94 and 95: Nigeria has several natural and cul

- Page 96 and 97: Sector Male Female Total Activities

- Page 98 and 99: Annex 3 (Table A1) also shows the a

- Page 100 and 101: Sector Industrial Sector Energy Tou

- Page 102 and 103: matters regarding trade negotiation

- Page 104 and 105: to the changes in interest rates by

- Page 106 and 107: hoped that these activities will ra

- Page 108 and 109: economic controls. Specifically, th

- Page 110 and 111:

Resuscitation and enforcement of do

- Page 112 and 113:

All financial institutions require

- Page 114 and 115:

Current Banking Services Activities

- Page 116 and 117:

Bank Total Assets Foreign Locations

- Page 118 and 119:

1961 1963 1965 1967 1969 1971 1973

- Page 120 and 121:

is a membership-driven institute wh

- Page 122 and 123:

Table 17: CIBN Membership Statistic

- Page 124 and 125:

Table 20: Share of Banks’ Profit

- Page 126 and 127:

2009, it increased after conditions

- Page 128 and 129:

Contribution of Banking Services to

- Page 130 and 131:

Year Agriculture Manufacturing Serv

- Page 132 and 133:

Figure 5: Percentage Growth of UBA

- Page 134 and 135:

generally suggests that the growth

- Page 136 and 137:

epresentative offices in Beijing, D

- Page 138 and 139:

1989 16. Ecobank Côte d’Ivoire a

- Page 140 and 141:

Figure 13: Percentage Growth of ETI

- Page 142 and 143:

premiums on conversion of local cur

- Page 144 and 145:

and technology driven. 62 Therefore

- Page 146 and 147:

From previous reforms, to the 2005

- Page 148 and 149:

come to dominate the system in the

- Page 150 and 151:

In conclusion, it may not be as mea

- Page 152 and 153:

BGL Research. Getting Banks to Lend

- Page 154 and 155:

Musuku, Thilasoni, et al. Increasin

- Page 156 and 157:

Business Day. ‘Ghana Approves Tak

- Page 158 and 159:

Annex 2: List of Services Imported

- Page 160 and 161:

Table A2: Share of Services Value A

- Page 162 and 163:

Table A3: Share of Services Value A

- Page 164 and 165:

Table A4: Nigeria’s Trade in Serv

- Page 166:

Table A8: Total Number of Employees

- Page 169 and 170:

Information Systems, Networks and I

- Page 171 and 172:

enterprises. Preferences may includ

- Page 173 and 174:

Growth Rate (%) Share of GDP (%) Fi

- Page 175 and 176:

Table 1: Examples of Approved Proje

- Page 177 and 178:

principles included in the WTO Tele

- Page 179 and 180:

Layer 2 includes telecommunications

- Page 181 and 182:

firms involved in the wholesale/ret

- Page 183 and 184:

Figure 4: Cross-border Exports of

- Page 185 and 186:

9 days. Thus the application of ICT

- Page 187 and 188:

software; system integration; compu

- Page 189 and 190:

years’ experience in BPO in Seneg

- Page 191 and 192:

3. Proactive policies in services,

- Page 193 and 194:

Due to labour shortages for young g

- Page 195 and 196:

Institutions When it comes to servi

- Page 197 and 198:

Financial Attractiveness Other fact

- Page 199 and 200:

Proactive Policies to Promote Expor

- Page 201 and 202:

Table 13: SWOT Analysis: Senegal as

- Page 203 and 204:

promote more coherent efforts in su

- Page 205 and 206:

Bibliography ANDS. Second Follow-up

- Page 207 and 208:

Annex 1: Evaluation Framework for t

- Page 209 and 210:

Annex 3: Standards and Certificatio

- Page 211 and 212:

Sectors or Subsectors Mobile cellul

- Page 213 and 214:

Annex 5: Short Version of the Quest

- Page 215 and 216:

1. Is the classification system use

- Page 218 and 219:

5. CULTURAL INDUSTRIES: A CASE STUD

- Page 220 and 221:

will help generate new opportunitie

- Page 222 and 223:

Mode 4, Presence of Natural Persons

- Page 224 and 225:

(d) Evaluate the factors that have

- Page 226 and 227:

Organisation of the Report The pres

- Page 228 and 229:

Percent Table 2: Balance of Service

- Page 230 and 231:

(notably the balance of payments) c

- Page 232 and 233:

With the exception of the travel co

- Page 234 and 235:

goods and products that are not ban

- Page 236 and 237:

Table 7: Involved Private and Publi

- Page 238 and 239:

particular. Because cultural produc

- Page 240 and 241:

copyrights 25 ), artistic expressio

- Page 242 and 243:

Ministers of Culture to endorse the

- Page 244 and 245:

Categories of Members 2000 2001 200

- Page 246 and 247:

lack of funding, a high level of di

- Page 248 and 249:

Success Story: Biz’Art Production

- Page 250 and 251:

Success Story: Cartel 38 Aware of t

- Page 252 and 253:

museums are currently operated comm

- Page 254 and 255:

Market Structure Providing adequate

- Page 256 and 257:

Human Capital Formation The continu

- Page 258 and 259:

creative goods were greatly at odds

- Page 260 and 261:

Figure 5: Different Types of Cultur

- Page 262 and 263:

The fees paid by the advertisers (c

- Page 264 and 265:

Estimated Employment Generated by C

- Page 266 and 267:

Table 30: Exports of Artefacts and

- Page 268 and 269:

more visitors than FESTIMA. From th

- Page 270 and 271:

impact of these imports on the bala

- Page 272 and 273:

Exports Total % Main Export Market

- Page 274 and 275:

First, the lack of available data a

- Page 276 and 277:

Moreover, the unequal distribution

- Page 278 and 279:

telecommunication networks), and in

- Page 280 and 281:

improve and support the development

- Page 282 and 283:

Inclusion of Cultural Services in E

- Page 284 and 285:

To ensure the provision of financia

- Page 286 and 287:

To improve market intelligence and

- Page 288 and 289:

Table 41: Practical Tools for the P

- Page 290 and 291:

Competitiveness Issues associations

- Page 292 and 293:

Competitiveness Issues services sec

- Page 294 and 295:

Bibliography Articles and Books CE,

- Page 296 and 297:

Paugam, J.M. (2013). Trade in Servi

- Page 298 and 299:

Table 45: Distribution of Cultural

- Page 300 and 301:

Annex 2: Questionnaire for the Priv

- Page 302 and 303:

3.2 Pour les festivals / Musées et

- Page 304 and 305:

4.2 Les ressources humaines qualifi

- Page 306:

Une règlementation en terme de dro

- Page 309 and 310:

There are factors which have favore

- Page 311 and 312:

The UN’s Provisional Central Prod

- Page 313 and 314:

Because education is designated as

- Page 315 and 316:

Global and Regional Trends in Trans

- Page 317 and 318:

(a) joint degrees between different

- Page 319 and 320:

education services imports. Accordi

- Page 321 and 322:

2006 2007 2008 2009 2010 2011 Finan

- Page 323 and 324:

Services Sector Export Strategy As

- Page 325 and 326:

tailoring, hairdressing, catering,

- Page 327 and 328:

improvement measures in delivering

- Page 329 and 330:

state of Kenya, Tanzania, and Ugand

- Page 331 and 332:

Figure 2: Enrolment of Foreign Stud

- Page 333 and 334:

Strengths, Weaknesses, Opportunitie

- Page 335 and 336:

tended to attract more students loc

- Page 337 and 338:

total government expenditure, publi

- Page 339 and 340:

Uganda’s declining market share o

- Page 341 and 342:

management processes leading to inc

- Page 343 and 344:

educational cooperation between Uga

- Page 345 and 346:

Uganda Christian University Uganda

- Page 347 and 348:

the university closer to its foreig

- Page 349 and 350:

At present there are no internation

- Page 351 and 352:

Using Social Media for University P

- Page 353 and 354:

338 6) Grant all universities disco

- Page 355 and 356:

Bibliography Alpen Capital. GCC Edu

- Page 357 and 358:

Tierney, William G., and Findlay, C

- Page 359 and 360:

Name of Institution Address Details

- Page 361 and 362:

iii. Students from outside Africa _

- Page 363 and 364:

9. Does your institution collaborat

- Page 365 and 366:

If so please elaborate below. _____

- Page 368 and 369:

AUTHOR BIOGRAPHIES Abiodun Surajude

- Page 370 and 371:

awareness of the relationships amon

- Page 372:

African Union Headquarters P.O. Box