Revista Tinerilor Economiºti (The Young Economists Journal)

Revista Tinerilor Economiºti (The Young Economists Journal)

Revista Tinerilor Economiºti (The Young Economists Journal)

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Revista</strong> <strong>Tinerilor</strong> Economişti (<strong>The</strong> <strong>Young</strong> <strong>Economists</strong> <strong>Journal</strong>)<br />

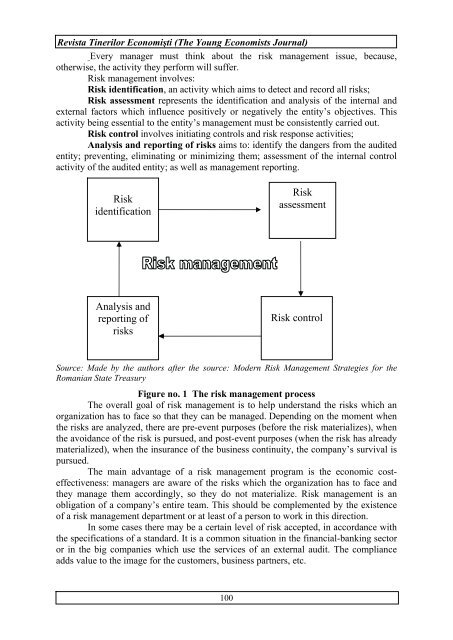

Every manager must think about the risk management issue, because,<br />

otherwise, the activity they perform will suffer.<br />

Risk management involves:<br />

Risk identification, an activity which aims to detect and record all risks;<br />

Risk assessment represents the identification and analysis of the internal and<br />

external factors which influence positively or negatively the entity’s objectives. This<br />

activity being essential to the entity’s management must be consistently carried out.<br />

Risk control involves initiating controls and risk response activities;<br />

Analysis and reporting of risks aims to: identify the dangers from the audited<br />

entity; preventing, eliminating or minimizing them; assessment of the internal control<br />

activity of the audited entity; as well as management reporting.<br />

Risk<br />

identification<br />

Analysis and<br />

reporting of<br />

risks<br />

Source: Made by the authors after the source: Modern Risk Management Strategies for the<br />

Romanian State Treasury<br />

Figure no. 1 <strong>The</strong> risk management process<br />

<strong>The</strong> overall goal of risk management is to help understand the risks which an<br />

organization has to face so that they can be managed. Depending on the moment when<br />

the risks are analyzed, there are pre-event purposes (before the risk materializes), when<br />

the avoidance of the risk is pursued, and post-event purposes (when the risk has already<br />

materialized), when the insurance of the business continuity, the company’s survival is<br />

pursued.<br />

<strong>The</strong> main advantage of a risk management program is the economic costeffectiveness:<br />

managers are aware of the risks which the organization has to face and<br />

they manage them accordingly, so they do not materialize. Risk management is an<br />

obligation of a company’s entire team. This should be complemented by the existence<br />

of a risk management department or at least of a person to work in this direction.<br />

In some cases there may be a certain level of risk accepted, in accordance with<br />

the specifications of a standard. It is a common situation in the financial-banking sector<br />

or in the big companies which use the services of an external audit. <strong>The</strong> compliance<br />

adds value to the image for the customers, business partners, etc.<br />

100<br />

Risk<br />

assessment<br />

Risk control