Revista Tinerilor Economiºti (The Young Economists Journal)

Revista Tinerilor Economiºti (The Young Economists Journal)

Revista Tinerilor Economiºti (The Young Economists Journal)

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

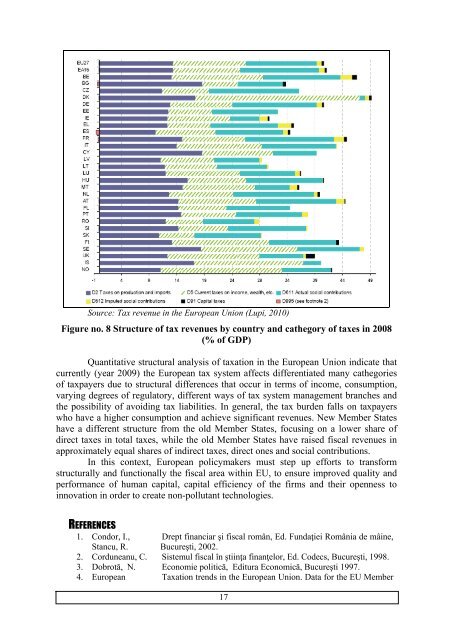

Source: Tax revenue in the European Union (Lupi, 2010)<br />

Figure no. 8 Structure of tax revenues by country and cathegory of taxes in 2008<br />

(% of GDP)<br />

Quantitative structural analysis of taxation in the European Union indicate that<br />

currently (year 2009) the European tax system affects differentiated many cathegories<br />

of taxpayers due to structural differences that occur in terms of income, consumption,<br />

varying degrees of regulatory, different ways of tax system management branches and<br />

the possibility of avoiding tax liabilities. In general, the tax burden falls on taxpayers<br />

who have a higher consumption and achieve significant revenues. New Member States<br />

have a different structure from the old Member States, focusing on a lower share of<br />

direct taxes in total taxes, while the old Member States have raised fiscal revenues in<br />

approximately equal shares of indirect taxes, direct ones and social contributions.<br />

In this context, European policymakers must step up efforts to transform<br />

structurally and functionally the fiscal area within EU, to ensure improved quality and<br />

performance of human capital, capital efficiency of the firms and their openness to<br />

innovation in order to create non-pollutant technologies.<br />

REFERENCES<br />

1. Condor, I.,<br />

Stancu, R.<br />

Drept financiar şi fiscal român, Ed. Fundaţiei România de mâine,<br />

Bucureşti, 2002.<br />

2. Corduneanu, C. Sistemul fiscal în ştiinţa finanţelor, Ed. Codecs, Bucureşti, 1998.<br />

3. Dobrotă, N. Economie politică, Editura Economică, Bucureşti 1997.<br />

4. European Taxation trends in the European Union. Data for the EU Member<br />

17