ipsas 29—financial instruments: recognition and measurement - IFAC

ipsas 29—financial instruments: recognition and measurement - IFAC

ipsas 29—financial instruments: recognition and measurement - IFAC

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

FINANCIAL INSTRUMENTS: RECOGNITION AND MEASUREMENT<br />

to be received is recognized on the trade date as described in IPSAS 29.AG70. In<br />

that case, the entity recognizes a liability of an amount equal to the carrying amount<br />

of the financial asset to be delivered on settlement date.<br />

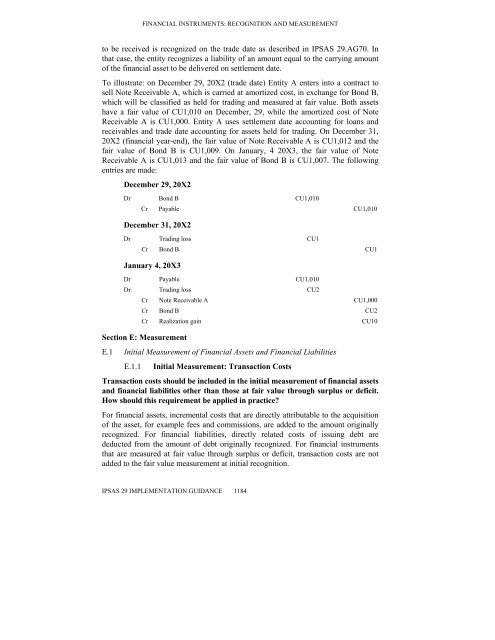

To illustrate: on December 29, 20X2 (trade date) Entity A enters into a contract to<br />

sell Note Receivable A, which is carried at amortized cost, in exchange for Bond B,<br />

which will be classified as held for trading <strong>and</strong> measured at fair value. Both assets<br />

have a fair value of CU1,010 on December, 29, while the amortized cost of Note<br />

Receivable A is CU1,000. Entity A uses settlement date accounting for loans <strong>and</strong><br />

receivables <strong>and</strong> trade date accounting for assets held for trading. On December 31,<br />

20X2 (financial year-end), the fair value of Note Receivable A is CU1,012 <strong>and</strong> the<br />

fair value of Bond B is CU1,009. On January, 4 20X3, the fair value of Note<br />

Receivable A is CU1,013 <strong>and</strong> the fair value of Bond B is CU1,007. The following<br />

entries are made:<br />

December 29, 20X2<br />

Dr Bond B CU1,010<br />

Cr Payable CU1,010<br />

December 31, 20X2<br />

Dr Trading loss CU1<br />

Cr Bond B CU1<br />

January 4, 20X3<br />

Dr Payable CU1,010<br />

Dr Trading loss CU2<br />

Cr Note Receivable A CU1,000<br />

Cr Bond B CU2<br />

Cr Realization gain CU10<br />

Section E: Measurement<br />

E.1 Initial Measurement of Financial Assets <strong>and</strong> Financial Liabilities<br />

E.1.1 Initial Measurement: Transaction Costs<br />

Transaction costs should be included in the initial <strong>measurement</strong> of financial assets<br />

<strong>and</strong> financial liabilities other than those at fair value through surplus or deficit.<br />

How should this requirement be applied in practice?<br />

For financial assets, incremental costs that are directly attributable to the acquisition<br />

of the asset, for example fees <strong>and</strong> commissions, are added to the amount originally<br />

recognized. For financial liabilities, directly related costs of issuing debt are<br />

deducted from the amount of debt originally recognized. For financial <strong>instruments</strong><br />

that are measured at fair value through surplus or deficit, transaction costs are not<br />

added to the fair value <strong>measurement</strong> at initial <strong>recognition</strong>.<br />

IPSAS 29 IMPLEMENTATION GUIDANCE 1184

![International Auditing and Assurance Standards Board [IAASB] - IFAC](https://img.yumpu.com/22522144/1/190x245/international-auditing-and-assurance-standards-board-iaasb-ifac.jpg?quality=85)