ipsas 29—financial instruments: recognition and measurement - IFAC

ipsas 29—financial instruments: recognition and measurement - IFAC

ipsas 29—financial instruments: recognition and measurement - IFAC

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

FINANCIAL INSTRUMENTS: RECOGNITION AND MEASUREMENT<br />

Hedge Accounting Considerations<br />

Illustrating the Designation of the Hedging Relationship<br />

The discussion <strong>and</strong> illustrations thus far have focused primarily on economic <strong>and</strong> risk<br />

management considerations relating to the identification of risk in future periods <strong>and</strong> the<br />

adjustment of that risk using interest rate swaps. These activities form the basis for<br />

designating a hedging relationship for accounting purposes.<br />

The examples in IPSAS 29 focus primarily on hedging relationships involving a<br />

single hedged item <strong>and</strong> a single hedging instrument, but there is little discussion <strong>and</strong><br />

guidance on portfolio hedging relationships for cash flow hedges when risk is being<br />

managed centrally. In this illustration, the general principles are applied to hedging<br />

relationships involving a component of risk in a portfolio having multiple risks from<br />

multiple transactions or positions.<br />

Although designation is necessary to achieve hedge accounting, the way in which the<br />

designation is described also affects the extent to which the hedging relationship is<br />

judged to be effective for accounting purposes <strong>and</strong> the extent to which the entity’s<br />

existing system for managing risk will be required to be modified to track hedging<br />

activities for accounting purposes. Accordingly, an entity may wish to designate the<br />

hedging relationship in a manner that avoids unnecessary systems changes by taking<br />

advantage of the information already generated by the risk management system <strong>and</strong><br />

avoids unnecessary bookkeeping <strong>and</strong> tracking. In designating hedging relationships,<br />

the entity may also consider the extent to which ineffectiveness is expected to be<br />

recognized for accounting purposes under alternative designations.<br />

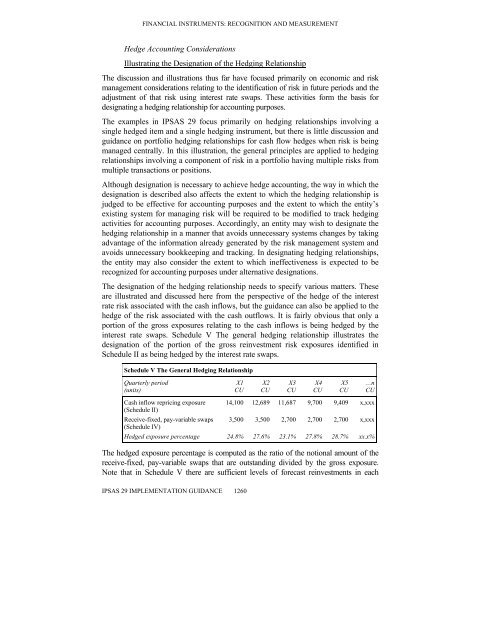

The designation of the hedging relationship needs to specify various matters. These<br />

are illustrated <strong>and</strong> discussed here from the perspective of the hedge of the interest<br />

rate risk associated with the cash inflows, but the guidance can also be applied to the<br />

hedge of the risk associated with the cash outflows. It is fairly obvious that only a<br />

portion of the gross exposures relating to the cash inflows is being hedged by the<br />

interest rate swaps. Schedule V The general hedging relationship illustrates the<br />

designation of the portion of the gross reinvestment risk exposures identified in<br />

Schedule II as being hedged by the interest rate swaps.<br />

Schedule V The General Hedging Relationship<br />

Quarterly period X1 X2 X3 X4 X5 …n<br />

(units) CU CU CU CU CU CU<br />

Cash inflow repricing exposure<br />

(Schedule II)<br />

Receive-fixed, pay-variable swaps<br />

(Schedule IV)<br />

IPSAS 29 IMPLEMENTATION GUIDANCE 1260<br />

14,100 12,689 11,687 9,700 9,409 x,xxx<br />

3,500 3,500 2,700 2,700 2,700 x,xxx<br />

Hedged exposure percentage 24.8% 27.6% 23.1% 27.8% 28.7% xx.x%<br />

The hedged exposure percentage is computed as the ratio of the notional amount of the<br />

receive-fixed, pay-variable swaps that are outst<strong>and</strong>ing divided by the gross exposure.<br />

Note that in Schedule V there are sufficient levels of forecast reinvestments in each

![International Auditing and Assurance Standards Board [IAASB] - IFAC](https://img.yumpu.com/22522144/1/190x245/international-auditing-and-assurance-standards-board-iaasb-ifac.jpg?quality=85)