ipsas 29—financial instruments: recognition and measurement - IFAC

ipsas 29—financial instruments: recognition and measurement - IFAC

ipsas 29—financial instruments: recognition and measurement - IFAC

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

FINANCIAL INSTRUMENTS: RECOGNITION AND MEASUREMENT<br />

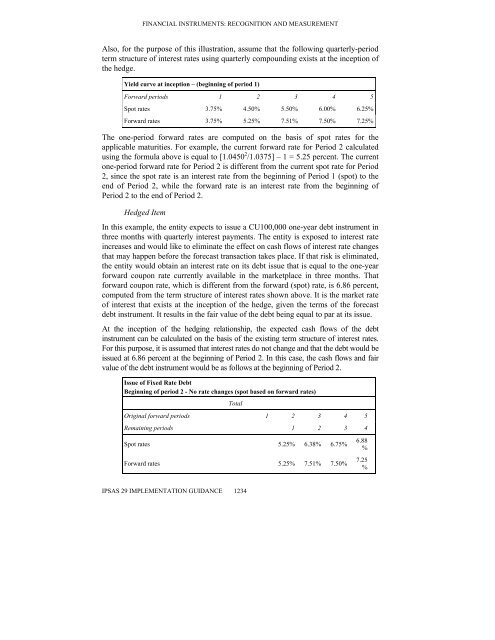

Also, for the purpose of this illustration, assume that the following quarterly-period<br />

term structure of interest rates using quarterly compounding exists at the inception of<br />

the hedge.<br />

Yield curve at inception – (beginning of period 1)<br />

Forward periods 1 2 3 4 5<br />

Spot rates 3.75% 4.50% 5.50% 6.00% 6.25%<br />

Forward rates 3.75% 5.25% 7.51% 7.50% 7.25%<br />

The one-period forward rates are computed on the basis of spot rates for the<br />

applicable maturities. For example, the current forward rate for Period 2 calculated<br />

using the formula above is equal to [1.0450 2 /1.0375] – 1 = 5.25 percent. The current<br />

one-period forward rate for Period 2 is different from the current spot rate for Period<br />

2, since the spot rate is an interest rate from the beginning of Period 1 (spot) to the<br />

end of Period 2, while the forward rate is an interest rate from the beginning of<br />

Period 2 to the end of Period 2.<br />

Hedged Item<br />

In this example, the entity expects to issue a CU100,000 one-year debt instrument in<br />

three months with quarterly interest payments. The entity is exposed to interest rate<br />

increases <strong>and</strong> would like to eliminate the effect on cash flows of interest rate changes<br />

that may happen before the forecast transaction takes place. If that risk is eliminated,<br />

the entity would obtain an interest rate on its debt issue that is equal to the one-year<br />

forward coupon rate currently available in the marketplace in three months. That<br />

forward coupon rate, which is different from the forward (spot) rate, is 6.86 percent,<br />

computed from the term structure of interest rates shown above. It is the market rate<br />

of interest that exists at the inception of the hedge, given the terms of the forecast<br />

debt instrument. It results in the fair value of the debt being equal to par at its issue.<br />

At the inception of the hedging relationship, the expected cash flows of the debt<br />

instrument can be calculated on the basis of the existing term structure of interest rates.<br />

For this purpose, it is assumed that interest rates do not change <strong>and</strong> that the debt would be<br />

issued at 6.86 percent at the beginning of Period 2. In this case, the cash flows <strong>and</strong> fair<br />

value of the debt instrument would be as follows at the beginning of Period 2.<br />

Issue of Fixed Rate Debt<br />

Beginning of period 2 - No rate changes (spot based on forward rates)<br />

Total<br />

Original forward periods 1 2 3 4 5<br />

Remaining periods 1 2 3 4<br />

Spot rates 5.25% 6.38% 6.75%<br />

Forward rates 5.25% 7.51% 7.50%<br />

IPSAS 29 IMPLEMENTATION GUIDANCE 1234<br />

6.88<br />

%<br />

7.25<br />

%

![International Auditing and Assurance Standards Board [IAASB] - IFAC](https://img.yumpu.com/22522144/1/190x245/international-auditing-and-assurance-standards-board-iaasb-ifac.jpg?quality=85)