ipsas 29—financial instruments: recognition and measurement - IFAC

ipsas 29—financial instruments: recognition and measurement - IFAC

ipsas 29—financial instruments: recognition and measurement - IFAC

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

FINANCIAL INSTRUMENTS: RECOGNITION AND MEASUREMENT<br />

June 30, 20X2<br />

Dr Payable LC107,400<br />

Cr Cash LC107,200<br />

Cr Surplus or deficit LC200<br />

To record the settlement of the payable at the spot rate (FC100,000 × 1.072 = LC107,200) <strong>and</strong><br />

the associated exchange gain of LC200 (– [1.072 – 1.074] × FC100,000).<br />

Dr Surplus or deficit (spot element) LC197<br />

Dr Surplus or deficit (interest element) LC232<br />

Cr Forward liability LC429<br />

To record the change in the fair value of the forward exchange contract between April 1, 20X2<br />

<strong>and</strong> June 30, 20X2 (i.e., LC2,400 – LC1,971 = LC429). The change in the present value of the<br />

spot settlement of the forward exchange contract is a loss of LC197 ([1.072 × 100,000] –<br />

107,200 – {([1.074 × 100,000] – 107,200)/1.06(3/12)}), which is recognized in surplus or deficit.<br />

The change in the interest element of the forward exchange contract (the residual change in fair<br />

value) is a loss of LC232 (LC429 – LC197), which is recognized in surplus or deficit. The hedge<br />

is fully effective because the loss in the spot element of the forward contract (LC197) exactly<br />

offsets the change in the present value of the spot settlement of the payable [(LC197) = {[1.072 ×<br />

100,000] – 107,200 – {([1.074 × 100,000] – 107,200)/1.06(3/12)}].<br />

Dr Forward liability LC2,400<br />

Cr Cash LC2,400<br />

To record the net settlement of the forward exchange contract.<br />

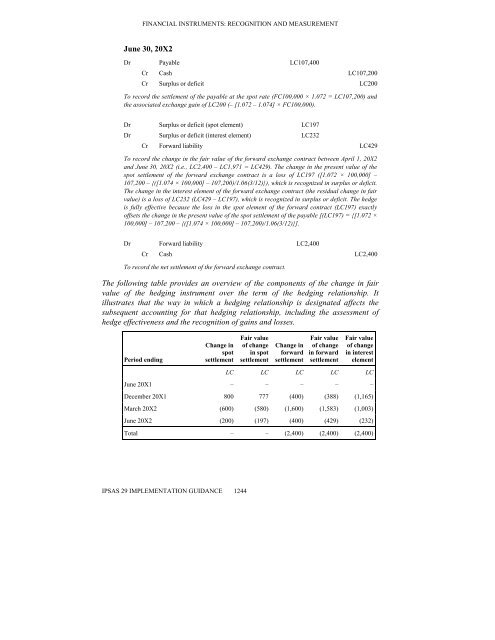

The following table provides an overview of the components of the change in fair<br />

value of the hedging instrument over the term of the hedging relationship. It<br />

illustrates that the way in which a hedging relationship is designated affects the<br />

subsequent accounting for that hedging relationship, including the assessment of<br />

hedge effectiveness <strong>and</strong> the <strong>recognition</strong> of gains <strong>and</strong> losses.<br />

Period ending<br />

Change in<br />

spot<br />

settlement<br />

IPSAS 29 IMPLEMENTATION GUIDANCE 1244<br />

Fair value<br />

of change<br />

in spot<br />

settlement<br />

Change in<br />

forward<br />

settlement<br />

Fair value<br />

of change<br />

in forward<br />

settlement<br />

Fair value<br />

of change<br />

in interest<br />

element<br />

LC LC LC LC LC<br />

June 20X1 – – – – –<br />

December 20X1 800 777 (400) (388) (1,165)<br />

March 20X2 (600) (580) (1,600) (1,583) (1,003)<br />

June 20X2 (200) (197) (400) (429) (232)<br />

Total – – (2,400) (2,400) (2,400)

![International Auditing and Assurance Standards Board [IAASB] - IFAC](https://img.yumpu.com/22522144/1/190x245/international-auditing-and-assurance-standards-board-iaasb-ifac.jpg?quality=85)