ipsas 29—financial instruments: recognition and measurement - IFAC

ipsas 29—financial instruments: recognition and measurement - IFAC

ipsas 29—financial instruments: recognition and measurement - IFAC

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

FINANCIAL INSTRUMENTS: RECOGNITION AND MEASUREMENT<br />

1209<br />

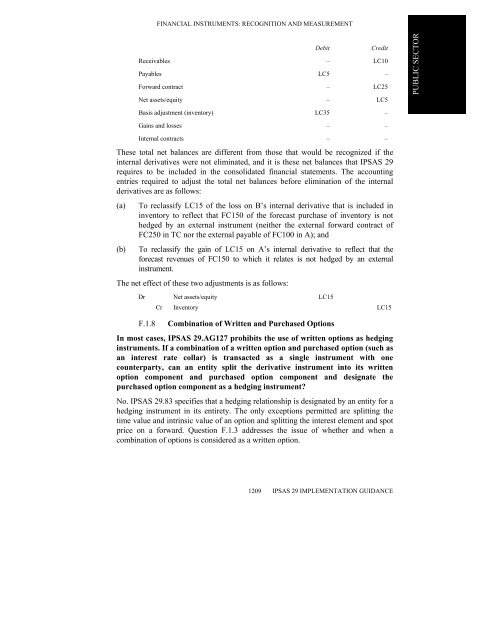

Debit Credit<br />

Receivables – LC10<br />

Payables LC5 –<br />

Forward contract – LC25<br />

Net assets/equity – LC5<br />

Basis adjustment (inventory) LC35 –<br />

Gains <strong>and</strong> losses – –<br />

Internal contracts – –<br />

These total net balances are different from those that would be recognized if the<br />

internal derivatives were not eliminated, <strong>and</strong> it is these net balances that IPSAS 29<br />

requires to be included in the consolidated financial statements. The accounting<br />

entries required to adjust the total net balances before elimination of the internal<br />

derivatives are as follows:<br />

(a) To reclassify LC15 of the loss on B’s internal derivative that is included in<br />

inventory to reflect that FC150 of the forecast purchase of inventory is not<br />

hedged by an external instrument (neither the external forward contract of<br />

FC250 in TC nor the external payable of FC100 in A); <strong>and</strong><br />

(b) To reclassify the gain of LC15 on A’s internal derivative to reflect that the<br />

forecast revenues of FC150 to which it relates is not hedged by an external<br />

instrument.<br />

The net effect of these two adjustments is as follows:<br />

Dr Net assets/equity LC15<br />

Cr Inventory LC15<br />

F.1.8 Combination of Written <strong>and</strong> Purchased Options<br />

In most cases, IPSAS 29.AG127 prohibits the use of written options as hedging<br />

<strong>instruments</strong>. If a combination of a written option <strong>and</strong> purchased option (such as<br />

an interest rate collar) is transacted as a single instrument with one<br />

counterparty, can an entity split the derivative instrument into its written<br />

option component <strong>and</strong> purchased option component <strong>and</strong> designate the<br />

purchased option component as a hedging instrument?<br />

No. IPSAS 29.83 specifies that a hedging relationship is designated by an entity for a<br />

hedging instrument in its entirety. The only exceptions permitted are splitting the<br />

time value <strong>and</strong> intrinsic value of an option <strong>and</strong> splitting the interest element <strong>and</strong> spot<br />

price on a forward. Question F.1.3 addresses the issue of whether <strong>and</strong> when a<br />

combination of options is considered as a written option.<br />

IPSAS 29 IMPLEMENTATION GUIDANCE<br />

PUBLIC SECTOR

![International Auditing and Assurance Standards Board [IAASB] - IFAC](https://img.yumpu.com/22522144/1/190x245/international-auditing-and-assurance-standards-board-iaasb-ifac.jpg?quality=85)