ipsas 29—financial instruments: recognition and measurement - IFAC

ipsas 29—financial instruments: recognition and measurement - IFAC

ipsas 29—financial instruments: recognition and measurement - IFAC

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

FINANCIAL INSTRUMENTS: RECOGNITION AND MEASUREMENT<br />

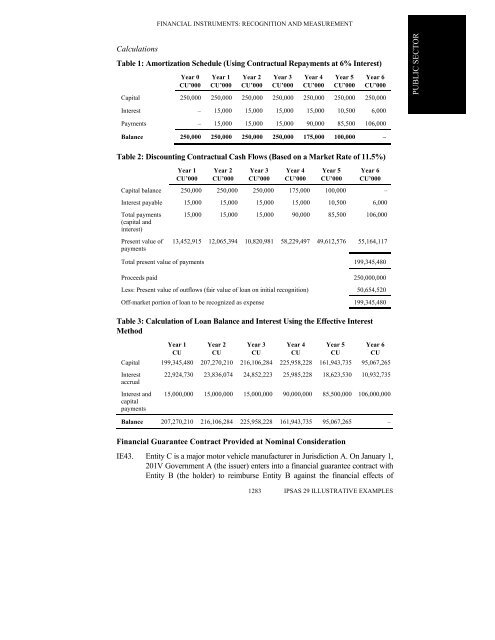

Calculations<br />

Table 1: Amortization Schedule (Using Contractual Repayments at 6% Interest)<br />

Year 0<br />

CU’000<br />

Year 1<br />

CU’000<br />

Year 2<br />

CU’000<br />

1283<br />

Year 3<br />

CU’000<br />

Year 4<br />

CU’000<br />

Year 5<br />

CU’000<br />

Year 6<br />

CU’000<br />

Capital 250,000 250,000 250,000 250,000 250,000 250,000 250,000<br />

Interest – 15,000 15,000 15,000 15,000 10,500 6,000<br />

Payments – 15,000 15,000 15,000 90,000 85,500 106,000<br />

Balance 250,000 250,000 250,000 250,000 175,000 100,000 –<br />

Table 2: Discounting Contractual Cash Flows (Based on a Market Rate of 11.5%)<br />

Year 1<br />

CU’000<br />

Year 2<br />

CU’000<br />

Year 3<br />

CU’000<br />

Year 4<br />

CU’000<br />

Year 5<br />

CU’000<br />

Year 6<br />

CU’000<br />

Capital balance 250,000 250,000 250,000 175,000 100,000 –<br />

Interest payable 15,000 15,000 15,000 15,000 10,500 6,000<br />

Total payments<br />

(capital <strong>and</strong><br />

interest)<br />

15,000 15,000 15,000 90,000 85,500 106,000<br />

Present value of<br />

payments<br />

13,452,915 12,065,394 10,820,981 58,229,497 49,612,576 55,164,117<br />

Total present value of payments 199,345,480<br />

Proceeds paid 250,000,000<br />

Less: Present value of outflows (fair value of loan on initial <strong>recognition</strong>) 50,654,520<br />

Off-market portion of loan to be recognized as expense 199,345,480<br />

Table 3: Calculation of Loan Balance <strong>and</strong> Interest Using the Effective Interest<br />

Method<br />

Year 1<br />

CU<br />

Year 2<br />

CU<br />

Year 3<br />

CU<br />

Year 4<br />

CU<br />

Year 5<br />

CU<br />

Year 6<br />

CU<br />

Capital 199,345,480 207,270,210 216,106,284 225,958,228 161,943,735 95,067,265<br />

Interest<br />

accrual<br />

Interest <strong>and</strong><br />

capital<br />

payments<br />

22,924,730 23,836,074 24,852,223 25,985,228 18,623,530 10,932,735<br />

15,000,000 15,000,000 15,000,000 90,000,000 85,500,000 106,000,000<br />

Balance 207,270,210 216,106,284 225,958,228 161,943,735 95,067,265 –<br />

Financial Guarantee Contract Provided at Nominal Consideration<br />

IE43. Entity C is a major motor vehicle manufacturer in Jurisdiction A. On January 1,<br />

201V Government A (the issuer) enters into a financial guarantee contract with<br />

Entity B (the holder) to reimburse Entity B against the financial effects of<br />

IPSAS 29 ILLUSTRATIVE EXAMPLES<br />

PUBLIC SECTOR

![International Auditing and Assurance Standards Board [IAASB] - IFAC](https://img.yumpu.com/22522144/1/190x245/international-auditing-and-assurance-standards-board-iaasb-ifac.jpg?quality=85)