ipsas 29—financial instruments: recognition and measurement - IFAC

ipsas 29—financial instruments: recognition and measurement - IFAC

ipsas 29—financial instruments: recognition and measurement - IFAC

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

FINANCIAL INSTRUMENTS: RECOGNITION AND MEASUREMENT<br />

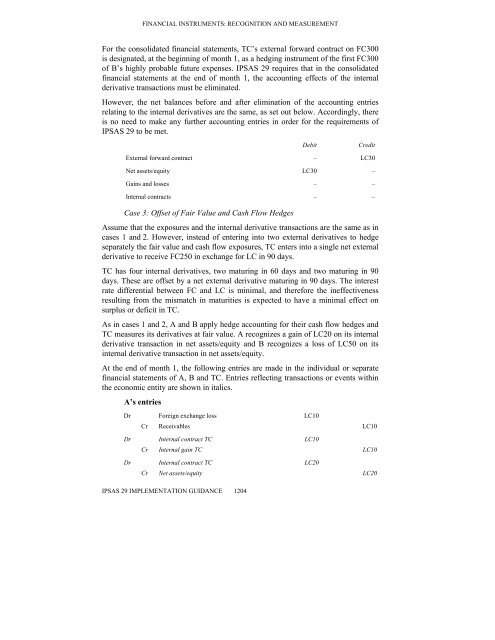

For the consolidated financial statements, TC’s external forward contract on FC300<br />

is designated, at the beginning of month 1, as a hedging instrument of the first FC300<br />

of B’s highly probable future expenses. IPSAS 29 requires that in the consolidated<br />

financial statements at the end of month 1, the accounting effects of the internal<br />

derivative transactions must be eliminated.<br />

However, the net balances before <strong>and</strong> after elimination of the accounting entries<br />

relating to the internal derivatives are the same, as set out below. Accordingly, there<br />

is no need to make any further accounting entries in order for the requirements of<br />

IPSAS 29 to be met.<br />

IPSAS 29 IMPLEMENTATION GUIDANCE 1204<br />

Debit Credit<br />

External forward contract – LC30<br />

Net assets/equity LC30 –<br />

Gains <strong>and</strong> losses – –<br />

Internal contracts – –<br />

Case 3: Offset of Fair Value <strong>and</strong> Cash Flow Hedges<br />

Assume that the exposures <strong>and</strong> the internal derivative transactions are the same as in<br />

cases 1 <strong>and</strong> 2. However, instead of entering into two external derivatives to hedge<br />

separately the fair value <strong>and</strong> cash flow exposures, TC enters into a single net external<br />

derivative to receive FC250 in exchange for LC in 90 days.<br />

TC has four internal derivatives, two maturing in 60 days <strong>and</strong> two maturing in 90<br />

days. These are offset by a net external derivative maturing in 90 days. The interest<br />

rate differential between FC <strong>and</strong> LC is minimal, <strong>and</strong> therefore the ineffectiveness<br />

resulting from the mismatch in maturities is expected to have a minimal effect on<br />

surplus or deficit in TC.<br />

As in cases 1 <strong>and</strong> 2, A <strong>and</strong> B apply hedge accounting for their cash flow hedges <strong>and</strong><br />

TC measures its derivatives at fair value. A recognizes a gain of LC20 on its internal<br />

derivative transaction in net assets/equity <strong>and</strong> B recognizes a loss of LC50 on its<br />

internal derivative transaction in net assets/equity.<br />

At the end of month 1, the following entries are made in the individual or separate<br />

financial statements of A, B <strong>and</strong> TC. Entries reflecting transactions or events within<br />

the economic entity are shown in italics.<br />

A’s entries<br />

Dr Foreign exchange loss LC10<br />

Cr Receivables LC10<br />

Dr Internal contract TC LC10<br />

Cr Internal gain TC LC10<br />

Dr Internal contract TC LC20<br />

Cr Net assets/equity LC20

![International Auditing and Assurance Standards Board [IAASB] - IFAC](https://img.yumpu.com/22522144/1/190x245/international-auditing-and-assurance-standards-board-iaasb-ifac.jpg?quality=85)