Challenger TAFE | Annual Report 2006 - Parliament of Western ...

Challenger TAFE | Annual Report 2006 - Parliament of Western ...

Challenger TAFE | Annual Report 2006 - Parliament of Western ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

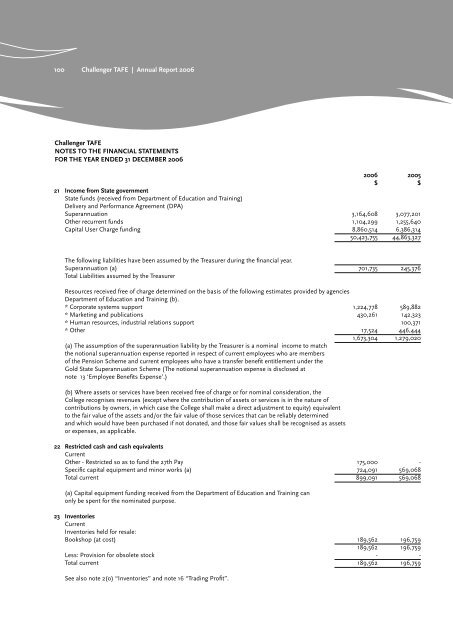

100 <strong>Challenger</strong> <strong>TAFE</strong> | <strong>Annual</strong> <strong>Report</strong> <strong>2006</strong><br />

<strong>Challenger</strong> <strong>TAFE</strong><br />

NOTES TO THE FINANCIAL STATEMENTS<br />

FOR THE YEAR ENDED 31 DECEMBER <strong>2006</strong><br />

<strong>2006</strong> 2005<br />

$ $<br />

21 Income from State government<br />

State funds (received from Department <strong>of</strong> Education and Training)<br />

Delivery and Performance Agreement (DPA)<br />

Superannuation 3,164,608 3,077,201<br />

Other recurrent funds 1,104,299 1,255,640<br />

Capital User Charge funding 8,860,514 6,386,314<br />

50,423,755 44,863,327<br />

The following liabilities have been assumed by the Treasurer during the fi nancial year.<br />

Superannuation (a) 701,735 245,376<br />

Total Liabilities assumed by the Treasurer<br />

Resources received free <strong>of</strong> charge determined on the basis <strong>of</strong> the following estimates provided by agencies<br />

Department <strong>of</strong> Education and Training (b).<br />

* Corporate systems support 1,224,778 589,882<br />

* Marketing and publications 430,261 142,323<br />

* Human resources, industrial relations support 100,371<br />

* Other 17,524 446,444<br />

1,673,304 1,279,020<br />

(a) The assumption <strong>of</strong> the superannuation liability by the Treasurer is a nominal income to match<br />

the notional superannuation expense reported in respect <strong>of</strong> current employees who are members<br />

<strong>of</strong> the Pension Scheme and current employees who have a transfer benefi t entitlement under the<br />

Gold State Superannuation Scheme (The notional superannuation expense is disclosed at<br />

note 13 ‘Employee Benefi ts Expense’.)<br />

(b) Where assets or services have been received free <strong>of</strong> charge or for nominal consideration, the<br />

College recognises revenues (except where the contribution <strong>of</strong> assets or services is in the nature <strong>of</strong><br />

contributions by owners, in which case the College shall make a direct adjustment to equity) equivalent<br />

to the fair value <strong>of</strong> the assets and/or the fair value <strong>of</strong> those services that can be reliably determined<br />

and which would have been purchased if not donated, and those fair values shall be recognised as assets<br />

or expenses, as applicable.<br />

22 Restricted cash and cash equivalents<br />

Current<br />

Other - Restricted so as to fund the 27th Pay 175,000 -<br />

Specifi c capital equipment and minor works (a) 724,091 569,068<br />

Total current 899,091 569,068<br />

(a) Capital equipment funding received from the Department <strong>of</strong> Education and Training can<br />

only be spent for the nominated purpose.<br />

23 Inventories<br />

Current<br />

Inventories held for resale:<br />

Bookshop (at cost) 189,562 196,759<br />

189,562 196,759<br />

Less: Provision for obsolete stock - -<br />

Total current 189,562 196,759<br />

See also note 2(o) “Inventories” and note 16 “Trading Pr<strong>of</strong>i t”.