AnnuAl REPORT 2011-2012 - Sbs

AnnuAl REPORT 2011-2012 - Sbs

AnnuAl REPORT 2011-2012 - Sbs

- TAGS

- annual

- media.sbs.com.au

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

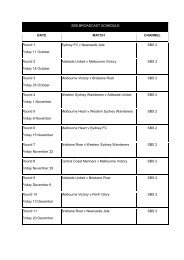

NOTES TO THE FINANCIAL STATEMENTS<br />

8(d) Analysis of property, plant and equipment, and intangibles (cont.)<br />

Reconciliation of the opening and closing balances of intangibles (2010–11)<br />

CoNsoLIDAteD<br />

GooDWILL<br />

$’000<br />

tRADeMARk<br />

$’000<br />

CoNtRACt<br />

RIGHts<br />

$’000<br />

CoMPUteR<br />

soFtWARe<br />

$’000<br />

totAL<br />

$’000<br />

As at 1 July 2010<br />

Gross Book Value 11,497 112 241 7,928 19,778<br />

Accumulated depreciation/amortisation – – (25) (4,466) (4,491)<br />

opening net book value 11,497 112 216 3,462 15,287<br />

Additions – by purchase<br />

Revaluations recognised in other<br />

– – – 1,703 1,703<br />

comprehensive income (equity) – – – – –<br />

Amortisation expense – – (40) (1,183) (1,223)<br />

Disposals<br />

From disposal of operations – – – – –<br />

Other disposals – – – (3) (3)<br />

Net book value as at 30 June <strong>2011</strong><br />

Net book value is represented by:<br />

11,497 112 176 3,979 15,764<br />

Gross Book Value 11,497 112 241 9,424 21,274<br />

Accumulated depreciation/amortisation – – (65) (5,445) (5,510)<br />

Closing net book value 11,497 112 176 3,979 15,764<br />

Intangibles relating to goodwill, trademark and contract rights.<br />

In 2010, the consolidated entity recognised additional goodwill of $2.254m following the purchase of the remaining 60%<br />

issued capital of PAN TV Ltd by the Corporation’s controlled entity, STV Ltd (which previously owned 40% of PAN TV<br />

Ltd’s issued capital).<br />

An independent valuer also valued the identifiable assets of PAN TV on acquisition as $0.353m ( $0.112m for trademark,<br />

and $0.241m for contract rights for the World Movies channel). Trademark is not amortised as it has an indefinite useful<br />

life, but is assessed annually for impairment.<br />

In 2009, the Corporation recognised goodwill of $9.243m following the restructure of the media representation<br />

function of the Corporation (previously outsourced) and the resulting acquisition of a business unit. In line with AASB 3<br />

“Business Combinations”, goodwill was recognised as the difference between the consideration paid and the fair value<br />

of identifiable net assets which was nil.<br />

Goodwill is not amortised but is assessed annually for impairment (based on its “value in use” calculated as the net<br />

present value of estimated future net cash inflows of the cash-generating unit (CGU) to which it has been allocated). In<br />

<strong>2012</strong>, the amount of goodwill recognised was reviewed, using estimated cash inflows assuming a risk adjusted pre-tax<br />

discount rate of 13% (<strong>2011</strong>: 15%), growth rate of 2% in perpetuity (<strong>2011</strong>: 4% to 2015 and 3% thereafter). On that basis,<br />

goodwill was assessed as not impaired.<br />

104 SBS