AnnuAl REPORT 2011-2012 - Sbs

AnnuAl REPORT 2011-2012 - Sbs

AnnuAl REPORT 2011-2012 - Sbs

- TAGS

- annual

- media.sbs.com.au

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

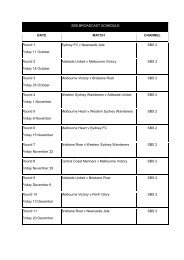

Depreciation and amortisation rates applying to each class of depreciable asset are based on the following useful lives:<br />

CLAss oF NoN FINANCIAL Asset <strong>2011</strong>-<strong>2012</strong> AVG 2010-<strong>2011</strong> AVG<br />

Buildings 40 years 40 40 years 40<br />

Leasehold improvements Lease term 15 Lease term 15<br />

Plant and equipment 3 to 20 years 7 3 to 20 years 7<br />

Intangibles (excluding goodwill and trademark) 5 to 7 years 6 5 to 7 years 6<br />

The aggregate amount of depreciation allocated for each<br />

class of asset during the reporting period is disclosed in<br />

Note 3(c).<br />

Leasehold improvements are amortised on a straight line<br />

basis over the shorter of either the unexpired period of the<br />

lease or the estimated useful life of the improvements.<br />

Intangible assets (computer software and contract rights)<br />

are amortised on a straight line basis over their estimated<br />

useful lives. Goodwill and trademark are not amortised,<br />

but tested for impairment.<br />

(t) Impairment of non-current assets<br />

All assets are reviewed for impairment as at 30 June <strong>2012</strong>.<br />

Where impairment testing is required (e.g. goodwill) or<br />

indications of impairment exist, the asset’s recoverable<br />

amount is estimated, and an impairment adjustment<br />

made if the asset’s recoverable amount is less than its<br />

carrying amount. The recoverable amount is the higher of<br />

its fair value less costs to sell and its “value in use”. “Value<br />

in use” is assessed as the “depreciated replacement cost”<br />

if the future economic benefit of the asset is not primarily<br />

dependent on the asset’s ability to generate cash flows,<br />

and the asset would be replaced by the Corporation<br />

if deprived of the asset. For the purposes of goodwill<br />

impairment testing, a “cash-generating unit” (CGU),<br />

comprising the smallest group of assets to which goodwill<br />

can be allocated, is identified and tested for impairment<br />

as a group – see Note 8(c).<br />

In <strong>2012</strong>, after writing off a number of assets identified as<br />

obsolete and/or disposed, no indicators of impairment<br />

were found for the remaining Corporation’s assets (at fair<br />

value or at cost) – see Note 3(e).<br />

(u) program inventory<br />

Program costs are capitalised as inventory and amortised<br />

over time to reflect their expected usage:<br />

Program acquisitions<br />

Program acquisitions are generally amortised on a straight<br />

line basis over the shorter of three years or licence period<br />

(for movies), or over the shorter period of two years or<br />

licence period (for documentaries and other overseas<br />

purchased programs).<br />

Commissioned programs<br />

Commissioned programs are valued at cost, and generally<br />

amortised on a straight line basis over the shorter of four<br />

years or licence period.<br />

Some programs are fully amortised in the current period.<br />

All internally produced news and current affairs programs,<br />

as well as sports events, are expensed immediately at the<br />

time of broadcast.<br />

(v) Investment in associates<br />

The Corporation’s investments in its associates are<br />

accounted for using the equity method.<br />

Under the equity method, investments in the associates<br />

are carried in the Corporation’s balance sheet at cost as<br />

adjusted for post-acquisition charges in the Corporation’s<br />

share of net assets of the associates. Goodwill relating<br />

to an associate is included in the carrying amount of the<br />

investment. After the application of the equity method,<br />

the Corporation determines whether it is necessary to<br />

recognise any impairment loss with respect to the net<br />

investment in associates.<br />

Further details relating to its associate company, Freeview<br />

Australia Ltd, are provided in Note 7(d)(ii).<br />

<strong>AnnuAl</strong> RepoRt <strong>2011</strong> – <strong>2012</strong> 85